FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

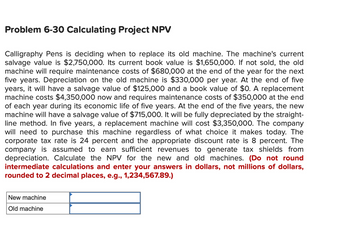

Transcribed Image Text:Problem 6-30 Calculating Project NPV

Calligraphy Pens is deciding when to replace its old machine. The machine's current

salvage value is $2,750,000. Its current book value is $1,650,000. If not sold, the old

machine will require maintenance costs of $680,000 at the end of the year for the next

five years. Depreciation on the old machine is $330,000 per year. At the end of five

years, it will have a salvage value of $125,000 and a book value of $0. A replacement

machine costs $4,350,000 now and requires maintenance costs of $350,000 at the end

of each year during its economic life of five years. At the end of the five years, the new

machine will have a salvage value of $715,000. It will be fully depreciated by the straight-

line method. In five years, a replacement machine will cost $3,350,000. The company

will need to purchase this machine regardless of what choice it makes today. The

corporate tax rate is 24 percent and the appropriate discount rate is 8 percent. The

company is assumed to earn sufficient revenues to generate tax shields from

depreciation. Calculate the NPV for the new and old machines. (Do not round

intermediate calculations and enter your answers in dollars, not millions of dollars,

rounded to 2 decimal places, e.g., 1,234,567.89.)

New machine

Old machine

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- New factory = $10,000,000 Tear down Old factory which cost to build = $2,000,000 Instead of building new factory, can sell the land for = $500,000 New factory has a life of 5 Years but the project is 4 years so depreciate straight line over 5 years Salvage Value at the end of 4 years = $1,000,000 Revenue= $5,000,000 per year Variable Costs = $1,000,000 per year Fixed Costs excluding depreciation = $500,000 WACC=10% Tax Rate = 30% WHAT’S THE NPV OF THIS PROJECTarrow_forwardPROBLEM 1. New Project You must evaluate a proposal to buy a new milling machine. The base price is $108,000, and shipping and installation costs would add another $12,500. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $65,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The machine would require a $5,500 increase in working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $44,000 per year. The marginal tax rate is 35%, and the WACC is 12%. Also, the firm spent $5,000 last year investigating the feasibility of using the machine. What are the project's annual net cash flows during Years 0 through 3?arrow_forwardNonearrow_forward

- D-76 A new chemical remediation tank is needed. C'urrent lechnology tanks, which cost $150,000, musI Ie drained and treated every 2 years at a cost of $30,000; the tanks will last 10 years, and ench will have a salvage value of 5% of first cost. A tank with new technology has just come on the market. T'hore are no periodic maintenance costs, and a tank will last 20 years. If the new tanks cost $325,000, what minimum salvage value, as a percentage of lirst cont, would be required for this technology to be a betler option? Use a 12% interest rate. (a) 10% (b) 36% (c) 57% (d) 72%arrow_forward5 Homework Finch Freight Company owns a truck that cost $41,000. Currently, the truck's book value is $24,000, and its expected remaining useful life is four years. Finch has the opportunity to purchase for $30,500 a replacement truck that is extremely fuel efficient. Fuel cost for the old truck is expected to be $6,100 per year more than fuel cost for the new truck. The old truck is paid for but, in spite of being in good condition, can be sold for only $18,000. Required Calculate the total relevant costs. Should Finch replace the old truck with the new fuel-efficient model, or should it continue to use the old truck until it wears out? Replace With New Keep Old Total relevant costs Should Finch replace or continue the old truck? Replace the old truck. Continue to use the old truck.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education