FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the current

week are as follows: hours worked, 46; federal income tax withheld, $120; cumulative earnings for the year prior to this week, $5,500; Social

security tax rate, 6% on maximum of $100,000; and Medicare tax rate, 1.5% on all earnings; state unemployment compensation tax, 3.4% on the

first $7,000; federal unemployment compensation tax, .8% on the first $7,000. Prepare the journal entry to record the salaries expense.

Do not include dollar signs in the entry. Please round all numerical answers to the nearest cent. For example, 711.267 would be answered

as "711.27". Use the following chart of accounts to ensure that accounts names are spelled correctly.

11

12

13

14

15

17

18

19

21

22

23

24

25

26

27

28

31

32

Cash

Assets

Accounts receivable

Allowance for doubtful accounts

Supplies

Prepaid insurance

Land

Equipment

Accumulated depreciation-equipment

Liabilities

Accounts payable

Salaries payable

Notes payable

Social security taxes payable

Medicare taxes payable

Federal withholding taxes payable

SUTA payable

FUTA payable

Owner's Equity

Retained earnings

Common stock

Transcribed Image Text:41

51

52

53

54

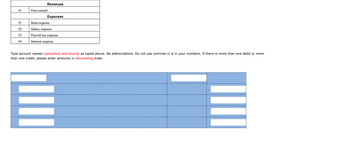

Revenues

Fees earned

Expenses

Rent expense

Salary expense

Payroll tax expense

Interest expense

Type account names completely and exactly as typed above. No abbreviations. Do not use commas or $ in your numbers. If there is more than one debit or more

than one credit, please enter amounts in descending order.

Expert Solution

arrow_forward

Step 1

ANSWER:-

JOURNAL ENTRIES

| Date | Description | Post Ref. | Debit($) | Credit($) |

| December 31 | Salary Expense | 735.00 | ||

| Federal Withholding Taxes Payable | 120.00 | |||

| Social Security Taxes Payable | 44.10 | |||

| Medicare Taxes Payable | 11.03 | |||

| Salaries Payable | 559.87 | |||

| December 31 | Payroll Tax Expense | 86.00 | ||

| Social Security Taxes Payable | 44.10 | |||

| Medicare Taxes Payable | 11.03 | |||

| State Unemployment Comp. Taxes Payable | 24.99 | |||

| Federal Unemployment Comp. Taxes Payable | 5.88 |

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS’s fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Salaries expense $ 530,000 Federal and state income tax withheld 106,000 Federal unemployment tax rate 0.80 % State unemployment tax rate (after FUTA deduction) 5.40 % Social security (FICA) tax rate 7.65 % Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.)arrow_forwardAn employee receives an hourly rate of $25.00, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 42; federal income tax withheld, $281.00; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $769.00 $1,075.00 $688.38 $713.38arrow_forwardAn employee earned $43,300 working for an employer in the current year. The current rate for Federal Insurance Contributions Act (FICA) Social Security is 6.2% payable on earnings up to $137,700 maximum per year, and the rate for Federal Insurance Contributions Act (FICA) Medicare 1.45%. The employer's total Federal Insurance Contributions Act (FICA) payroll tax for this employee is: Multiple Choice O $7.221.60 $3,312.45 $10,534.05 $2.684 60arrow_forward

- Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS’s fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Salaries expense $ 520,000 Federal and state income tax withheld 104,000 Federal unemployment tax rate 0.80 % State unemployment tax rate (after FUTA deduction) 5.40 % Social security (FICA) tax rate 7.65 % Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.) 1. Record the employee salary, withholdings, and salaries payable 2. Record the employer payroll tax expense.arrow_forwardThe current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $3,060 in the current period and had cumulative pay for prior periods of $6,120. What is the amount of unemployment taxes the employer must pay on this employee's wages for the current period? Multiple Choice $420.00. $367.20. $52.80. O $183.60. $0.00.arrow_forwardThomas Martin receives an hourly wage rate of $15, with time-and-a-half pay for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 48; federal income tax withheld, $370; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? Round your answer to the nearest whole dollar. Oa. $720 Ob. $780 Oc. $1,080 Od. $1,440arrow_forward

- . Robart Services pays its employees monthly. The payroll information listed below is for January 2021, the first month of BMS's fiscal year. Assume none of the employees' earnings reached $7,000 during the month. Salaries $80,000 Federal income taxes to be withheld 16,000 Federal unemployment tax rate (FUTA) 0.80% State unemployment tax rate (after FUTA deduction) 5.40% Social security tax rate 6.2% Medicare tax rate 1.45% The journal entry to record payroll for the January 2021 pay period will include a debit to payroll tax expense of: A. $6,120. B. $4,960. C. $57,880. D$11,080arrow_forwardAn employee receives an hourly wage rate of $18, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 45; federal income tax withheld, $349; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $442 $855 $1,151 $1,207arrow_forwardThe summary of the payroll for the monthly pay period ending July 15 indicated the following: Sales salaries $135,000 Federal income tax withheld 32,300 Office salaries 30,000 Medical insurance withheld 7,370 Social security tax withheld 10,200 Medicare tax withheld 2,550 Journalize the entries to record (a) the payroll and (b) the employer's payroll tax expense for the month. The state unemployment tax rate is 3.1%, and the federal unemployment tax rate is 0.8%. Only $30,000 of salaries are subject to unemployment taxes.arrow_forward

- An employee earned $62,500 during the year working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 of employer earnings per calendar year and the FICA tax rate Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount of total unemployment taxes the employee must pay?arrow_forwardMartin Jackson receives an hourly wage rate of $25, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 46; federal income tax withheld, $362; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the net amount to be paid to Jackson? Oa. $1,225.00 Ob. $1,846.13 Oc. $771.13 Od. $1,633.13arrow_forwardAn employee receives an hourly rate of 15 with time and a half for all fours worked in excess of 40during the week. Payroll data for the current week are as follows: hours worked 46- federal income tax withheld, 120 all earnings are subject to social security tax, social security tax rate 6% and Medicare tax rate 1.5%, state employment tax 5.4% on the first 7,000, federal unemployment tax 0.8% on the first 7,000. Prepare journal entry to record the salaries expense. Record the employer payroll tax expense.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education