FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

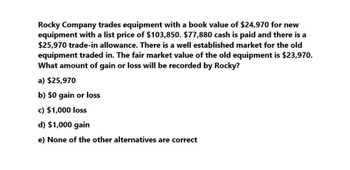

Transcribed Image Text:Rocky Company trades equipment with a book value of $24,970 for new

equipment with a list price of $103,850. $77,880 cash is paid and there is a

$25,970 trade-in allowance. There is a well established market for the old

equipment traded in. The fair market value of the old equipment is $23,970.

What amount of gain or loss will be recorded by Rocky?

a) $25,970

b) $0 gain or loss

c) $1,000 loss

d) $1,000 gain

e) None of the other alternatives are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required A Required B Required C Prepare all worksheet consolidation entries needed to remove the effects of the intercorporate bond ownership in prepa consolidated financial statements for 20X4. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not your intermediate calculations. Round your final answers to nearest whole dollar. No Event A 1 Bonds payable Accounts Interest income Investment in Scarf Company bonds Bond discount Interest expense B 2 Interest payable Interest receivable Show I Debit 400,000 Credit 16,000 395,200 4,800 16,000 × 16,000 16,000arrow_forwardA machine cost $229,000, has annual depreciation expense of $45,800, and has accumulated depreciation of $114,500 on December 31, 2020. On April 1, 2021, when the machine has a fair value of $91,210, it is exchanged for a similar machine with a fair value of $291,900 and the proper amount of cash is paid. The exchange lacked commercial substance.Prepare all entries that are necessary at April 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit April 1, 2021 (To record depreciation) April 1, 2021 (To record exchange of machineries)arrow_forward1. Denver, Inc., exchanged land and cash of $8,000 for equipment. The land was purchased at $55,000 a few years ago and a fair value of $60,000. Prepare the journal entry to record the exchange. Assume the exchange has no commercial substance. 2. Metro Inc. trades its used machine for a new model at Denver Inc. The used machine has a book value of $8,000 (original cost of $12,000) and a fair value of $4,000. The new model lists for $15,000. Denver gives Metro a trade-in allowance of $7,000 for the used machine, $3,000 more than its fair value. Prepare a journal entry for Metro, assuming commercial substance.arrow_forward

- Sheffield Company traded a used truck for a new truck. The used truck cost $44,700 and has accumulated depreciation of $40,230. The new truck is worth $55,130. Sheffield also made a cash payment of $53,640. Prepare Sheffield's entry to record the exchange. (The exchange lacks commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardA company purchased a machine valued at $70,000. It traded in an old (similar) machine for a $9, 400 trade-in allowance, meaning the company paid $60, 600 cash with the trade-in. The old machine cost $48,000 and had accumulated depreciation of $39,600. For tax purposes, the new machine should be recorded at $. ( Do not input a comma or cents.)arrow_forwardUSE THE FOLLOWING INFORMATION: The following information regarding the exchange is available: Motown Corporation trades in a delivery vehicle for a new delivery vehicle. Assume the transaction has commercial substance. Cost of Motown's vehicle (old) $ 59,000 Accumulated Depreciation - Motown's vehicle (old) $ 2,200 Fair value Motown's vehicle (old) $ 39,000 List price of new vehicle (new) $ 61,000 Trade in allowance for Motown's vehicle (old) $ 38,000 26.) Compute the basis of the new vehicle to be recorded on Motown's books.arrow_forward

- Caleb Company owns a machine that had cost $46,000 with accumulated depreciation of $20,200. Caleb exchanges the machine for a newer model that has a market value of $56,000. Record the exchange assuming Caleb paid $31,800 cash and the exchange has commercial substance. Record the exchange assuming Caleb paid $23,800 cash and the exchange has commercial substance.arrow_forwardWillis Bus Service traded in a used bus for a new one. The original cost of the old bus was $52,900. Accumulated depreciation at the time of the trade-in amounted to $35,300. The new bus cost $71,000 but Willis was given a trade-In allowance of $10,600. a. What amount of cash did Willis have to pay to acquire the new bus? b. Compute the gain or loss on the disposal for financial reporting purposes. Complete this question by entering your answers in the tabs below. Required A Required B What amount of cash did Willis have to pay to acquire the new bus? Payment of casharrow_forwardA printer that cost $600 and has been owned for 2 years is traded in for a new one. Depreciation in the amount of $120 had been taken each yearThe new printer has a fair market value of $1,250. A trade-in allowance of $400 is granted, and the balance is paid in cashThe transaction to enter the exchanges of these two assets would result in the recognition of?arrow_forward

- Traded the company car (Automobile) for a newer one at Plume Motors. The old car originally cost $23,000 and is depreciated up-to-date in the amount of $19,000. A trade-in allowance of $5,500 was given. The new car had a market value of $40,000 and the balance was paid in cash. The new car should last at least 100,000 miles and will be depreciated at $0.375 per mile. How would I journalize this?arrow_forwardLarkspur Ltd. traded a used truck (cost $30,200, accumulated depreciation $27,180, fair value $1,950) for a new truck. Larkspur did look up the value of its used truck and determined its fair value at the date of the trade is $1,950. The list price of the new truck is $35,700 and the trade-in allowance given on the trade was $4,970. If Larkspur paid $30,730, what should be the amount used as the cost of the new truck? The cost of the new truck $ Prepare Larkspur's entry to record the exchange. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit NOOarrow_forwardA company recently traded in an older model of equipment for a new model. The old model's book value was $216,000 (original cost of $476,000 less $260,000 in accumulated depreciation) and its fair value was $240,000. The company paid $64,000 to complete the exchange which has commercial substance. Required: Prepare the journal entry to record the exchange. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education