Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

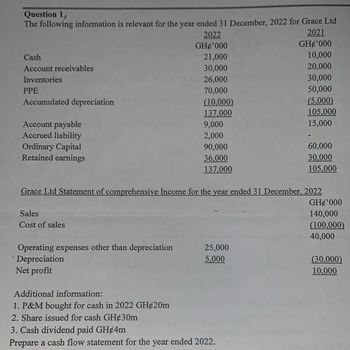

Transcribed Image Text:Question 1,

The following information is relevant for the year ended 31 December, 2022 for Grace Ltd

2022

GH¢'000

2021

GH¢'000

Cash

21,000

10,000

Account receivables

30,000

20,000

Inventories

26,000

30,000

PPE

70,000

50,000

Accumulated depreciation

(10.000)

(5.000)

137.000

105.000

Account payable

9,000

15,000

Accrued liability

2,000

Ordinary Capital

90,000

60,000

Retained earnings

36,000

30,000

137.000

105,000

Grace Ltd Statement of comprehensive Income for the year ended 31 December, 2022

GH¢'000

Sales

140,000

Cost of sales

(100,000)

40,000

Operating expenses other than depreciation

Depreciation

25,000

5.000

(30,000)

Net profit

10.000

Additional information:

1. P&M bought for cash in 2022 GH¢20m

2. Share issued for cash GH¢30m

3. Cash dividend paid GH¢4m

Prepare a cash flow statement for the year ended 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PB7. LO 4,3 Using the following information, A. Make the December 31 adjusting journal entry for depreciation. B. Determine the net book value (NBV) of the asset on December 31. • Cost of asset, $195,000 Accumulated depreciation, beginning of year, $26,000 • Current year depreciation, $13,000arrow_forward4arrow_forwardRefer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000arrow_forward

- A2 Can you please show all steps.arrow_forwardP10.5A Journalise a series of equipment transactions related to purchase, sale, retirement, and depreciation At December 31, 2021. Grand Regency Limited reported the following as Non-current tangible assets: 4,000,000 16,400,000 June 11 July 1 Dec. 31 Land Buildings Less: Accumulated depreciation - buildings Equipment Less: Accumulated depreciation - equipment Total plant assets During 2022, the following selected cash transactions occurred. April 1 Purchased land for R2,130,000. May 1 (b) (c) (d) 28,500,000 12,100,000 48,000,000 5,000,000 Required: (a) 43,000,000 £63,400,000 Sold equipment that cost R750,000 when purchased on January 1, 2018. The equipment was sold for R450,000. Sold land purchased on June 1, 2012 for R1,500,000. The land cost R400,000. Purchased equipment for R2,500,000. Retired equipment that cost R500,000 when purchased on December 31, 2012. No salvage value was received. Prepare general journal entries the above transactions. The company uses straight-line…arrow_forwardYu.27.arrow_forward

- Why is depreciation and interest expense in the excel 300,000 if it states its 3 million?arrow_forwardA machine that produces cellphone components is purchased on January 1, 2024, for $112,000. It is expected to have a useful life of four years and a residual value of $10,000. The machine is expected to produce a total of 200,000 components during its life. distributed as follows: 40,000 in 2024, 50,000 in 2025, 60,000 in 2026, and 50,000 in 2027. The company has a December 31 year end. (a) Calculate the amount of depreciation to be charged each year, using each of the following methods: i. Straight-line method Straight-line method depreciation $ per year ii. Units-of-production method (Round depreciation per unit to 3 decimal places, e.g. 15.257 and depreciation expense to 0 decimal places, e.g. 125.) Units-of-production method depreciation S per unitarrow_forwardSubject: accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT