Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

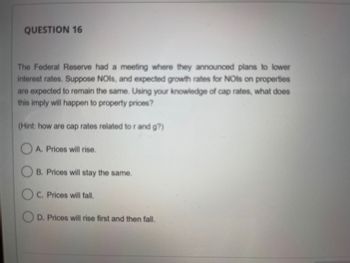

Transcribed Image Text:QUESTION 16

The Federal Reserve had a meeting where they announced plans to lower

interest rates. Suppose NOIs, and expected growth rates for NOIs on properties

are expected to remain the same. Using your knowledge of cap rates, what does

this imply will happen to property prices?

(Hint: how are cap rates related to r and g?)

A. Prices will rise.

B. Prices will stay the same.

OC. Prices will fall.

OD. Prices will rise first and then fall.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required Information [The following information applies to the questions displayed below.] Professor John Morton has just been appointed chairperson of the Finance Department at Westland University. In reviewing the department's cost records, Professor Morton found the following total cost associated with Finance 101 over the last five terms: Term Fall, last year winter, last year Summer, last year Fall, this year winter, this year Professor Morton knows there are some variable costs, such as amounts paid to graduate assistants, associated with the course. He would like to have the variable and fixed costs separated for planning purposes. Total Cost (in dollars) 16,000 14,000 12,000 10,000 Required: 1. Prepare a scattergraph plot. (Plot total cost on the vertical axis and number of sections offered on the horizontal axis.) Instructions: 1. On the graph below, use the point tool (Fall last year) to plot number of sections offered on the horizontal axis and total cost on the vertical…arrow_forwardQ1. The management of an oil company is trying to decide whether to drill for oil in a particular fieldin the Gulf of Mexico. It costs the company $600 thousand to drill in the selected field. Themanagement believes that if oil is found in this field, its estimated value will be $3400 thousand. Atpresent, this oil company believes that there is a 45% chance that the selected field actually containsoil. Before drilling, the oil company can hire a team of geologists to perform seismographic tests at acost of $55 thousand. Based on similar tests in other fields, the tests have a 25% false negative rate(no oil predicted when oil is present) and a 15% false positive rate (oil predicted when no oil ispresent).A. Assume the oil company wants to maximize its expected net earnings. Please utilize decisiontree analysis to determine its optimal strategy.B. Calculate the expected value of the information (EVI/EVSI) provided by the team ofgeologists.C. Conduct a sensitivity analysis on the chance…arrow_forwardSHORT ANSWER - Linear programming model (Management Science)arrow_forward

- S5. Accountarrow_forwardCould you please help me with these.arrow_forwardWhich of these factors would NOT be needed when prorating an expense? the total of the annual bill the real estate transfer tax amount whether the expense was prepaid or accrued the length of the calendar being usedarrow_forward

- What principal will earn $34.44 interest at 8.25% from May 30, 2012, to January 4, 2013? ..... The principal is $ . (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardMoney taken out of a sole proprietorship by an owner is: Choose the correct answer 1. subject to income tax, Employment Insurance and Canada Pension Plan 2. deductions when taken out. 3. considered an expense 4. taken as a draw against anticipated profits 5. all of the abovearrow_forwardOn December 31, 2019, the unadjusted trial balance of Tarzwell Services showed the following balances: Accounts receivable Allowance for doubtful accounts Sales $200,000 1,000 Cr. 700,000 The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense. Required a) Provide the entry for the write-off. b) If the firm uses the percent-of-sales allowance method for recording bad-debt expense, and has experienced an average 6% rate of non-collection based on sales, provide the entry to record bad-debt expense for 2019. c) Assume that after the firm recorded the $5,000 of write-offs, it determined that 18% of its remaining accounts receivable will be uncollectible under the aging method. Provide the entry to record bad-debt expense. Don't give answer in image formatarrow_forward

- What are 3 examples of cash controls and 3 of inventory controls?arrow_forwardfor this table. In other words, the table of data provided does not need a composite primary key. Table 1. Parking Tickets STID LName, FName PhoneNo St Lic LicNo Ticketno Date Code Fine 38249 Brown, Thomas 111-7804 FL BRY 123 15634 09/17/17 2 $25 38249 Brown, Thomas 111-7804 FL BRY 123 16017 09/13/17 1 $15 82453 Green, Sally 391-1689 AL TRE 141 14987 09/05/17 3 $100 82453 Green, Sally 82453 391-1689 AL TRE 141 Green, Sally 391-1689 AL TRE-141 16293 17892 09/18/17 1 $15 09/13/17 2 $25 Please examine the table of data and perform the following tasks: 1. Depict the full key, partial and transitive functional dependencies in the data table using the written notation (e.g., ID →Name, Address);arrow_forwardThe first public disclosure by a public company to the SEC of a non-recurring event is on which form? O A. Form 8K O B. Form 10Q O C. Form 10K O D. Form 20-K O E. Form SG 13G Rocot Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.