EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Give me step by step answer with explanation

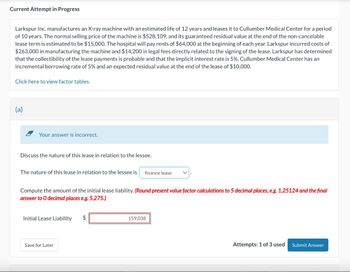

Transcribed Image Text:Current Attempt in Progress

Larkspur Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Cullumber Medical Center for a period

of 10 years. The normal selling price of the machine is $528,109, and its guaranteed residual value at the end of the non-cancelable

lease term is estimated to be $15,000. The hospital will pay rents of $64,000 at the beginning of each year. Larkspur incurred costs of

$263,000 in manufacturing the machine and $14,200 in legal fees directly related to the signing of the lease. Larkspur has determined

that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Cullumber Medical Center has an

incremental borrowing rate of 5% and an expected residual value at the end of the lease of $10,000.

Click here to view factor tables.

(a)

Your answer is incorrect.

Discuss the nature of this lease in relation to the lessee.

The nature of this lease in relation to the lessee is finance lease

Compute the amount of the initial lease liability. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final

answer to O decimal places e.g. 5,275.)

Initial Lease Liability

$

159,038

Save for Later

Attempts: 1 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Amirante Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $495,678, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $15,000. The hospital will pay rents of $60,000 at the beginning of each year. Amirante incurred costs of $300,000 in manufacturing the machine and $14,000 in legal fees directly related to the signing of the lease. Amirante has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Instructions a. Discuss the nature of this lease in relation to the lessor and compute the amount of each of the following items. 1. Lease receivable at commencement of the lease. 2. Sales price. 3. Cost of sales. b. Prepare a 10-year lease amortization schedule for Amirante, the lessor. c. Prepare all of the lessor's journal entries for the first…arrow_forwardAmirante Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $495,678, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $15,000. The hospital will pay rents of $60,000 at the beginning of each year. Amirante incurred costs of $300,000 in manufacturing the machine and $14,000 in legal fees directly related to the signing of the lease. Amirante has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Chambers Medical Center has an incremental borrowing rate of 5% and an expected residual value at the end of the lease of $10,000 What is the initial lease liability?arrow_forwardPLEASE PROVIDE CORRECT ANSWER AND I WILL LIKE YOUR ANSWER. Indigo Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Sweet Medical Center for a period of 10 years. The normal selling price of the machine is $503,479, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $14,500. The hospital will pay rents of $61,000 at the beginning of each year. Indigo incurred costs of $225,000 in manufacturing the machine and $14,600 in legal fees directly related to the signing of the lease. Indigo has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Sweet Medical Center has an incremental borrowing rate of 5% and an expected residual value at the end of the lease of $10,000.arrow_forward

- Cullumber Inc manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $505,456. and its guaranteed residual value at the end of the non- cancelable lease termis estimated to be $16,400. The hospital will pay rents of $61,100 at the beginning of each year. Cullumber incurred costs of $227,000 in manufacturing the machine and $13400 in legal fees directly related to the signing of the lease. Cullumber has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Discuss the nature of this lease in relation to the lessor. The nature of this lease in relation to the lessor is Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimai places, eg. 5,275.) (1) Lease receivable at commencement of the lease (2) Sales price…arrow_forward5...new Indigo Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $524,166, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $16,500. The hospital will pay rents of $63,400 at the beginning of each year. Indigo incurred costs of $258,000 in manufacturing the machine and $14,900 in legal fees directly related to the signing of the lease. Indigo has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%.Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessor.The nature of this lease in relation to the lessor is .Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places,…arrow_forward5...new..B Indigo Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $524,166, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $16,500. The hospital will pay rents of $63,400 at the beginning of each year. Indigo incurred costs of $258,000 in manufacturing the machine and $14,900 in legal fees directly related to the signing of the lease. Indigo has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. (b) Prepare a 10-year lease amortization schedule for Indigo, the lessor. (Round answers to 0 decimal places e.g. 5,275.) INDIGO INC. (Lessor)Lease Amortization Schedule(Annuity due basis, guaranteed residual value) Beginningof Year Annual Lease PaymentPlus Residual Value Interest onLease Receivable Recovery of…arrow_forward

- 5... new...C Indigo Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $524,166, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $16,500. The hospital will pay rents of $63,400 at the beginning of each year. Indigo incurred costs of $258,000 in manufacturing the machine and $14,900 in legal fees directly related to the signing of the lease. Indigo has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. (c) Prepare all of the lessor’s journal entries for the first year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places e.g. 5,275.) No. Account Titles and…arrow_forward5..new a Indigo Inc. manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $524,166, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $16,500. The hospital will pay rents of $63,400 at the beginning of each year. Indigo incurred costs of $258,000 in manufacturing the machine and $14,900 in legal fees directly related to the signing of the lease. Indigo has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%.Click here to view factor tables. (a) Discuss the nature of this lease in relation to the lessor.The nature of this lease in relation to the lessor is (what answer do you put here ????) .Compute the amount of each of the following items. (Round present value factor…arrow_forwardA hospital wants to buy a new MRI machine for $45,000. The annual revenue from the machine is estimated at $18,000 per year while maintenance costs per year are calculated to be $ 6,000. The salvage value at the end of the machine’s six-year operational life is $12,000. If the hospital’s MARR is 10% per year, should this investment be undertaken? (Use PW-Method).arrow_forward

- A toy manufacturer is considering the installation of a new process machine for the toy manufacturing facility. The machine costs $350,000 installed. wi ll generate additional revenues of $120,000 per year and will save $50,000 per year in labor and material costs. The machine will be financed by a $250,000 bank loan repayable in three equal annual principal installments plus 9% interest on the outstanding balance. The machine will be depreciated by seven-year MACRS. The useful life of this processing machine is 10 years at which time it will be soldfor $20,000. The combined marginal tax rate is 40%.(a) Find the year-by-year after-tax cash flow for the project.(b) Compute the IRR for this investment.(c) At MARR= 18%, is this project economically justifiable?arrow_forwardDauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardThe Ham and Egg Restaurant is considering an investment in a new oven that has a cost of $60,000, with annual net cash flows of $9,950 for 8 years. The required rate of return is 6%. Compute the net present value of this investment to determine whether or not you would recommend that Ham and Egg invest in this oven.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College