Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

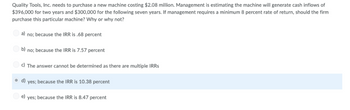

Transcribed Image Text:Quality Tools, Inc. needs to purchase a new machine costing $2.08 million. Management is estimating the machine will generate cash inflows of

$396,000 for two years and $300,000 for the following seven years. If management requires a minimum 8 percent rate of return, should the firm

purchase this particular machine? Why or why not?

a) no; because the IRR is .68 percent

b) no; because the IRR is 7.57 percent

c) The answer cannot be determined as there are multiple IRRs

d) yes; because the IRR is 10.38 percent

e) yes; because the IRR is 8.47 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QRW Corp, needs to replace an old machine with a new, more efficient model. The new machine being considered will result in an increase in camings before interest and taxes of $70,000 per year. The purchase price is $200,000, and it would cost an additional $10,000 to properly install the machine. In addition, to properly operate the machine, inventory must be increased by S10,000. This machine has an expected life of 10 years, with no salvage value. Assume that a straight-line depreciation method being used and that this machine is being depreciated down to zero, the marginal tax rate is 34%, and a required rate of return of 15%. (i) Solve for the value of the initial outlay associated with this project. (ii) Solve for the value of annual after-tax cash flows for this project from 1 through 9arrow_forwardTurner Hardware is adding a new product line that will require an investment of $1,530,000. Managers estimate that this investment will have a 10-year life and generate net cash inflows of $320,000 the first year, $265,000 the second year, and $230,000 each year thereafter for eight years. The investment has no residual value. Compute the payback period. First enter the formula, then calculate the payback period. (Round your answer to two decimal places.) Full years Amount to complete recovery in next year Projected cash inflow in next year )= Payback )= yearsarrow_forwardAcme Company plans to replace some obsolete equipment with new equipment that costs $232,000 and has a useful life of 16 years and a salvage value of $40,000. Acme expects that the new equipment will reduce operating costs (labor, energy, etc.) by $59,000 per year. Acme can sell the old equipment for $20,000. What is the simple rate of return on the investment in the new equipment? Round to one decimal place. 23.9% 21.6% 20.5% 22.2%arrow_forward

- Your company is considering a machine that will cost $1,000 at Time 0 and which can be sold after 3 years for $100. To operate the machine, $200 must be invested at Time 0 in inventories; these funds will be recovered when the machine is retired at the end of Year 3. The machine will produce sales revenues of $900/year for 3 years; variable operating costs (excluding depreciation) will be 50 percent of sales. Operating cash inflows will begin 1 year from today (at Time 1). The machine will have depreciation expenses of $500, $300, and $200 in Years 1, 2, and 3, respectively. The company has a 40 percent tax rate, enough taxable income from other assets to enable it to get a tax refund from this project if the project's income is negative, and a 10 percent required rate of return. Inflation is zero. What is the project's NPV?arrow_forwardTurner Printing is looking to invest in a printer, which costs $60,000. Turner expects a 15% rate of return on this printer investment. The company expects incremental revenues of $30,000 and incremental expenses of $15,000. There is no salvage value for the printer. What is the accounting rate of return (ARR) for this printer? Did it meet the hurdle rate of 15%?arrow_forwardMAG Industrial needs 1000 square meters of storage space. Purchasing land for $80,000 and then erecting a temporary metal building at $70 persquare meter is one option. The president hopes to sell the land for $100,000 and the building for $20,000 after 3 years. Another option is to lease space for $30 per square meter per year payable at the beginning of each year. The MARR is 20%. Perform a present worth analysis of the building and leasing alternatives to determine the sensitivity of the decision if the construction cost decreases by 10% to $63 per square meter and the lease cost remainsat $30 per square meter per year.arrow_forward

- the to be In 2 years, XYZ is considering buying a new, high efficiency interception system. The new system would be purchased today for $46,500.00. It would be depreciated straight-line to $0 over 2 years. system would be sold for an after-tax cash flow of $14,700.00. Without the system, costs are expected to be $100,000.00 in 1 year and $100,000.00 in 2 years. With the system, $79,700.00 in 1 year and $67,000.00 in 2 years. If the tax rate is 48.30% and the cost of capital is 8.30%, what is the net present value of the new interception system project? costs are expected O $13344.34 (plus or minus $50) O $14279.01 (plus or minus $50) O $10213.60 (plus or minus $50) O $11718.49 (plus or minus $50) None of the above is within $50 of the correct answerarrow_forwardCecil company is considering the of a new machine. The machine cost $227,500 and will generate a yearly cash inflow of $35,000. what is the payback period? Requirement: what is the payback period?arrow_forwardPaige Company is contemplating the acquisition of a machine that costs $50,000 and promises to reduce annual cash operating costs by $11,000 over each of the next six years. Which of the following is a proper way to evaluate this investment if the company desires a 12% return on all investments? Select one: a. $50,000 versus -$11,000 × 6. b. $50,000 versus -$66,000 × 0.507. c. $50,000 versus -$66,000 × 4.111. d. $50,000 versus -$11,000 × 4.111. e. $50,000 × 0.893 versus -$11,000 × 4.111.arrow_forward

- Vijayarrow_forwardLukow Products is investigating the purchase of automated equipment that will save $130,000 each year in direct labor and inventory carrying costs. This equipment costs $920,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 11% on all equipment purchases. Management expects this equipment to provide intangible benefits such as greater flexibility and higher-quality output that will increase future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount. 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $920,000 investment? Note: Do not round intermediate calculations. Round your…arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education