ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

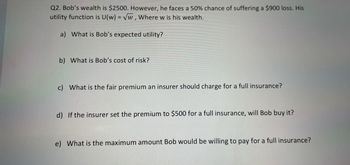

Transcribed Image Text:Q2. Bob's wealth is $2500. However, he faces a 50% chance of suffering a $900 loss. His

utility function is U(w) = √w, Where w is his wealth.

a) What is Bob's expected utility?

b) What is Bob's cost of risk?

c) What is the fair premium an insurer should charge for a full insurance?

d) If the insurer set the premium to $500 for a full insurance, will Bob buy it?

e) What is the maximum amount Bob would be willing to pay for a full insurance?

Expert Solution

arrow_forward

Step 1

utility addresses the satisfaction that purchasers/consumers get for consuming a decent or administration. The utility function estimates customers' preferences for a bunch of goods and services. In economics, the utility capability estimates the government assistance or fulfillment of a shopper as an element of the utilization of genuine merchandise, like food or dress. The utility capability is broadly utilized in objective decision hypotheses to dissect the human way of behaving.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The value of a successful project is $420,000; the probabilities of success are 1/2 with good supervision and 1/4 without. The manager is risk neutral, not risk averse as in the text, so his expected utility equals his expected income minus his disutility of effort. He can get other jobs paying $90,000, and his disutility for exerting the extra effort for good supervision on your project is $100,000. (a) Show that inducing high effort would require the firm to offer a compensation scheme with a negative base salary; that is, if the project fails, the manager pays the firm an amount stipulated in the scheme. (b) How might a negative base salary be implemented in reality? (c) Show that if a negative base salary is not feasible, then the firm does better to settle for the low-pay, low-effort situation.arrow_forwardExpected utility in portfolio theoryarrow_forwardEconomics Fenner Smith from Workouts 13.2 is an investor who has preferences for risk o and returnu given by the utility function u = min (µ, 4 –0). He plans to invest $40,000. The market rate of return is 8 percent and the risk-free rate of return is 2 percent. The risk on the market portfolio is 2 percent. a. How much of his $40,000 will a utility maximizing investor hold in the market portfolio? Show this as Bundle A in your diagram. b. The market return rises to 16 percent.How much of his $40,000 will he hold in the market portfolio. Show this as Bundle C in your diagram. c. Calculate the Hicksian ČV for this change. Show this in your diagram as Bundle B.arrow_forward

- Exercise 4: Insurance Fiona has von Neumann-Morgenstern utility function u(x) = VT and initial wealth 640, 000. She faces a 25% chance of losing L = 280, 000. 1. Is Fiona risk averse? 2. What is Fiona's utility if no loss occurs, what is her utility if the loss occurs? What is Fiona's expected utility? 3. What is the cost of fair insurance against the possible loss? Suppose Fiona is able to choose insurance with any coverage z E [0, 1] (i.e. 0 0 C(z) = if z = 0 4. Suppose co = 0 and c1 = 70,000. Is insurance at coverage level z > 0 fair insurance? What coverage level z* would Fiona choose? Explain. 5. Suppose co = 100 and c1 = 70,000. Is insurance at coverage level z > 0 fair insurance? What coverage level z** would Fiona choose? Explain. (Note that co = 100 is an "avoidable fixed cost" which is only paid if she chooses strictly positive insurance coverage. However, the "marginal cost" of additional insurance, c1 = 70,000, is the same as in the previous part.) 6. Suppose co = 100 and…arrow_forwardA risk-averse consumer with $100,000 in wealth faces 0.1 probability of losing half of his wealth within the next year. a. What is the consumer's expected wealth one year from now? b. An insurance company offers our consumer full insurance against the possible loss. What premium must the consumer be charged for the insurance company to expect to break even? c. Suppose our risk-averse consumer is indifferent between getting $85,000 wealth with certainty and facing the above described uncertain situation. What is the maximum premium that the insurance company will be able to charge this consumer for its full insurance policy?arrow_forwardQ4. An individual with the utility function u(x) = x² owns her wealth of $20,000. An expected profit maximizing company (or risk neutral company) facing the individual can make expected profit greater than $ 19,900. True or False? Explain it. If it is true, showarrow_forward

- Use the utility function u = E (r,) – 0.5 A o, where A is the risk aversion parameter and A = 3.5. Use the average annual return on the S&P 500 as E(r,). Use the average annual interest rate on the US Government 10-year treasury bond over the past decade as r Solve for the investor's optimal allocation between the risky and the risk-free asset.arrow_forwardSarah has a utility function expressed as the square root of wealth (w). Currently, Sarah has an initial wealth of $2000 and faces a potential loss of $1500 with a loss probability of .15. What is Sarah's expected utility if an insurer charges her a pure (actuarially fair) premium? 63.75 41.37 42.13 225arrow_forwardExercise 5: Insurance Consider two individuals, Dave and Eva. Both Dave and Eva have initial wealth 810,000 and face a 40% chance of losing L = 450, 000. Dave has von Neumann-Morgenstern utility function up(x) = x and Eva has von Neumann-Morgenstern utility function ug (x) = VT. 1. What do you know about Dave's and Eva's risk preferences? 2. What is the most Dave would be willing to pay for complete insurance against the loss? 3. What is the most Eva would be willing to pay for complete insurance against the loss? Suppose they are each able choose insurance with any coverage level z [0, 1] (i.e. 0 0. 6. Is Eva's optimal choice full insurance, i.e. z = 1?arrow_forward

- !arrow_forwardPriyanka has an income of £90,000 and is a von Neumann-Morgenstern expected utility maximiser with von Neumann-Morgenstern utility index . There is a 1 % probability that there is flooding damage at her house. The repair of the damage would cost £80,000 which would reduce the income to £10,000. a) Would Priyanka be willing to spend £500 to purchase an insurance policy that would fully insure her against this loss? Explain. b) What would be the highest price (premium) that she would be willing to pay for an insurance policy that fully insures her against the flooding damage?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education