FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:←EXTRA CREDIT OPPORTUNITY

Question 2 of 20

View Policies

Current Attempt in Progress

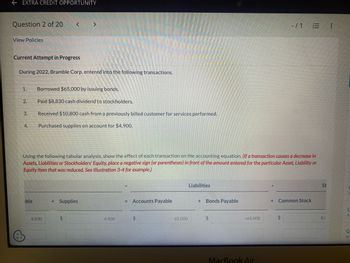

During 2022, Bramble Corp. entered into the following transactions.

1.

2.

3.

4.

< >

ible

Borrowed $65,000 by issuing bonds.

Paid $8,830 cash dividend to stockholders.

Received $10,800 cash from a previously billed customer for services performed.

Purchased supplies on account for $4,900.

8,830

Using the following tabular analysis, show the effect of each transaction on the accounting equation. (If a transaction causes a decrease in

Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or

Equity item that was reduced. See Illustration 3-4 for example.)

+ Supplies

$

4,900

Accounts Payable

$

-65,000

Liabilities

+ Bonds Payable

$

+65.000

MacBook Air

-/1

+ Common Stock

$

|||

St

8,1

C

As

Q

Ac

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 3 Company 3's shares are traded on the London Stock Exchange. It is now 1 January 2023, and the company has just paid a dividend of £0.45 for 2022. The recent dividend has been (a) (b) (c) 2022 0.45 (d) 2021 0.43 2020 0.41 2019 0.39 DPS (£) Company 3 has also in issue loan notes which will be redeemed in 7 years' time at the face value of £100. It pays a coupon interest of 6%. The company has a cost of equity of 10% and a before-tax cost of debt of 4%. It pays taxes at 25%. Required 2018 0.37 Using the Dividend Growth Model, estimate the share price for Company 3. What is the value of each £100 loan note? Suppose you have noted that the most recent share price of Company 3 does not agree with the estimation in (a). Explain what may have accounted for that discrepancy. Suppose Company 3 normally pays out 50% of earnings as dividend. Explain how you would use a PE ratio to determine the company's share price.arrow_forwardQuestion 4 of 7 View Policies Current Attempt in Progress Vaughn's Vegetable Market had the following transactions during 2020: < 1. Issued $50000 of par value common stock for cash. 2. Repaid a 6 year note payable in the amount of $23300. 3. Acquired land by issuing common stock of par value $105000. 4. Declared and paid a cash dividend of $2100. 5. Sold a long-term investment (cost $3200) for cash of $8000. 6. Acquired an investment in IBM stock for cash of $14700. What is the net cash provided (used) by investing activities? O($6700) $8000 $14700 $32000 eTextbook and Media Save for Later Attearrow_forward10..new Comparative balance sheet accounts of Sheridan Inc. are presented below. SHERIDAN INC.COMPARATIVE BALANCE SHEET ACCOUNTSAS OF DECEMBER 31, 2020 AND 2019 December 31 Debit Accounts 2020 2019 Cash $41,600 $33,700 Accounts Receivable 70,500 60,600 Inventory 29,700 23,700 Equity investments 22,300 38,900 Machinery 29,900 18,800 Buildings 67,600 56,300 Land 7,600 7,600 $269,200 $239,600 Credit Accounts Allowance for Doubtful Accounts $2,200 $1,500 Accumulated Depreciation—Machinery 5,600 2,300 Accumulated Depreciation—Buildings 13,500 9,000 Accounts Payable 34,700 24,800 Accrued Payables 3,300 2,600 Long-Term Notes Payable 20,900 31,300 Common Stock, no-par 150,000 125,000 Retained Earnings 39,000 43,100 $269,200 $239,600 Additional data (ignoring taxes): 1.…arrow_forward

- Munabhai Dot's upload image pleasearrow_forward10. Comparative balance sheet accounts of Sage Inc. are presented below. SAGE INC.COMPARATIVE BALANCE SHEET ACCOUNTSAS OF DECEMBER 31, 2020 AND 2019 December 31 Debit Accounts 2020 2019 Cash $42,400 $33,800 Accounts Receivable 70,500 59,700 Inventory 30,300 24,200 Equity investments 22,100 38,300 Machinery 30,200 18,500 Buildings 67,500 55,800 Land 7,400 7,400 $270,400 $237,700 Credit Accounts Allowance for Doubtful Accounts $2,300 $1,500 Accumulated Depreciation—Machinery 5,500 2,300 Accumulated Depreciation—Buildings 13,500 8,900 Accounts Payable 34,700 24,700 Accrued Payables 3,300 2,700 Long-Term Notes Payable 20,800 31,000 Common Stock, no-par 150,000 125,000 Retained Earnings 40,300 41,600 $270,400 $237,700 Additional data (ignoring taxes): 1. Net income…arrow_forwardRakesh Dot's upload image pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education