FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer within 30 minutes.

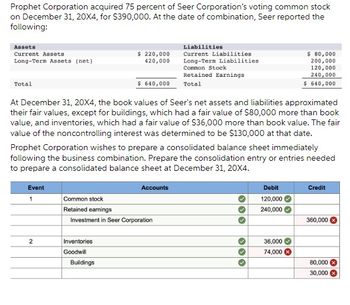

Transcribed Image Text:Prophet Corporation acquired 75 percent of Seer Corporation's voting common stock

on December 31, 20X4, for $390,000. At the date of combination, Seer reported the

following:

Assets

Current Assets

Long-Term Assets (net)

Total

Event

1

2

$ 220,000

420,000

At December 31, 20X4, the book values of Seer's net assets and liabilities approximated

their fair values, except for buildings, which had a fair value of $80,000 more than book

value, and inventories, which had a fair value of $36,000 more than book value. The fair

value of the noncontrolling interest was determined to be $130,000 at that date.

$ 640,000

Prophet Corporation wishes to prepare a consolidated balance sheet immediately

following the business combination. Prepare the consolidation entry or entries needed

to prepare a consolidated balance sheet at December 31, 20X4.

Inventories

Goodwill

Buildings

Common stock

Retained earnings

Investment in Seer Corporation

Liabilities

Current Liabilities.

Long-Term Liabilities

Common Stock

Retained Earnings

Total

Accounts

$80,000

200,000

120,000

240,000

$ 640,000

Debit

120,000

240,000

36,000

74,000

Credit

360,000

80,000

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SOLVE STEP BY STEP IN DIGITAL FORMAT dont use excel, dont use IA 5.28 Find the amount of 18 payments that the anesthetist Joaquín Murillo must make at the beginning of each bimonthly period, if the amount he deposits bimonthly is $1,985. The interest is 15% per year, compounded bimonthly.arrow_forwardPeg Gasperoni bought a $50,000 life insurance policy for $190 per year. Ryan Life Insurance Company sent her the following billing instructions along with a premium plan example: "Your insurance premium notice will be mailed to you in a few days. You may pay the entire premium in full without a finance charge or you may pay the premium in installments after a down payment and the balance in monthly installments of $50. The finance charge will be added to the unpaid balance. The finance charge is based on an annual percentage rate of 18%." If the total policy premium is: $190 290 390 And you put down: Finance Charge $50.00 70.00 95.00 The balance subject to finance charge will be: $140.00 220.00 295.00 $ 4.96 The total number of monthly installments ($30 minimum) will be: Peg feels that the finance charge of $4.35 is in error. a. What is the actual finance charge for the first three months? Note: Round your answer to the nearest cent. 3 5 6 The monthly installment before adding the…arrow_forwardTuition of $1219 will be due when the spring term begins in 3 months. What amount should a student deposit today, at 6.47%, to have enough to pay the tuition? The student should deposit $ (Simplify your answer. Round to the nearest dollar as needed.)arrow_forward

- You have a Visa credit card account lemi with a 24.99% annual percentage rate calculated on the average daily balance. The billing date is the first day of each month, and the billing cycle is the number of days in that month. Your credit card balance on June 1 was $252. On June 8th you made a $109 purchase. You made another purchase, a $75 gift card, on June 18th. You made a $100 payment on June 28th. Show your work for all parts of the problem. (a) What is the average daily balance for July? (b) What is your finance charge on the account as of July 1st? (c) What is your new credit card balance?arrow_forwardPlease write the final answer as a percentage with one decimal.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education