FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

33

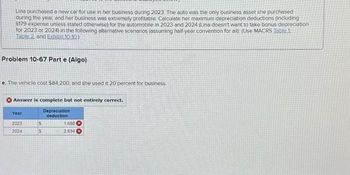

Transcribed Image Text:Lina purchased a new car for use in her business during 2023. The auto was the only business asset she purchased

during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including

$179 expense unless stated otherwise) for the automobile in 2023 and 2024 (Lina doesn't want to take bonus depreciation

for 2023 or 2024) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1.

Table 2 and Exhibit 10.10.)

Problem 10-67 Part e (Algo)

e. The vehicle cost $84,200, and she used it 20 percent for business.

Answer is complete but not entirely correct.

Depreciation

deduction

Year

2023

2024

$

$

1,688 X

2.694

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5 ar Consider the following table: Vehicle #1 $24,350 W x What is the value of y? 2.24 1.03 1.45 1.72 Vehicle #2 $34,890 1 Z Vehicle #3 $59,980 y 100arrow_forward36-The newest conceptual framework, which is the updated version of framework of 2010, is published in O a. None of the options O b. 2018 c. 2010 O d. 2013arrow_forwardtwo questionsarrow_forward

- Based on the following information, what is the expected return? State of Economy Recession Normal Boom Multiple Choice 7.63% 11.39% 9.06% Probability of State Rate of Return if of Economy State Occurs .25 - 9.30% .44 10.80% .31 21.40%arrow_forward26 A probable loss contingency is reasonably estimated within a range of possible amounts. No amount with a range is a better estimate than any other amounts within the range. The amount that should be accrued should be: Group of answer choices the upper amount of the range. zero. the average amount within the range. the lower amount of the range.arrow_forwardSubject: acountingarrow_forward

- Answers are 30. A 31.C How do you get to these?arrow_forward14. Determine the numerical value of the factor (F/A, 5%, 10). A 0.1295 0.0795 12.5779 D 7.7217 B.arrow_forward3:43 اليوم e 12:34 تحریر Problem 7 Illustrate which of the following sentences is true or false: ve 95% the following sentearrow_forward

- it say 43,636.36 is incorrectarrow_forward33 34arrow_forwardBumgardner Incorporated has provided the following data concerning one of the products in its standard cost system. Inputs Direct materials Standard Quantity or Hours per Unit of Output 8.0 liters Standard Price or Rate $ 5.00 per liter The company has reported the following actual results for the product for April: Actual output Raw materials purchased 7,400 units 65,400 liters $ 5.70 per liter 59,210 liters Actual price of raw materials Raw materials used in production The raw materials price variance for the month is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education