Question

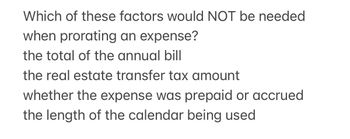

Transcribed Image Text:Which of these factors would NOT be needed

when prorating an expense?

the total of the annual bill

the real estate transfer tax amount

whether the expense was prepaid or accrued

the length of the calendar being used

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- S5. Accountarrow_forwardInventory on a company's balance sheet is Group of answer choices The product available for sale in the business's day-to-day operations Supplies available for sale in the business's day-to-day operations Equipment, furniture, and fixtures of the business All of the abovearrow_forwardLast Year Sales $208,000 $221,000 Cost of goods sold 106,000 116,000 Gross margin 102,000 105,000 Other expenses 49,000 49,000 Net income 53,000 56,000 Finished goods inventory 2,700 5,000 Work-in-process inventory 11,000 8,000 Raw material inventory 5,500 7,000 Total inventory (average for year) 19,200 20,000 Other current assets 93,000 109,000 Other assets 210,000 249,000 Total assets 322,200 378,000 ^THIS YEAR The plant manager, Murat Kristal, at York Technologies makes Aircraft Navigation Systems. He expects you, as the new OM analyst, to provide some insight for performance of the plant. High on his list is an understanding of his inventory…arrow_forward

- 27) A company’s corporate office has to decide between investing capital in a given business as it in a high growth industry or divesting that business given its current low market share. The company business is represented by which of the following? a) A star b) A question mark c) A cash cow d A dogarrow_forwardScenario analysis allows a firm to ask what - if type questions in capital budgeting. Question 22Select one: True Falsearrow_forwardhelparrow_forward

- On December 31, 2019, the unadjusted trial balance of Tarzwell Services showed the following balances: Accounts receivable Allowance for doubtful accounts Sales $200,000 1,000 Cr. 700,000 The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense. Required a) Provide the entry for the write-off. b) If the firm uses the percent-of-sales allowance method for recording bad-debt expense, and has experienced an average 6% rate of non-collection based on sales, provide the entry to record bad-debt expense for 2019. c) Assume that after the firm recorded the $5,000 of write-offs, it determined that 18% of its remaining accounts receivable will be uncollectible under the aging method. Provide the entry to record bad-debt expense. Don't give answer in image formatarrow_forwardfor this table. In other words, the table of data provided does not need a composite primary key. Table 1. Parking Tickets STID LName, FName PhoneNo St Lic LicNo Ticketno Date Code Fine 38249 Brown, Thomas 111-7804 FL BRY 123 15634 09/17/17 2 $25 38249 Brown, Thomas 111-7804 FL BRY 123 16017 09/13/17 1 $15 82453 Green, Sally 391-1689 AL TRE 141 14987 09/05/17 3 $100 82453 Green, Sally 82453 391-1689 AL TRE 141 Green, Sally 391-1689 AL TRE-141 16293 17892 09/18/17 1 $15 09/13/17 2 $25 Please examine the table of data and perform the following tasks: 1. Depict the full key, partial and transitive functional dependencies in the data table using the written notation (e.g., ID →Name, Address);arrow_forwardH2. Please show proper step by step calculationarrow_forward

- Under the operating method, each rental receipt of the lessor is recorded as generally when payments are received, i.e., performance obligation is satisfied. The underlying leased asset is still recognized on the balance sheet of the lessor and In addition to , any other related costs to the lease arrangement, such as insurance, maintenance, taxes, etc. are recorded Under a sales-type lease, lessors report in the income statement, in the order of the sequence shown on the multiple-step income statement, and thus at commencement of the lease. During the lease term, is reported. onarrow_forwardfive general risks involved in the revenue cycle of any business information processing system?arrow_forwardWhat are 'accelerated filers,' and how are they selected (i.e., based on revenue, number of employees, and so on)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios