FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

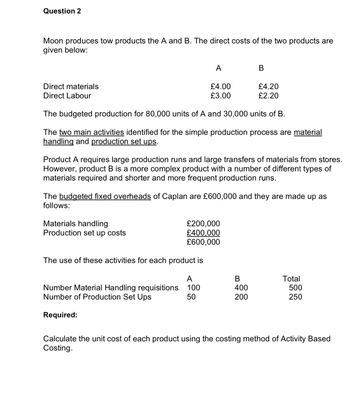

Transcribed Image Text:Question 2

Moon produces tow products the A and B. The direct costs of the two products are

given below:

Direct materials

Direct Labour

A

£4.00

£3.00

Materials handling

Production set up costs

The budgeted production for 80,000 units of A and 30,000 units of B.

The two main activities identified for the simple production process are material

handling and production set ups.

Product A requires large production runs and large transfers of materials from stores.

However, product B is a more complex product with a number of different types of

materials required and shorter and more frequent production runs.

A

Number Material Handling requisitions 100

Number of Production Set Ups

50

Required:

B

The budgeted fixed overheads of Caplan are £600,000 and they are made up as

follows:

£200,000

£400,000

£600,000

The use of these activities for each product is

£4.20

£2.20

B

400

200

Total

500

250

Calculate the unit cost of each product using the costing method of Activity Based

Costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11. There are two logistics network systems. Company JYZ is currently applying system 1 for the distribution and warehousing of its raw materials. In system 1, the raw materials are shipped from suppliers to the warehouse, where sorting is implemented. The materials are then shipped from the warehouse to the customers. JYZ is now thinking of implementing system 2, where raw materials are shipped from suppliers directly to the customers. The costs of both systems are provided below (per quarter). The cost formula is y=a+x(b₁ + b₂ + b3), where b₁,b2b3 are the unit cost for handling, logistics, and sorting. System 1 System 2 Fixed cost $2000 Variable cost Variable cost Variable cost (handling per unit) (logistics per unit) (Sorting per unit) $0.02 $0.01 $0.03 $0.01 $0.01 $0.05 y = a + b(x1+x2+x3) a. What is the breakeven point for the two systems to have identical total cost? b. The total number of units of JYZ is 90,000. Given the total unit 90,000, do you think it will be worth it if…arrow_forwardhravani plc has three products all of which require the same production facilities. Financial data on the three products are as follows: PRODUCT X Y Z £ per unit £ per unit £ per unit Labour: skilled 10 15 20 Labour: unskilled 3 6 3 Materials 9 12 15 Variable Overheads 8 12 16 Share of Fixed Overheads 10 15 20 All three of the products use just one raw material, which is the same material for all three products. This material costs £12 a kilo and is scarce. The company has adequate production capacity to satisfy the market demand for all three the products. All labour is a variable cost. Product X is sold in a market where the selling price per unit is fixed at £60. What is the price at which the business would need to sell product Y such that it would be equally profitable to produce and sell any one of the three products? £85 £94 £124 £104 hravani plc has three products all of…arrow_forward1arrow_forward

- i need the answer quicklyarrow_forwardRequired information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts: Direct Labor- Hours per unit 0.40 0.60 Additional information about the company follows: a. Rims require $20 in direct materials per unit, and Posts require $18. b. The direct labor wage rate is $18 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Machine setups Special processing General factory Annual Production 26,000 units 88,000 units Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours. Estimated Overhead Cost $28,160 $ 164,560 $ 780,000 Estimated Activity Rims 110 2,000 10,400 Posts 90 0 52,800 Total 200 2,000 63,200 2. Determine the unit product cost of each product…arrow_forward9.) If 12,500 units are sold, what is the total fixed manufacturing overhead costs to support this production level? 10.) If 12,500 units are sold, what is the fixed manufacturing overhead cost per unit sold? 11.) If 8,000 units are sold, what is the total manufacturing overhead costs to support this production level? What is the manufacturing overhead cost per unit?arrow_forward

- Please do not give solution in image format thankuarrow_forwardQ1: Consider a simple three-step manufacturing process as illustrated in the given figure. Assuming that demand is 1,000 units, what is the required input to meet demand? Assume that the scrap cost is $5 at process 1, $10 at process 2, and $15 at process 3. The defective rates are 3%, 5%, and 7%, respectively. Compute the total scrap cost for the given system. 1 d₂ = 3% 2 d₂ = 5% 3 d₂ = 7%arrow_forwardquestion 2arrow_forward

- FUT manufactures two products.. Both products require manufacturing operations in two departments: Product 1 2 Profit/Unit $25 $20 Labour Hours Dept. A 6 8 Labour Hours Dept. B 12 10 For the coming production period, FUT has available 900 hours of labor that can be allocated to either of the two departments. Find the production plan and labor allocation (hours assigned in each department) that will maximize profit. (Use Excel Solver)arrow_forwardPls sir correct on ownarrow_forwardowe subject-Accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education