FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

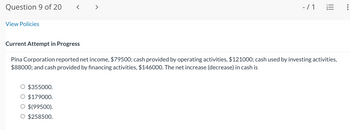

Transcribed Image Text:Question 9 of 20

View Policies

- / 1

O $355000.

O $179000.

O $(99500).

O $258500.

|||

Current Attempt in Progress

Pina Corporation reported net income, $79500; cash provided by operating activities, $121000; cash used by investing activities,

$88000; and cash provided by financing activities, $146000. The net increase (decrease) in cash is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lee Company has provided the following information: • Cash flow from operating activities, $258,000 .Net Income, $186.000 • Interest expense, $38,000 Interest cash payments, $28,000 • Income tax payments, $158,000 Income tax expense, $154.000 Using the modified method discussed in the text, what was Lee's cash coverage ratio? . Multiple Choice O O 15.86 16.07 8.04 6.50arrow_forwardSwifty Company uses the direct method in determining net cash provided by operating activities, During the year, operating expenses were $297500, prepaid expenses increased $25000, and accrued expenses payable increased $34700. Cash payments for operating expenses were O $287800. O $54700. O $40700. O $307200.arrow_forward11. In 2020, Windsor Corporation reported a net loss of $69,800. Windsor’s only net income adjustments were depreciation expense $81,700, and increase in accounts receivable $8,900.Compute Windsor’s net cash provided (used) by operating activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Net cash by operating activities $arrow_forward

- JEY-4322 Inc. reported the following data for last year: JEY-4322 Inc.Balance Sheet Beginning BalanceEnding BalanceAssets Cash$ 128,000$ 139,000Accounts receivable331,000481,000Inventory567,000471,000Plant and equipment, net894,000869,000Investment in Tesla Inc.400,000428,000Land (undeveloped)246,000249,000Total assets$ 2,566,000$ 2,637,000Liabilities and Stockholders' Equity Accounts payable$ 382,000$ 341,000Long-term debt981,000981,000Stockholders' equity1,203,0001,315,000Total liabilities and stockholders' equity$ 2,566,000$ 2,637,000 JEY-4322 Inc.Income StatementSales $ 3,880,000Operating expenses 3,336,800Net operating income 543,200Interest and taxes: Interest expense$ 111,000 Tax expense197,000308,000Net income $ 235,200 JEY-4322 Inc. paid dividends of $123,200 last year. The “Investment in Tesla Inc.” item on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return is 15%. What was the company’s residual income…arrow_forwardEB4. LO 16.3 Use the following information from Hamlin Company’s financial statements to determine operating net cash flows (indirect method). Net Income $113,750 Change in accumulated depreciation (no sale of depreciable assets this year) $9,800 Gain on sale of investments $11,400arrow_forwardsuppose that the following information is related to X company for 2020 net cash flows from operating activities 12000 net cash flows from financing activities 18000 beginning cash balance 5000 Ending cash balance 10000 The net cash flows from investing activities is O a. (25000) O b. 10000 O c. 30000 O d. 8000arrow_forward

- The net cash provided by operating activities in BLUE Company's statement of cash flows for 2021 was 770,000. For 2021, depreciation of plant assets was P 300,000; impairment of goodwill was P 50,000 and cash dividends paid on ordinary share was P 360,000. Based only on the information given, how much was BLUE's 2021 net income?arrow_forward10. Umlauf Corporation had $237,190 of net operating cash inflows, total cash inflows of $866,010 and average total assets of $4,865,225. Its cash flow on total assets was: O A. 4.9% В. 17.8% ОС. 20.5% OD. 48.8% O E. 95.1%arrow_forwardSarasota Corporation reported net income, $75000; cash provided by operating activies, $118000; cash used by investing activies, $85000; and cash provided by financing activies, $140000. The net increase (decrease) in cash isarrow_forward

- Mazaya Company has the following information available: Net Income R.O. 37,500; Cash Provided by Operations R.O. 46,500; Cash Sales R.O. 97,500; Capital Expenditures R.O.16,500; Dividends Paid R.O. 4,500. What is Mazaya's free cash flow?arrow_forwardBlossom Company reported net income of $148,500. For 2022, depreciation was $45,100, and the company reported a gain on sale of Investments of $12.100. Accounts recelvable increased $25,100 and accounts payable decreased $23.100. Compute net cash provided by operating activities using the indirect method. Net cash provided by operating activitiesarrow_forwardK73.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education