Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

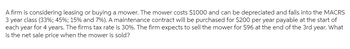

Transcribed Image Text:A firm is considering leasing or buying a mower. The mower costs $1000 and can be depreciated and falls into the MACRS

3 year class (33%; 45%; 15% and 7%). A maintenance contract will be purchased for $200 per year payable at the start of

each year for 4 years. The firms tax rate is 30%. The firm expects to sell the mower for $96 at the end of the 3rd year. What

is the net sale price when the mower is sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- RJR Logistics needs a new color printer. The cost of the printer is $2,025, plus $380 per year in maintenance costs (the first maintence cost would occur in 1 year). The color printer will last for five years. Alternatively, a local company offers to lease the printer to RJR and do the maintenance as well. If the discount rate is 5.7%, what is the most RJR would be willing to pay per year to lease the color printer (the first lease payment would be due in one year)? The most RJR would be willing to pay per year to lease the color printer is closest to: O A. $897 B. $857 C. $884 D. $777arrow_forwardConsider a project to supply 70 units of a product for the next five years. As the center of operations, you can use a building you own that cost $380 five years ago. Selling the building today would give you $330 after tax. If you start the project, you will not be able to sell the building until the project is over. You estimate that selling the building in 5 years will give you $800 after tax. You will also need to install $2,000 in new equipment at the beginning of the project; the equipment will be depreciated straight-line to zero over the project's five-year life. The equipment can be sold for $1,500 at the end of the project. You will also need $35 in initial net working capital for the project, and an additional investment of $33 annually. All net working capital will be recovered when the project ends. Your variable costs are $28 per unit, and you have fixed costs of $560 per year. Your tax rate is 35% and your required return on this project is 10%. If you were to submit a…arrow_forwardA firm is considering whether to buy specialized equipment that would cost $200,000 and have annual costs of $15,000. After 5 years of operation, the equipment would have no salvage value. The same equipment can be leased for $50,000 per year (annual costs included in the lease), payable at the beginning of each year. If the firm uses an interest rate of 5% per year, the annual cost advantage of leasing over purchasing is nearest what value? (a) $2494 (b) $8694 (c) $11,200 (d) $12,758arrow_forward

- Your company is planning to purchase a new loader for $20,937. If the company keeps the old loader, it will have $1,959 additional maintenance cost for the first year and increases $308 each year till the eighth year. Given the company's minimum attractive rate of return (MARR) is 6%, what is the present cost of keeping the old loader? 6% 1 2 3 4 5 879 6 9 Single Payment Compound Present Amount Worth Factor Factor Find F Find P Given F Given P F/P P/F 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1689 .9434 .8900 .8396 .7921 .7473 .7050 .6651 .6274 5919 Sinking Fund Factor Find A Given F A/F 1.0000 .4854 3141 .2286 .1774 .1434 .1191 1010 0870 Compound Interest Factors Uniform Payment Series Capital Recovery Factor Find A Given P A/P 1.0600 .5454 .3741 .2886 2374 2034 .1791 1610 1470 Compound Amount Factor Find F Given A F/A 1.000 2.060 3.184 4.375 5.637 6.975 8.394 9.897 11 491 Present Worth Factor Find P Given A P/A 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 Arithmetic…arrow_forwardBuiltrite is considering purchasing a new machine that would cost $60,000 and the machine would be depreciated (straight line) down to $0 over its five year life. At the end of five years it is believed that the machine could be sold for $15,000. The machine would increase EBDT by $42,000 annually. Builtrite’s marginal tax rate is 34%. What is the TCF associated with the purchase of this machine? $5,100 $7,500 $0 $9,900arrow_forwardA startup is considering buying a $295,000 piece of equipment. If it purchases the equipment, it will take a loan for the entire amount; the interest on the loan is 3%, and the loan will be repaid in 5 equal end of year payments. The startup estimates that the equipment would generate an additional $170,000 of revenue each year. At the end of 5 years, the equipment would have a salvage value of $21,000. The tax rate is 23%. Assuming a planning horizon of 5 years, that the equipment is depreciated using MACRS (3-year property class), and that the medical practice uses an after-tax MARR of 6%, compute the PW and determine whether the startup should invest in the equipment. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. 2$ Carry all interim calculations to 5 decimal places and then round…arrow_forward

- A laboratory might buy a new piece of equipment for $26,785. The equipment's useful life is 4 years, and its salvage value is $5000. The company will save $9000 per year for 4 years if it buys the equipment. Maintenance costs in year 1 will be zero, but will increase each year starting in year 2 by $500 per year (the first year is covered by a warranty). Determine the Equivalent Annual Worth if the company's cost of money is 10%.arrow_forwardVijayarrow_forwardMAG Industrial needs 1000 square meters of storage space. Purchasing land for $80,000 and then erecting a temporary metal building at $70 persquare meter is one option. The president hopes to sell the land for $100,000 and the building for $20,000 after 3 years. Another option is to lease space for $30 per square meter per year payable at the beginning of each year. The MARR is 20%. Perform a present worth analysis of the building and leasing alternatives to determine the sensitivity of the decision if the construction cost decreases by 10% to $63 per square meter and the lease cost remainsat $30 per square meter per year.arrow_forward

- A construction company can purchase a used backhoe for $90,000 and spend $450 per day in operating costs. The equipment will have a 5 -year life then sell it at salvage for $3,000. Alternatively, the company can lease the equipment for $800 per day. How many days per year must the company use the equipment in order to justify its purchase at an interest rate of 6% per year.arrow_forwardAfter spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will add $196,000 to your revenues for each of the next five years and it will cost you $96,000 per year to make the additional product. You will have to use some existing equipment and buy new equipment as well. The existing equipment is fully depreciated, but could be sold for $45,000 now. If you use it in the project, it will be worthless at the end of the project. You will buy new equipment valued at $29,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Your current production manager earns $79,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at$38,000 per year to help with the expansion. You will have to immediately increase your inventory from $20,000 to $30,000. It will return to $20,000 at the end of the project is 21% and your discount rate is 14.7%. What…arrow_forwardThe ABC Corporation is considering introducing a new product, which will require buying new equipment for a monthly payment of $5,000. Each unit produced can be sold for $20.00. ABC incurs a variable cost of $10.00 per unit. Suppose that ABC would like to realize a monthly profit of $50,000. How many units must they sell each month to realize this profit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education