FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:32

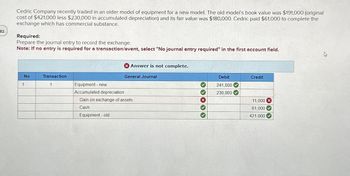

Cedric Company recently traded in an older model of equipment for a new model. The old model's book value was $191,000 (original

cost of $421,000 less $230,000 in accumulated depreciation) and its fair value was $180,000. Cedric paid $61,000 to complete the

exchange which has commercial substance.

Required:

Prepare the journal entry to record the exchange.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

No

1

Transaction

1

Equipment - new

Accumulated depreciation

X Answer is not complete.

General Journal

Gain on exchange of assets

Cash

Equipment - old

33

X

Debit

241,000

230,000

Credit

11,000 X

61,000

421,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Our Company trades in old equipment that cost $81,000, has a book value of $53,000 and a fair value of $45,000. The new equipment has a list price of $94,000. We receive a trade in allowance for the old equipment of $50,000. This transaction has commercial substance. Prepare the journal entry to record this exchange. Answer: Debits Creditsarrow_forwardRequired information [The following information applies to the questions displayed below] Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $20,500 (original cost of $45,000 less accumulated depreciation of $24,500) and a fair value of $10,700. Kapono paid $37,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $585,000 and a fair value of $870,000. Kapono paid $67,000 cash to complete the exchange. The exchange has commercial substance. Required: 1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 2. Assume the fair value of the farmland given is $468,000 instead of $870,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as…arrow_forwardWindsor Company traded a used welding machine (cost $10,440, accumulated depreciation $3,480) for office equipment with an estimated fair value of $5,800. Windsor also paid $3,480 cash in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forward

- Alpesharrow_forwardFoxtrot Co. exchanged equipment and $17,100 cash for similar equipment. The book value and the fair value of the old equipment were $81,000 and $91,700, respectively. Assuming that the exchange lacks commercial substance, Foxtrot would record a gain/(loss) on exchange of assets in the amount of: Multiple Choice $(10,700). $0. $10,700. $27,800.arrow_forwardKingbird Company traded a used welding machine (cost $12,780, accumulated depreciation $4, 260) for office equipment with an estimated fair value of $7,100. Kingbird also paid $4, 260 cash in the transaction. Prepare the journal entry to record the exchange. (The exchange has commercial substance.)arrow_forward

- Please do not give solution in image format ?arrow_forwardOn july 1, 2021, JULIA exchanged its-non-monetary asset (equipment) with GERALD's non-monetary asset (machinery). the following data were made available: JULIA: Equipment P4,400,000 accumulated depreciation 2,000,000 cash received from gerald 500,000 GERALD: Machinery P3,700,000 Accumulated depreiation 1,800,000 Fair value of the machinery 2,100,000 The transaction lack commerical substance. How much is the cost of the new asset of JULIA?arrow_forwardMarigold Corporation traded a used truck for a new truck. The used truck cost $25,000 and has accumulated depreciation of $21,250. The new truck is worth $43,750. Marigold also made a cash payment of $41,250. Prepare Marigold's entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education