FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

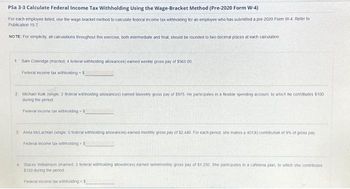

Transcribed Image Text:Psa 3-3 Calculate Federal Income Tax Withholding Using the Wage-Bracket Method (Pre-2020 Form W-4)

For each employee listed, use the wage-bracket method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to

Publication 15-T

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

1 Sam Colendge (married, 4 federal withholding allowances) earned weekly gross pay of $565 00

Federal income tax withholding-S

2. Michael Kolk (single: 2 federal withholding allowances) earned biweekly gross pay of $975 He participates in a flexible spending account, to which he contributes $100

during the period

Federal income tax withholding-5

3: Anita McLachlan (single. O federal withholding allowances) earned monthly gross pay of $2,440 For each period, she makes a 401(k) contribution of 9% of gross pay

Federal income tax withholding $

4 Stacey Williamson (mamed, 3 federal withholding allowances) earned semimonthly gross pay of $1.250 She participates in a cafetena plan, to which she contributes

$150 during the penod

Federal income tax withholding-5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 6: What is the earnings threshold over which an employee whose filing status is Married Filing Separately will be subject to the additional Medicare tax? Answer: А. O $117,000 В. O $125,000 С. O S200,000 D. O $250,000arrow_forwardPURELY COMPENSATION INCOME EARNER Instructions: 1. Download BIR Forms 1700 AND 2316 Version 2018 at www.bir.gov.ph. Compute the income tax payable, if any. Relevant information: YOU, single and a Filipino citizen, and a resident of Brgy. Talipapa, Quezon City is employed by PA-MINE Corp. located in N. Reyes St., Sampaloc, Manila for the calendar period 2021. During your employment, PA-MINE Corp. was able to apply for your TIN where BIR RDO No. 032 – Manila assigned you Taxpayer Identification No. 123-456-789-0000. PA-MINE Corp.’s TIN No. is 987-654-321-0000. Additional information: Your basic salary is Php 30,000 per month In addition to your basic pay, you received the following: Holiday pay – Php 10,000 Hazard pay – Php 20,000 Overtime pay – Php 20,000 Fixed transportation allowance – Php 10,000 Cost of Living Allowance – Php 20,000 13th month pay – Php 30,000 Other benefits – Php 20,000 De minimis benefit of Php – 20,000 PA-MINE Corp. has deducted the following…arrow_forwardUse (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method tablearrow_forward

- 3arrow_forwardSection 5-EMPLOYEE DATA: FORM W-4 AND STATE WITHHOLDING 0ALLOWANCE CERTIFICATES How long does a new employee have to submit a completed W-4? How must the employer withhold FIT until the W-4 is received from a new employee? On March 2, 2020, Mischa submits a new W-4. If payday is Friday, what is the date of the first paycheck that must reflect Mischa’s new W-4? On March 23,2020, Paul submits a new W-4. If Paul is paid the last weekday of each month, what is the date of the first paycheck that must reflect Paul’s new W-4? On October 2, 2020, Janet starts a part-time job. She did not owe federal income tax in 2019 and does not expect to earn enough to pay federal income tax for 2020, so she claims exempt from federal income tax withholding on her 2020 Form W-4. Does Janet need to submit a W-4 in 2021? If so, by when—and how does her employer withhold if she does not do this?arrow_forwardQuestion text The totals from the first payroll of the year are shown below. Total Earnings FICA OASDI FICA HI FIT W/H State Tax Union Dues Net Pay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the entry to deposit the FICA and FIT taxes.arrow_forward

- What amount is withheld yearly for state income tax?arrow_forwardQuestion 7: What is the highest number of withholding allowances an employee using the wage-bracket method can claim on a pre-2020 Form W-4? Answer: А. В. С. 10 D. 480arrow_forwardPSb 3-4 Calculate Federal Income Tax Withholding Using the Percentage Method (pre-2020 Form W-4) For each employee listed. use the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4 to the Federal Tax Tables in Appendix A of your textbook. Note: For simplicity. all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1. Juan Hoffman (single; 2 federal withholding allowances) earned weekly gross pay of $445. Federal income tax withholding=$arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education