Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

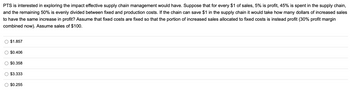

Transcribed Image Text:PTS is interested in exploring the impact effective supply chain management would have. Suppose that for every $1 of sales, 5% is profit, 45% is spent in the supply chain,

and the remaining 50% is evenly divided between fixed and production costs. If the chain can save $1 in the supply chain it would take how many dollars of increased sales

to have the same increase in profit? Assume that fixed costs are fixed so that the portion of increased sales allocated to fixed costs is instead profit (30% profit margin

combined now). Assume sales of $100.

$1.857

$0.406

$0.358

$3.333

$0.255

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are thinking about opening an oil change shop. Your fixed costs will be $14,500 per month. You will charge customers $30 for a lube-oil-filter. The cost of materials is in addition to your fixed costs and is estimated at $10 per customer. How many customers must you have each month in order to break even?arrow_forwardA grocery store sells a bag of 4 oranges for $2.84. How much would it cost for 5 oranges?arrow_forwardTaylor Smith owns a small clothing company, Cuteness for You, that offers an online subscription and personal shopping service targeted at busy families with children aged newborn to five years old. Currently, Taylor has one level of subscription service, the standard service. For $100 a month, the standard service provides its customers a monthly delivery of 10 clothing items carefully chosen to match the child's size, gender, and emerging style. The online clothing subscription market is fairly new but is growing rapidly and thus Taylor is considering extending the product line to increase its market share and profits. Taylor is debating whether to add a premium subscription service featuring profitable high-markup items for $125 per month, a basic subscription service that contains lower-markup popular items priced at $75 per month, or possibly both. Taylor knows that the new product lines provide an opportunity to attract more customers and possibly increase revenues and profit,…arrow_forward

- Can someone help me with the following problems. Thank youarrow_forwardAs a potential owner of a club known as Club Salida, you are interested in determining the necessary volume of sales in dollars to reach the breakeven next year. You decided to break down the club's sales into. four categories, where beer is the first. Your estimate of the sale of beer is that it will serve 30,000 servings. The selling price per unit will average $ 1.50; its cost is $ .75. The second category is food, of which you expect sell 10,000 units with an average unit price of $ 10.00 and a cost of $ 5.00. The third category is desserts and wine, of which you also hope to sell 10,000 units, but with an average unit price of $ 2.50 and a cost of $ 1.00. The last category is inexpensive lunches and sandwiches, of which you expect sell a total of 20,000 units with an average price of $ 6.75 and a cost per unit of $ 3.25. Your fixed costs (i.e. rent, utilities, etc.) are $ 1,800 a month plus $ 2,000 a month for entertainment. a) What is your breakeven point in dollars per month? b)…arrow_forwardWhich of the following accounts would be assigned a higher level of risk: Building or Merchandising Inventory? Explain your answer.arrow_forward

- A machine that costs $8,000 is expected to operate for 10 years. The estimated salvage value at the end of 10 years is $0. The machine is expected to save the company $1,554 per year before taxes and depreciation. The company depreciates its assets on a straight-line basis and has a marginal tax rate of 35 percent. What is the internal rate of return on this investment?arrow_forwardCompanies must chase the objective of matiching supply with demand in order to boost their overall performance. This objective is fully achieved when; A. Costs are minimised while lead time are maxiimised in the supply chain B. Costs are maximised while lead times ar minimised in supply chain C.Costs and lead times are maximesed in the supply chain D. Costs and lead times are minimised in the supply chainarrow_forwardThe higher the price, the fewer goods or services consumers will demand. Conversely, the lower the price, the more goods or services they will demand. Select one: True Falsearrow_forward

- help me with parts a,,b,c. Previous experts provided the wrong answer for me and please draw the graph so i can get a clear image.arrow_forwardPlease show all work and explain answer. OneRing Company sells memorabilia to residents of Middle-Earth. They are about to invest $6 million in a new ring making plant. Fixed costs of operating the plant are $1 million a year. The ring costs $60/unit to manufacture (variable cost) and will be sold for $200/unit. The plant will last for 5 years, and will be depreciated over 5 years to zero using the straight-line method. The plant will have no salvage value after five years. Net working capital requirements are negligible for this project. Assume there are no taxes in Middle-Earth, and that the appropriate discount rate for the project is ten percent. How many rings per year must OneRing sell in order to break even?arrow_forwardImagine that you are the chief operations officer (COO) of Amazon.com. You are interested in creating a competitive advantage for your company (compared to other online retailers) in that you wish to be able to provide to your customers faster shipping than you have been able to provide with your existing set of warehouses and fulfillment centers. It has been decided that using overnight shipping on every order (which would, of course, be about as quick as shipping could be) has been eliminated as a possibility due to being prohibitively expensive. Describe what you would recommend as the COO to improve the speed with which Amazon.com customers receive the products that they have ordered. What negative consequences or disadvantages, if any, do you see as a result of your proposed solution?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.