Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Question Completion Status:

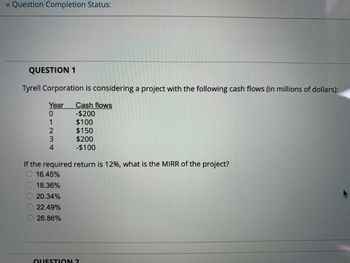

QUESTION 1

Tyrell Corporation is considering a project with the following cash flows (in millions of dollars):

Year Cash flows

-$200

$100

$150

$200

-$100

0

1

·234

If the required return is 12%, what is the MIRR of the project?

16.45%

18.36%

20.34%

22.49%

26.86%

QUESTION ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 5 Garfield Inc is considering a new project that requires an initial investment of $39500 and will generate a net income of $5242 per year, if the project's profitability index is 1.3, the present value of the project's future cash flows is $ Round to the nearest dollar.arrow_forwardpm.2arrow_forwardQuestion Compute the IRR statistic for Project A and note whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is 12 %. Time 1 2 3 4 5 Cash Flow ($92,000$42.999 $45,668 $38,554 $36,778 $47,000 O The project's IRR is 36.3 % and the project should be accepted. O The project's IRR is 65.5 % and the project should be accepted. O The project's IRR is 23.9 % and the project should be rejected.. O The project's IRR is 43.2 % and the project should be accepted.arrow_forward

- 4. Fer Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? The WACC is 9%. Cash flow from project -$1,000 $400 $100 $800 Year 0 123arrow_forward24 Matterhorn Mountain Gear is evaluating two projects with the following cash flows: Project X Project Y -$ 320,000 -$ 300,100 145,800 137, 150 163,300 154,350 128,400 120, 100 Year 0 1 2 3 What interest rate will make the NPV for the projects equal?arrow_forwardY8 For the given cash flows, suppose the firm uses the NPV decision rule. Year Cash Flow 0 −$ 149,000 1 67,000 2 72,000 3 56,000 At a required return of 8 percent, what is the NPV of the project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. At a required return of 21 percent, what is the NPV of the project? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

- Question 24 The Flour Baker is considering a project with the following cash flows. Should this project be accepted based on its internal rate of return if the required return is 5 percent? Year Cash Flows 0 -$200,000 1 40,000 2 50,000 3 60,000 4 70,000 Group of answer choices Yes, because the project’s IRR is higher than the required rate Yes, because the project’s IRR is lower than the required rate No, because the project’s IRR is higher than the required rate No, because the project’s IRR is lower than the required rate You are indifferentarrow_forwardQuestion 1 Davidsons Incorporated is using Payback Period and Net Present Value (NPV) methods for investment decision making for small projects. The cut-off period will remain at 3 years. The net after tax cash flows of the projects are as follows: Cash Flows Initial Cost Year 1 Year 2 Year 3 Required: Project 1 £11,000 £5,000 £5,000 £5,000 Project 2 £20,000 £7,000 £5,500 £4,000 Project 3 £8,000 b) Explain the uses, limitations, and merits of the Payback Period compared to Net Present Value in investment appraisal. £3,000 £3,500 £4,000 a) Calculate the NPV of each project at 9% discount rate. Given the above four projects' cash flows and using a 9% discount rate, which projects that would have been accepted under Payback Period will now be rejected under Net Present Value? Project 4 £19,000 £11,000 £12,000 £0arrow_forwardSuppose a project has the following cash flows. What is the NPV if the cost of the project is $105,000 and the required return is 9.75%? Year Cash Flow $28.000 32,000 3 36,000 4 39,000 O$6,000 O $20,678 $1,193 $27,335 O $30,000 Page 16 of 30arrow_forward

- #20 IRR You are offered to participate in a project that produces the following cash flows: C0- $5,000; C1-$4,000; C2 -$11,000 The interval rate of return is 13.6%. If the opportunity cost of capital is 12% , would you accept the offer?arrow_forwardMoving to another question will save this response. Question 5 XYZ is evaluating a project that would last for 3 years. The project's cost of capital is 17.20 percent, its NPV is $43,100.00 and the expected cash flows are presented in the table. What is 27 Years from today 0 1 2 3 Expected Cash Flow (in $) -53,600 71,700 -13,000 X O An amount equal to or greater than $69,384.00 but less than $75,459.00 O An amount equal to or greater than $43,100.00 but less than $52,436.00 O An amount equal to or greater than $52,436.00 but less than $63,115.00 O An amount equal to or greater than $63,115.00 but less than $69,384.00 O An amount less than $43,100.00 or an amount greater than $75,459.00arrow_forwardklp.3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education