FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello-

Please help me to find the Acid Test Ratio for JPMorgan Chase.

I have attached the Financial Statement pages

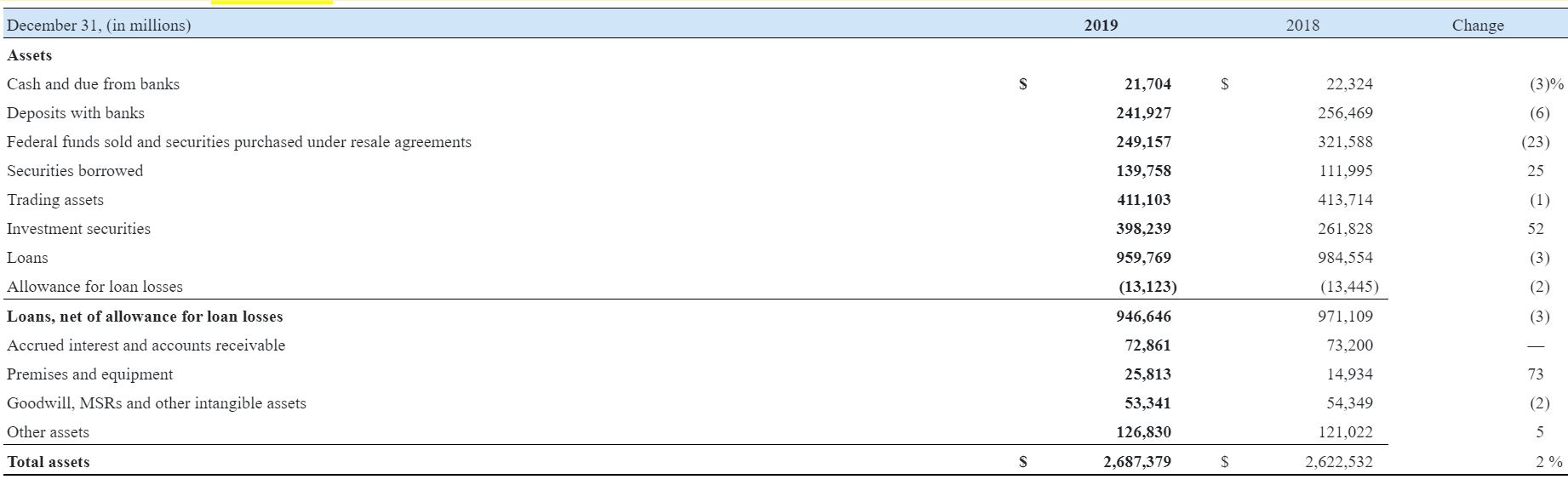

Transcribed Image Text:December 31, (in millions)

2019

Change

2018

Assets

Cash and due from banks

Deposits with banks

Federal funds sold and securities purchased under resale agreements

21,704

22,324

(3)%

241,927

256,469

(6)

249,157

321,588

(23)

Securities borrowed

139,758

111,995

25

Trading assets

411,103

413,714

(1)

Investment securities

398,239

261,828

52

Loans

959,769

984,554

(3)

Allowance for loan losses

(13,123)

(13,445)

(2)

Loans, net of allowance for loan losses

Accrued interest and accounts receivable

Premises and equipment

946,646

971,109

(3)

72,861

73,200

25,813

14,934

73

Goodwill, MSRS and other intangible assets

53,341

54,349

(2)

Other assets

121,022

126,830

Total assets

2,687,379

2,622,532

2%

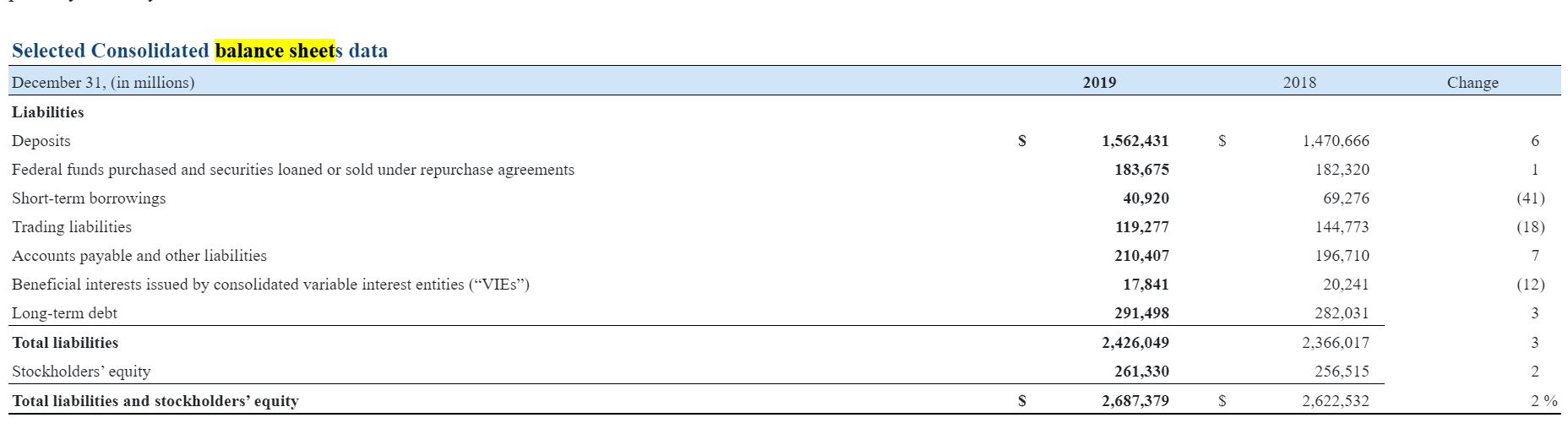

Transcribed Image Text:Selected Consolidated balance sheets data

December 31, (in millions)

2019

2018

Change

Liabilities

2$

1,470,666

Deposits

Federal funds purchased and securities loaned or sold under repurchase agreements

Short-term borrowings

Trading liabilities

1,562,431

183,675

182,320

40,920

69,276

(41)

144,773

119,277

(18)

Accounts payable and other liabilities

Beneficial interests issued by consolidated variable interest entities ("VIES")

210,407

196,710

17,841

20,241

(12)

291,498

Long-term debt

Total liabilities

282,031

2,426,049

2,366,017

Stockholders' equity

261,330

256,515

Total liabilities and stockholders' equity

2,687,379

2,622,532

2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Splish Inc. recently hired a new accountant with extensive experience in accounting for partnerships. Because of the pressure of the new job, the accountant was unable to review what he had learned earlier about corporation accounting. During the first month, he made the following entries for the corporation's capital stock. Date Account Titles and Explanation May 2 Cash Capital Stock (Issued 13,000 shares of $5 par value common stock at $16 per share) May 10 Cash Capital Stock (Issued 11,000 shares of $40 par value preferred stock at $80 per share) May 15 Capital Stock Cash (Purchased 1,200 shares of common stock for the treasury at $14 per share) May 31 Cash Capital Stock Gain on Sale of Stock (Sold 740 shares of treasury stock at $18 per share) Debit Credit 208,000 880,000 16,800 13,320 208,000 880,000 16,800 7,400 5,920 On the basis of the explanation for each entry, prepare the entries that should have been made for the capital stock transactions. (List all debit entries before…arrow_forwardplease help me explain the relationships of 5 financial elements (A, L, E, Exp, Rev) using accounting equation with an example.arrow_forwardfind the websites for a list of companies and organizations related to accounting and finance. Once you have located the websites, your task is to conduct a brief analysis of their content, summarizing their key features and information. Association of Government Accountants National Association of State Auditors, Comptrollers, and Treasurersarrow_forward

- make a proper Chart of Accounts for ABC Company: Accounts Payable, Accounts Receivable, Advertising Expense, Cash, C.C. Capital, C.C. Drawing, Equipment, Inventory, Prepaid Insurance, Rent Expense, Sales, Supplies, Utilities Expense. We will work on this in class. Upload here if you don't finish in clasarrow_forwardStudypug.com Recliner Company wants to verify that all of its accounts are in balance. Which of the following will be prepared for this purpose? a.Balance sheet b.General ledger c.Trial balance d.Chart of accountsarrow_forwardIdentify the financial statement on which each of the following accounts would appear: the income statement, the retained earnings statement, or the balance sheet: a. Insurance Expense b. accounts receivable c. office supplies d. sales revenue e. common stock f. notes payablearrow_forward

- On January 1, 2022, the stockholders' equity section of Bramble Corporation shows common stock ($6 par value) $1,800,000; paid-in capital in excess of par $1,050,000; and retained earnings $1,230,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 51,000 shares for cash at $15 per share. 1 Sold 12,000 treasury shares for cash at $17 per share. Sold 10,000 treasury shares for cash at $14 per share. July Sept. 1arrow_forwardIndicate whether each of the following companies is primarily a service, merchandies, or manufacturing business. If you are unfamiliar with the company, you may use the internet to locate the company's home page or use the finance web site of Yahoo.comarrow_forwardOn January 1, 2022, the stockholders' equity section of Bridgeport Corporation shows common stock ($4 par value) $1,200,000; paid- in capital in excess of par $1,000,000; and retained earnings $1,240,000. During the year, the following treasury stock transactions occurred. 1 Purchased 50,000 shares for cash at $15 per share. July 1 Sold 11,000 treasury shares for cash at $17 per share. Sept. 1 Sold 9,500 treasury shares for cash at $14 per share. Mar. (a) Journalize the treasury stock transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forward

- What is an estimate in QuickBooks Online? Select an answer: An estimate is a document that outlines a customer's purchase history. An estimate is a document that shows a customer's payment history. An estimate is a document that outlines the expenses a business expects to incur in the future. An estimate is a document that outlines the products or services a business plans to provide to a customer.arrow_forwardHi, Can you please help me with problem 5.6? Thank you.arrow_forwardAnalyze each of the following transactions in terms of their effects on the accounting equation of Osgood Delivery Service. Enter the correct amounts in the columns of the spreadsheetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education