FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

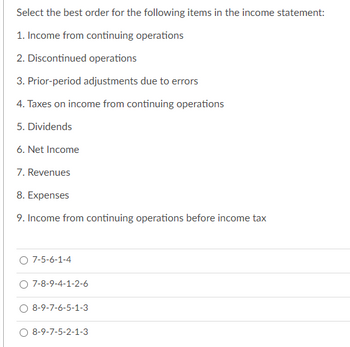

Transcribed Image Text:Select the best order for the following items in the income statement:

1. Income from continuing operations

2. Discontinued operations

3. Prior-period adjustments due to errors

4. Taxes on income from continuing operations

5. Dividends

6. Net Income

7. Revenues

8. Expenses

9. Income from continuing operations before income tax

7-5-6-1-4

7-8-9-4-1-2-6

8-9-7-6-5-1-3

8-9-7-5-2-1-3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Completing the Income Statement columns and preparing closing entries P1 P2 Following are Income Statement columns from a 10-column work sheet for Brown's Bike Rental Company. 1. Determine the amount that should be entered on the net income line of the work sheet. 2. Prepare the company's closing entries. The owner, H. Brown, did not make any withdrawals this period. Account Title Rental revenue Salaries expense Insurance expense Supplies expense Bike repair expense Depreciation expense-Bikes Totals Net income Totals Debit $46,300 7,400 16,000 4,200 20,500 Credit $120,000arrow_forwardIt is added to income received to determine the total income for the yearthat is recorded under the accrual basis of accounting A. deferred income - endB. prepaid expense - begC. accrued income - begD. deferred income - begarrow_forwardWhat is the purpose of arranging an income statement toshow subtotals for income from continuing operations andincome before extraordinary items?arrow_forward

- Failure to record the typical balance day adjustment to the Unearned Revenue account would: Select one: a. result in Liabilities being overstated. b. result in Assets being overstated. c. result in Revenues being overstated. O d. result in Net Profit being overstated.arrow_forwardWhat is total assets on this company's balance sheet? What is total current liabilities on this company's balance sheet? What is the correct order for the current liabilities section of the balance sheet? a. Accounts payable, payments to suppliers, deferred revenue, income tax payable b. Bank loan payable, Income tax payable, Accounts payable, Deferred revenue c. Accounts payable, Income tax payable, Payments to suppliers d. Accounts payable, Deferred revenue, Income tax payable e. Accounts payable, Income tax payable Enter the letter that corresponds to your choice. (A B C D E) What is total liabilities on this company's balance sheet? What is total equity on this company's balance sheet? What is the correct order for the equity section of the balance sheet? a. Owners' Capital, Retained earnings b. Retained earnings, Owners' capital c. Retained earnings, Owners' capital, Profit d. Retained earnings, Profit, Owners' capital e.…arrow_forwardWhat is reported in the discontinued operations section of the income statement?arrow_forward

- On the multiple-step income statement, which of the following would be the least likely to be found in the section often described as "Other Revenues and Expenses" (or "Other Income and Losses)? a. Dividend revenue b. Interest expense c. Gains or losses on the sale of a long-term asset d. Interest revenue e. Income tax expensearrow_forwardUsing IFRS, how should prior period errors that are discovered in a subsequent reporting period be recognized in the financial statements? a. As an adjustment to beginning retained earnings for the reporting period in which the error was discovered. b. As a note in the financial statements that the error was previously made but has since been corrected. c. In the current period if it’s not considered practicable to report it retrospectively. d. In the statement of comprehensive income.arrow_forwardWhich of the following expenses is usually listed last on the income statement? a. Advertising expense b. Income tax expense c. Salaries and benefits expense d. Cost of salesarrow_forward

- Sales Returns and Allowances account is report it like a. contra-revenue account on the income statement. b. current liability on the balance sheet. c. deduction from accounts receivable on the balance sheet. d. selling expense on the income statement.arrow_forwardHow are discontinued operations reported in the income statement?arrow_forwardWhat is the order of the subtotals that appear on a multi-step income statement? a. Gross Profit, Operating Income, Net Income, Total Other Revenues and Expenses b. Operating Income, Gross Profit, Net Income, Total Other Revenues and Expenses c. Total Other Revenues and Expenses, Operating Income, Gross Profit, Net Income d. Gross Profit, Operating Income, Total Other Revenues and Expenses, Net Incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education