Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

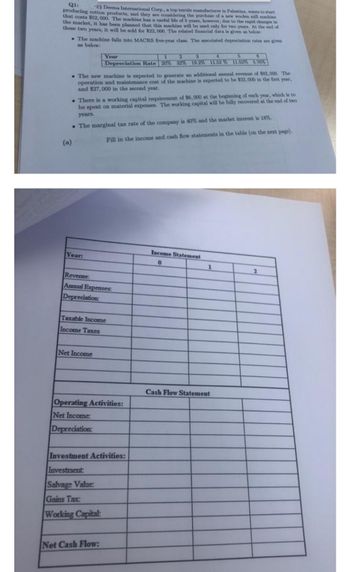

Transcribed Image Text:Q1: - Deema International Corp., a top textile manufacturer in Palestine, wants to start

producing cotton products, and they are considering the purchase of a new woolen mill machine

that costs $52, 000. The machine has a useful life of 5 years, however, due to the rapid changes in

the market, it has been planned that this machine will be used only for two years. At the end of

these two years, it will be sold for $22,000. The related financial data is given as below:

The machine falls into MACRS five-year class. The associated depreciation rates are given

as below:

(a)

The new machine is expected to generate an additional annual revenue of $82,000. The

operation and maintenance cost of the machine is expected to be $22,000 in the first year,

and $27,000 in the second year.

. There is a working capital requirement of $6,000 at the beginning of each year, which is to

be spent on material expenses. The working capital will be fully recovered at the end of two

years,

The marginal tax rate of the company is 40% and the market interest is 18%.

Year:

Year

1

2

4

6

6

Depreciation Rate 20% 32% 19.2% 11.52% 11.52% 5.76%

Net Income

Revenne:

Annual Expenses:

Depreciation:

Taxable Income

Income Taxes

Fill in the income and cash flow statements in the table (on the next page).

Salvage Value:

Gains Tax:

Working Capital:

Operating Activities:

Net Income:

Depreciation:

Net Cash Flow:

Investment Activities:

Investment

Income Statement

0

1

Cash Flow Statement

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1 A travel company is considering obtaining a new boat for tours. It is expected to cost 3,000,000, have a useful life of three years, and sold for 2,000,000 at that time. It will fall into a 25% CCA rate, the firm's tax rate is 40% and its cost of capital is 14%. The boat builder is offering a lease (rent) alternative. What is the most the travel company would be willing to pay at the end of each of the three years, before tax, if it decided to lease the boat? The boat will be returned to the leasing company at that time. (You are calculating the pre-tax lease payment amount. Hint, calculate the net cost of ownership as a starting point). a. 586,111 b. 976,851 c. 289,323 d. 1,000,000arrow_forward9. A company that sells high-purity laboratory chemicals is considering investing in new equipment that will reduce cardboard costs by better matching the size of the products to be shipped to the size of the shipping container. If the new equipment will cost Php1M to purchase and install, how much must the company save each year for 3 years in order to justify the investment, if the interest rate is 10% per year? A Php66465.26 B Php88465.26 Php302114.80 Php402114.80arrow_forwardThe answers are provided, but need help discovering how to get them.arrow_forward

- B 1. Fethe's Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows will be $25,000 per year for 2 years. If demand is bad (60% probability), then the net cash flows will be $5,000 per year for 2 years. Fethe's cost of capital is 10%. What is the expected NPV of the project? Round your answer to the nearest dollar If Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this case, the cash flows that occurred in Years 1 and 2 will be repeated (so if demand was good in Years 1 and 2, it will continue to be good in Years 3 and 4). Use the Black-Scholes model to estimate the value of the option. Assume the variance of the project's rate of return is 0.2369 and that the risk-free rate…arrow_forwardYummy Food is expanding its business and wants to open a new facility to make frozen lasagna, which requires a new automated lasagna maker. A lasagna maker can be purchased for $350,000 or leased under a finance lease over 7 years, with lease payments to be made at the beginning of each year. If the company purchases the lasagna maker, it can be fully depreciated to zero using the straight-line method over seven years. The management expects the scrap/residual value of the lasagna maker to be $60,000 at the end of the lease. After a detailed analysis of the project, Yummy Food determines the appropriate after-tax cost of capital of the project to be 15% per annum. Yummy Food pays a corporate tax rate of 28% and it can borrow funds at a before-tax interest rate of 5% per annum. All cash-flows have been quoted on a before-tax basis. Given this information, what is the lease payment (per annum) that would make Yummy Food indifferent between leasing and borrow-to-buy the machine? (Using…arrow_forwardEe 276.arrow_forward

- A firm is considering leasing or buying a mower. The mower costs $1000 and can be depreciated and falls into the MACRS 3 year class (33%; 45%; 15% and 7%). A maintenance contract will be purchased for $200 per year payable at the start of each year for 4 years. The firms tax rate is 30%. The firm expects to sell the mower for $96 at the end of the 3rd year. What is the net sale price when the mower is sold?arrow_forwardLeeds Limited is looking to expand its operations and increase its market share in the cell phone industry. To achieve this, they are looking to increase its current productive capacity of 100 000 cell phones a year by at least 6% for each of the next 5 years. It is considering two cell phone making machines and is unsure which to purchase: Cell Phone Machine ABC:Cell Phone Machine ABC can be imported at a landed purchase cost of R160 000 and a further R20 000 transport and installation costs will have to be incurred to get it ready for production. This machine is expected to last 5 years after which it will be sold at its scrap value of R20 000. Net cash flow from the sale of the additional production is expected to be R58 000, R63 000, R68 000, R72 000 and R51 000 respectively over the 5-year lifespan of the machine. This machine will enable Leeds Limited to achieve a 4% increase in productive capacity.Cell Phone Machine XYZ:Cell Phone Machine XYZ can be purchased locally for R190…arrow_forwardYour company "Digitup Ltd" needs a new earth moving machine which it can buy for GBP 120,000. The economic life of the machine is 6 years. It can lease the machine for 6 years, with lease payments due at the start of each year, or buy it outright. Hello Yellow Ltd is a leasing company specialising in construction equipment. Due to its volume trades with the supplier it can get a superior discount and buy the machine for GBP 100,000 and depreciate it over 5 years to zero terminal value with maintenance and administration costs of an estimated £12,000 p.a.. Inflation is zero, Hello Yellow's cost of capital is 7% and has an average tax rate of 28%. What is the break-even lease that the company will charge if it lease for 6 years with payment annually in advance?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education