FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Compute for the net operating income under variable costing for year 2

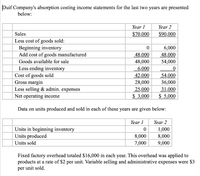

Transcribed Image Text:Duif Company's absorption costing income statements for the last two years are presented

below:

Year 1

Year 2

Sales

$70,000

$90,000

Less cost of goods sold:

Beginning inventory

6,000

Add cost of goods manufactured

48,000

48,000

54,000

Goods available for sale

48,000

Less ending inventory

Cost of goods sold

6,000

42,000

54,000

28,000

Gross margin

Less selling & admin. expenses

36,000

25,000

31,000

Net operating income

$ 3,000

$ 5,000

Data on units produced and sold in each of these years are given below:

Year 1

Year 2

Units in beginning inventory

Units produced

1,000

8,000

8,000

Units sold

7,000

9,000

Fixed factory overhead totaled $16,000 in each year. This overhead was applied to

products at a rate of $2 per unit. Variable selling and administrative expenses were $3

per unit sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Annual equivalent cost (AEC),arrow_forwardThe equation for total costs (Y) is: Y = a+ bX In this equation, “a” represents: Net income Cost of goods sold Total fixed costs The level of activity (e.g., the number of units produced) Total variable costs Variable cost per unit of X Total revenuearrow_forwardSunland Products manufactures and sells a variety of camping products. Recently the company opened a new factory to manufacture a deluxe portable cooking unit. Cost and sales data for the first month of operation are shown below: Beginning inventory Units produced Units sold Manufacturing costs Fixed overhead Variable overhead Direct labour Direct material Selling and administrative costs Fixed Variable 0 units 11,200 10,100 $100,800 $3 $12 $28 $207,100 per unit. per unit per unit $3 per unit sold The portable cooking unit sells for $110. Management is interested in the opening month's results and has asked for an income statement.arrow_forward

- CS_3_QA1_PIR: Req 1A: Compute the unit product cost for Year 1, Year 2, and Year 3. Unit Product Cost Year 1 Year 2 Year 3 Req 1B: Prepare an income statement for Year 1, Year 2, and Year 3. O’Brien Company Variable Costing Income Statement Year 1 Year 2 Year 3 Variable expenses: Total variable expenses 0 0 0 0 0 0 Fixed expenses: Total fixed expenses 0 0 0 $0 $0 $0arrow_forwardb. Prepare a contribution format income statement for May.arrow_forwardCurrent Attempt in Progress Tamarisk Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information: $14,800 12,120 3,840 47,120 77,440 132,480 8,000 Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising Office supplies used $66,480 44,320 2,400 1,280 1,920 14,400 2,510arrow_forward

- When preparing a forecasted contribution margin income statement and you are given the units produced, how do you compute dollars per unit?arrow_forwardHow is operating income affected if the number of units sold exceeds the number of units produced? Select one: a. Operating income would be higher under a variable costing income statement. b. Operating income would be lower under a variable costing income statement. c. Operating income would be higher under an absorption costing income statement. d. Operating income would be the same under both a variable costing and absorption costing income PreviousSave AnswersNextarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education