FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

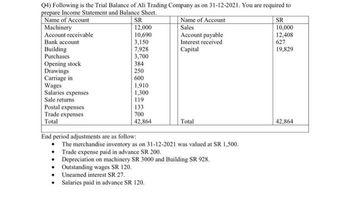

Transcribed Image Text:Q4) Following is the Trial Balance of Ali Trading Company as on 31-12-2021. You are required to

prepare Income Statement and Balance Sheet.

Name of Account

Machinery

Account receivable

Bank account

Building

Purchases

Opening stock

Drawings

Carriage in

Wages

Salaries expenses

Sale returns

Postal expenses

Trade expenses

Total

SR

12,000

10,690

.

3,150

7,928

3,700

384

250

600

1,910

1,300

119

133

700

42,864

Name of Account

Sales

Account payable

Interest received

Capital

Total

End period adjustments are as follow:

The merchandise inventory as on 31-12-2021 was valued at SR 1,500.

Trade expense paid in advance SR 200.

•

•

•

Depreciation on machinery SR 3000 and Building SR 928.

Outstanding wages SR 120.

Unearned interest SR 27.

Salaries paid in advance SR 120.

SR

10,000

12,408

627

19,829

42,864

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Required information Skip to question [The following information applies to the questions displayed below.] The following information for the year ended December 31, 2021, was reported by Nice Bite, Incorporated Accounts Payable $ 54,000 Accounts Receivable 31,800 Cash (balance on January 1, 2021) 102,400 Cash (balance on December 31, 2021) 86,000 Common Stock 138,500 Dividends 0 Equipment 145,700 Income Tax Expense 11,000 Interest Expense 30,400 Inventory 18,100 Notes Payable 32,600 Office Expense 15,200 Prepaid Rent 7,900 Retained Earnings (beginning) 10,800 Salaries and Wages Expense 36,600 Service Revenue 155,800 Utilities Expense 26,000 Salaries and Wages Payable 17,000 Other cash flow information: Cash from issuing common stock $ 30,000 Cash paid to reacquire common stock 34,100 Cash paid for income taxes 11,900 Cash paid to purchase long-term assets 61,400 Cash paid to suppliers and employees 94,000 Cash received…arrow_forwardRequired information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Debits Credits $25,500 16,300 13,800 157,000 $7,600 6,700 Deferred Revenue Common Stock Retained Earnings Totals 152,000 46,300 $212,600 $212,600 The following is a summary of the transactions for the year. storage services for cash, $143,100, and on account, $56,700. on accounts receivable, 1. January 9 2. February 12 Provide Collect $52,400. 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 Receive cash in advance from customers, $13,800. Purchase supplies on account, $11,000. Pay property taxes, $9,409. Pay on accounts payable, $12,300. Pay salaries, $132,600. Issue shares of Common stock in dividends to exchange for $36,000 cash. 9. December 30 Pay $3,700 cash stockholders. 8-a. Prepare the income…arrow_forward45) Based on the following information from a business's financial statements, what amount of accounts receivable change was attributed to sales Sales Ending account receivable a. $37.00 b. $40.00 c. $44.40 d. $48.00 Year 1 ($) 4,440 500 Year 2 ($) 4,795 600arrow_forward

- Below are the accounts of King's Landing Trading for the year ended June 30, 2020 Prepare the Statement of Financial Position. (The accounts are not in order) Include the additional information when making the Balance sheet Cash on hand P150,000 20,000 20,000 Trade securities Accounts Receivable Prepaid rent Merchandise Inventory Prepaid Utilities Cash on bank 12,000 38,000 15,000 100,000 42,000 Advance to employees Land 120,000 220,000 65,000 Building Furniture and Fixture Accounts Payable Notes Payable Unearned Revenue 120,000 50,000 30,000 20,000 11,000 Taxes Payable Warranty payable Loan(lyear) Mortgage Bonds Payable Goodwill Trademark 35,000 200,000 150,000 25,000 10,000 The beginning capital of King's Landing Trading is 120,000. During the year the owner made an additional investment of P50,000 and withdrew P30,000 for personal use. Net income during the year amounted to 56,500. The business assessed their Assets and incurred a depreciation on Building for P20,000 and Furniture…arrow_forward(a) Describe the detail of the transaction being performed in the following screen. (b) Give the journal entry that MYOB made as a result of the transaction in part (a) (Note: account numbers are not required, just use account names.)arrow_forward23. Prepare closing entries rom the following end-of period spreadsheet. Austin Entergrises Fadof Peried Spreadsheet For the Year Eaded December JI Adnted Trial Balance Credit Income Statement Debt Balance Sheet Deb 26.500 7000 Account Titie Crede Debit Crede 26,500 7,000 1,000 18300 Cash Accounts Receivable Supplies Equipment Accumalated Depr 18.500 5.000 5.000 Accoures Payabie Wages Payable Common Stock Retained arnings Dividends Eees Earmed Wages Eapense Rest Esgeme Depreciation Eapense Toals Net omeLo) 11,000 100 6.000 2.000 1000 1,000 6.000 2.000 2.000 2,000 59.500 59.500 19,000 7.000 3.00 19000 7000 3.300 .500 .500 29,500 20.0 59.500 5.000 25,000 20.000arrow_forward

- Can you help prepare the 2 attached journal entries for this example The management of Banciu Corporation provides you with comparative balance sheets at December 31, 20X1, and December 31, 20X0, appearing below. December 31, 20X1 20X0 Assets Cash $ 174,000 $ 223,200 Accounts receivable 306,000 327,600 Allowance for uncollectible accounts (19,200 ) (20,400 ) Inventories 579,600 645,600 Machinery and equipment 1,112,400 776,400 Accumulated depreciation on machinery and equipment (499,200 ) (446,400 ) Leasehold improvements 104,400 104,400 Accumulated amortization on leasehold improvements (69,600 ) (58,800 ) Securities held for plant expansion 180,000 0 Patents 33,360 36,000 Totals $ 1,901,760 $ 1,587,600 Liabilities and stockholders’ equity Accounts payable $ 279,360 $ 126,000 Dividend payable 48,000 0 Current portion of 6% serial bonds…arrow_forward! Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Debits $25,400 Credits 16,200 13,600 156,000 $7,500 6,600 151,000 46,100 Totals $211,200 $211,200 The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 9. December 30 Provide storage services for cash, $142,100, and on account, $56,200. Collect on accounts receivable, $52,300. Receive cash in advance from customers, $13,700. Purchase supplies on account, $10,800. Pay property taxes, $9,300. Pay on accounts payable, $12,200. Pay salaries, $131,600. Issue shares of common stock in exchange for $35,000 cash. Pay $3,600 cash dividends to stockholders. 1. 3. 6. & 10. Post the…arrow_forwardThe manufacturing costs of Mocha Industries for three months of the year are as follows: Total Cost $71,260 73,735 77,585 April May June Production 1,120 units 1,570 units 2,270 units a. Using the high-low method, determine the variable cost per unit. Round your answer to two decimal places. per unit LA b. Using the high-low method, determine the total fixed costs.arrow_forward

- Required information [The following information applies to the questions displayed below.] Lawson Consulting had the following accounts and amounts on December 31. Totals Cash Accounts receivable Equipment Accounts payable Common stock Use the above information to prepare a December 31 trial balance. LAWSON CONSULTING Trial Balance December 31 $ Debit $14,500 6,400 8,400 Rent expense 4,710 Wages expense 22,190 Dividends Services revenue 0 $ Credit 0 $ 3,400 17,700 3,900 8,000arrow_forwardRecord the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education