Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

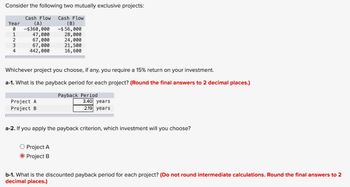

Transcribed Image Text:Consider the following two mutually exclusive projects:

Cash Flow Cash Flow

Year

0

(A)

-$360,000

(B)

-$56,000

1

47,000

28,000

2

67,000

24,000

3

67,000

21,500

4

442,000

16,600

Whichever project you choose, if any, you require a 15% return on your investment.

a-1. What is the payback period for each project? (Round the final answers to 2 decimal places.)

Project A

Project B

Payback Period

3.40 years

2.19 years

a-2. If you apply the payback criterion, which investment will you choose?

O Project A

Project B

b-1. What is the discounted payback period for each project? (Do not round intermediate calculations. Round the final answers to 2

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following are the cash flows of two projects: Year Project A Project B -$200 -$200 01234 Project A B If the opportunity cost of capital is 11%, what is the profitability index for each project? (Do not round intermediate calculations. Round your answers to 4 decimal places.) Profitability index 80 80 80 80 00 100 100 100 Is the project with the highest profitability index also the one with the highest NPV? Yes Noarrow_forward1. A project has an initial cost of 40,000. The future cash flows are 5,500, 15,200, -3,600, and 32,000 for year 1 to 4 respectively. How many IRRs will this project have? a. 3 b. 1 c. 4 d. 0arrow_forwardThe following information regarding an investment project is available. Initial investment is £125,000 Scrap Value £10,000 at the end of 5 years Year Inflow 1 £60,000 2 £50,000 3 £10,000 4 £10,000 5 £50,000 A). What is the ARR using the Average Investment formula? Choose one from the following: A. 15% B. 17% C. 19% D. 21%arrow_forward

- Suppose an investment has conventional cash flows with positive NPV. how would it impact your decision based on capital budgeting techniques mentioned below? 1.profitability index 2.internal rate of return 3.payback periodarrow_forward1. The Bolster Company is considering two mutually exclusive projects: Year Cash Flow A Cash Flow B -$100,000 31,250 31,250 31,250 31,250 -$100,000 1 2 4 31,250 The required rate of return on these projects is 12%. 200,000 What is each project's payback period? What is each project's discounted payback period? What is each project's net present value? а. b. с.arrow_forwardYear Cash Flow (A) Cash Flow (B) 0 −$ 417,000 −$ 36,000 1 48,000 19,600 2 58,000 14,100 3 75,000 14,600 4 532,000 11,400 The required return on these investments is 13 percent. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. What is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. What is the IRR for each project? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. What is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. Based on your answers in (a) through (d), which project will you finally choose?arrow_forward

- A firm evaluates all of its projects by applying the IRR rule. Year Cash Flow 0 -$ 152,000 1 64,000 2 75,000 3 59,000 a. What is the project's IRR? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. If the required return is 13 percent, should the firm accept the project? % a. Internal rate of return b. Project acceptancearrow_forwardA firm evaluates all of its projects by applying the IRR rule. Year 0 1 2 3 Cash Flow -$ 149,000 67,000 72,000 56,000 What is the project's IRR? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardA firm evaluates all of its projects by applying the IRR rule. Cash Flow Year 0 1 2 3 147,000 69,000 70,000 54,000 What is the project's IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Internal rate of return % If the required return is 16 percent, should the firm accept the project?arrow_forward

- Nonearrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$350,000 −$35,000 1 25,000 17,000 2 70,000 11,000 3 70,000 17,000 4 430,000 11,000 Assume you require a 15 percent return on your investment and a payback of 4 years. a. If you apply the discounted payback criterion, which investment will you choose? Why? b. If you apply the NPV criterion, which investment will you choose? Why? c. Based on your answers in (a) and (b), what you can say anything about the IRR of both projects? which project will you finally choose? Why?arrow_forwardManshukharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education