Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

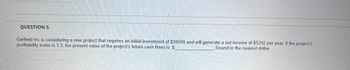

Transcribed Image Text:QUESTION 5

Garfield Inc is considering a new project that requires an initial investment of $39500 and will generate a net income of $5242 per year, if the project's

profitability index is 1.3, the present value of the project's future cash flows is $

Round to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Engineering Economics 00012 Please use the Rate of Return (ROR) Solutionarrow_forward13. The IBC Company is considering undertaking an investment that promises to have the following cash flows Period 0 is = -$100 Period 1 is= $150 Period 2 is = $50 Period 3 is = $50 If it waits a year, it can invest in an alternative (that is, mutually exclusive) investment that promises to pay Period 1 Period 2 Period 3 −$150 $250 $50 Assume a time value of money of 0.05. Which investment should the firm undertake? Use the present value method and the internal rate of return approaches. With the IRR approach, use the incremental cash flows.arrow_forwardaa.1arrow_forward

- Question 23 Charles Henri is considering investing $60,000 in a project this is expected to provide him with cash inflows of $15,000 in each of the first three years and $20,000 for the following year. At a discount rate of 7 percent this investment has a net present value of ____, but at the relevant discount rate of 3 percent the project’s net present value is ____. Group of answer choices $5,000; $198.91 $5,000; $289.19 $5,000; $378.27 $10,000; $289.19 $10,000; $423.15arrow_forward5.1.3 Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). INFORMATION Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only available to invest in one of them. You are given the following projected data: Initial cost Scrap value Depreciation per year Net profit Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flows Year 1 Year 2 Year 3 Year 4 Year 5 Project A R300 000 R40 000 R52 000 R20 000 R30 000 R50 000 R60 000 R10 000 Project B R300 000 0 R60 000 R90 000 R90 000 R90 000 R90 000 R90 000arrow_forwardProblem 3: A banking service project has an investment of $875,000. It has profits of $335,000 in years 1,3,5,7, and 9, and $157,000 in years 2,4,6,8,and 10. Assume the required rate of return is 20% and the inflation rate is 2.5%. Using the Net Present Value method, determine if the banking company should invest in this project.arrow_forward

- Nonearrow_forwardANSWER PART C PLEASE Mett Co. is planning to develop a new product. A year after the launch of the product, itcan generate additional cash flows for the company of either £250,000, £110,000,£90,000 or £50,000, with all four scenarios equally likely. The project requires an initialinvestment of £90,000. The company’s beta is 0.65, its cost of capital is 6%, and the riskfree rate is 3%. Assume perfect capital markets. a) What is the Net Present Value (NPV) of the project? b) Suppose that the project is sold to investors as an all-equity firm to raise funds forthe initial investment. The cash flows of the project will be distributed to equityholders in one year. How much money can be raised in this way – that is, what isthe initial market value of the unlevered equity? Explain your answer c) Suppose the initial £90,000 is raised by borrowing at the risk-free interest rateinstead of issuing equity. What are the cash flows to equity and debt holders, andwhat is the initial value of the…arrow_forwardQUESTION 7 A company is considering to invest in a project that is expected to yield the following cash flows; the firm's required rate of return from the project is 10%. Initial Outflow = $200,000 Cash Flow Year 1 = $80,000 Cash Flow Year 4 = $160,000 Cash Flow Year 5 = $120,000 What is the project's NPV? O 50,310.77 O 49,689.85 O 56,519.98 O 42,859.72 O 36,029.58arrow_forward

- | All techniques Rieger International is evaluating the feasibility of investing $109,000 in a piece of equipment that has a 5-year life. The firm has estimated the cash inflows associated with the proposal as shown in the following table: firm has a cost of capital of 11%. The a. Calculate the payback period for the proposed investment. b. Calculate the discounted payback period for the proposed investment. c. Calculate the net present value (NPV) for the proposed investment. d. Calculate the probability index for the proposed investment. e. Calculate the internal rate of return (IRR) for the proposed investment. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year (t) 1 GAW N 2 3 4 5 Print Cash inflows (CF₂) $35,000 $20,000 $30,000 $35,000 $40,000 Done X ces.)arrow_forwardQuestion 4 a. The stock market provides an annual return of 8.4%. A risky project costs £35,000 but provides £20,000 cash flow for two years. Would you invest in the project? Why/Why Not? b. Assume in order to undertake this project the firm needs to undertake project 2 that costs £12,000 but provides a one-year cash flow of £13,500 and project 3 that costs £8,000 but provides three years of cash flow of £3,000. Will the firm still take on the project and how much will firm value and increase? c. Your client has been given a trust fund valued at £1.25 million. He cannot access the money until he turns 65 years old, which is in 25 years. At that time, he can withdraw £24,000 per month. If the trust fund is invested at a 4.5 percent rate, compounded monthly, how many months will it last your client once he starts to withdraw the money? d. You are comparing houses in two towns in Sheffield. You have £100,000 to put as a down payment, and 30-year mortgage rates are at 8% Location 1…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education