FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

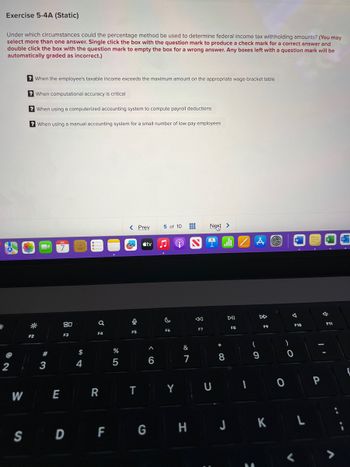

Transcribed Image Text:Exercise 5-4A (Static)

Under which circumstances could the percentage method be used to determine federal income tax withholding amounts? (You may

select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and

double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be

automatically graded as incorrect.)

@

2

W

? When the employee's taxable income exceeds the maximum amount on the appropriate wage-bracket table

? When computational accuracy is critical

? When using a computerized accounting system to compute payroll deductions

? When using a manual accounting system for a small number of low-pay employees

F2

#

3

JUL

7

E

80

F3

$

4

a

F4

R

.

%

5

< Prev 5 of 10

m

F5

T

tv ♫ A

A

6

F6

Y

&

7

←

F7

Next >

U

8

DII

F8

ZAO

1

(

DD

9

F9

)

0

0

W

F10

S D F G H J K L

P

X

F11

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please answer fast without plagiarism please no plagiarismarrow_forwardQuestion 9: The Internal Revenue Service levies a small service fee for employers who utilize the Electronic Federal Tax Payment System. Answer: A. True В. Falsearrow_forwardPSc 3-4 Calculate Federal Income Tax Withholding Using the Percentage Method (pre-2020 Form W-4) For each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to the Federal Tax Tables in Appendix A of your textbook. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Publication 15-T (2020) 1: Tony Daniels (Married; 4 federal withholding allowances) earned weekly gross pay of $800. Federal income tax withholding = $ 2: Mario Gonzales (married; 5 federal withholding allowances) earned biweekly gross pay of $2,025. He participates in a flexible spending account, to which he contributes $100 during the period. Federal income tax withholding = $ 3: Angela Brown (single; 3 federal withholding allowances) earned monthly gross pay of $5,170. For each period, she makes a 401(k) contribution of 12%…arrow_forward

- 1. true or falsearrow_forwardQuestion 12: In general, when the number of withholding allowances increases for an employee who has completed a pre-2020 Form W-4, the federal income tax withholding Answer: A. decreases В. increases also C. is not affected D. decreases for some and increases for othersarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please Solve In 20minsarrow_forward1. The secondary authority should be cited in the analysis section of a tax file memo. Is true or false? 2. What is the title of Section 152? a.Dependent defined b.Allowance of deductions for personal exemptions (151) c.Allowance for deductions (161) d.None of the above 3.(True/False) Letter rulings are a source of tax law.arrow_forwardQuestion 6 The following income received by officials and employees in the public sector are not subject to income tax and withholding tax on compensation, except The excess of the 13th month pay and other benefits paid or accrued during the year over P90,000 Representation and transportation allowance (RATA) granted under the General Appropriations Act Personnel Economic Relief Allowance (PERA) granted to government personnel Monetized value of leave credits paid to government officials and employees Question 7 S1: Gross income exclusion are flow of wealth to taxpayers which are not considered as part of gross income farrow_forward

- Theme: Adjusted Gross Income as determined by IRS of USA. Examine the case below and do the following:1.Indicates the income items that are part of the gross income.2.Indicates the salary exclusions.3.Identify the deductions to which the taxpayer is entitled to calculate the adjusted gross income.4.Calculate adjusted gross income.5.Indicates the status that the taxpayer must file. Case 4 Rosa Hernández was born on May 2, 1979, is a veteran, secretary, divorced, and her W-2 shows a salary of $55,000 and tax withheld of $4,000. Rosa is studying and paid $8,000 for her college tuition for her bachelor's degree. She has a son who was born on April 24, 2008.arrow_forwardPSb 3-7 Calculate Federal Income Tax Withholding Using the Percentage Method (2020 Form W-4) For each employee listed, use the percentage method to calculate federal income tax withholding for an employee who has submitted a 2020 Form W-4. Refer to Appendix A, 2020 Federal Tax Tables in your textbook. Publication 15-T (2020) 1: Julia Jacobsen files as single on her tax return and earned weekly gross pay of 500. For each pay period she makes a 401(k) contribution of 2% of gross pay. Julia checked box 2c on Form W-4, entered $40 on line 4c of the form, and did not enter any information in step 3 of the form. Federal income tax withholding = | 2: Alejandro Wright files as single on his tax return and earned weekly gross pay of 1300. He does not make any retirement plan contributions. Alejandro entered 500 in step 3 of the form and did not enter any information in steps 2 & 4 of the form. Federal income tax withholding = $ Tentative Federal Income Tax Withholding = $ 3: Beatrice Nen files…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education