FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

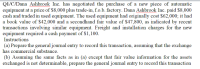

Transcribed Image Text:Q1/C/Dana Ashbrook Inc. has negotiated the purchase of a new piece of automatic

equipment at a price of $8,000 plus trade-in, f.o.b. factory. Dana Ashbrook Inc. paid $8,000

cash and traded in used equipment. The used equipment had originally cost $62,000; it had

a book value of $42,000 and a secondhand fair value of $47,800, as indicated by recent

transactions involving similar equipment. Freight and installation charges for the new

equipment required a cash payment of $1,100.

Instructions

(a) Prepare the general journal entry to record this transaction, assuming that the exchange

has commercial substance.

(b) Assuming the same facts as in (a) except that fair value information for the assets

exchanged is not determinable, prepare the general journal entry to record this transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Steele Corp. purchases equipment for $20,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $900. • Paid installation fees of $1,800. • Pays annual maintenance cost of $280. • Received a 5% discount on $20,000 sales price. Determine the acquisition cost of the equipment.arrow_forwardDELIBIRD Company has recently purchased a computer system for its office. The following information was gathered in relation to the acquisition of the unit: List price P152,000 Trade discounts and rebates taken 56,000 Installation and assembly cost 3,200 Initial delivery and handling cost 6,400 Purchase discount 2% What is the acquisition cost of the new computer? O94.080 O 105.680 O 103,680 O160.600arrow_forwardCedric Company recently traded in an older model of equipment for a new model. The old model’s book value was $180,000 (original cost of $400,000 less $220,000 in accumulated depreciation) and its fair value was $170,000. Cedric paid $60,000 to complete the exchange which has commercial substance. Required: Equipment - new ___?___ Accumulated depreciation 220,000 Loss on exchange of assets 10,000 Cash 60,000 Equipment - old 400,000arrow_forward

- Caine Company exchanged a car from inventory for a computer to be used as a long-term asset. The following information relates to this exchange: Carrying amount of the car, 600,000List selling price of the car, 900,000’ Fair value of the computer, 860,000’; Cash difference paid by Caine, 100,000. What is the cost of the computer acquired in exchange? 1. Indicate the appropriate entries requires for each of the transactions. 2. Will Caine company declare a gain or loss on this transaction?arrow_forwardnt Oaktree Company purchased new equipment and made the following expenditures: Purchase price Sales tax $46,000 2, 300 Freight charges for shipnent of equipnent Insurance on the equipnent for the first year Installation of equipment 71e 910 1,100 The equipment, including sales tax, was purchased on open account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Prepare the necessary journal entries to record the above expenditures. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet > Record the purchase of equipment. Note: Enter debits before credits. Transaction General Journal Debit Credit Journal entry worksheet 11 Record any expenditures not capitalized in the purchase of equipment. Note Peter Oebits before credita Transaction General Journal Debit Credit 21arrow_forward1. Assume Trois Cuisines Manufacturing bought three machines in a $100,000 lump-sum purchase. An independent appraiser valued the machines as follows: (1) Trois Cuisines paid one-third in cash and signed a note payable for the remainder. What is each machine’s individual cost? (2) Immediately after making this purchase, Trois Cuisines sold machine 2 for its appraised value. What is the result of the sale? Round to three decimal places. The result of the sale a _____ of $_____. Prepare the journal entry to record the sale. Please show all steps.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education