Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

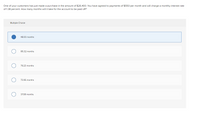

Transcribed Image Text:One of your customers has just made a purchase in the amount of $26,400. You have agreed to payments of $550 per month and will charge a monthly interest rate

of 1.38 percent. How many months will it take for the account to be paid off?

Multiple Choice

48.00 months

85.32 months

79.23 months

73.95 months

37.08 months

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have a credit card that has a balance of $6400 at an APR of 13.49%. You plan to pay $300 each month in an effort to clear the debt quickly. How many months will it take you to pay off the balance?arrow_forward10arrow_forwardLetter of credit or line of credit. As We Go Bank offers its customers a line-of-credit loan in which each month’s outstanding balance has an interest charge at 12% APR. For the following loans, all with a $100,000 credit line, what are the required monthly interest payments and the total interest paid for the year?arrow_forward

- You just obtained a loan of $12,157 with monthly payments for four years at 5.77 percent interest, compounded monthly. What is the amount of each payment? Instruction: Enter your response rounded to two decimal places. 1 harrow_forwardAssume that you start with a balance of $3900 on your credit card. During the first month you charge $400 and during the second month you charge $650 Assume that you credit card charges a 29% APR and that each month only the minimum payment of 2.5% of the balance. Table round to the nearest cent 1 month Previous balance, Finance charge- Purchase- New balance 2 month Previous balance, Finance charge- Purchase- New balancearrow_forwardQ. 8arrow_forward

- One of your customers has just made a purchase in the amount of $27,200. You have agreed to payments of $575 per month and will charge a monthly interest rate of 1.41 percent. How many months will it take for the account to be paid off? One of your customers has just made a purchase in the amount of $27,200. You have agreed to payments of $575 per month and will charge a monthly interest rate of 1.41 percent. How many months will it take for the account to be paid off? Multiple Choice: 36.50 months 84.57 months 78.53 months 73.30 months 47.30 monthsarrow_forwardToday, you signed loan papers agreeing to borrow $4,954.85 at 12% APR compounded monthly. The loan payment is $142.33 a month. How many loan payments must you make before the loan is paid in full? A. 29.89B. 30.02C. 38.88D. 40.00E. 43.00arrow_forwardIf you borrow $7,300 at $800 interest for one year, what is your effective interest rate for the following payment plans? Note: Input your answers as a percent rounded to 2 decimal places. a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective Rate of Interest % % % %arrow_forward

- Suppose Jorge Otero has set up an annuity due with a certain credit union. At the beginning of each month, $130 is electronically debited from his checking account and placed into a savings account earning 6% interest compounded monthly. What is the value (in $) of Jorge's account after 17 months? (Round your answer to the nearest cent.)arrow_forwardOne of your customers is delinquent on his accounts payable balance. You’ve mutually agreed to a repayment schedule of $590 per month. You will charge .99 percent per month interest on the overdue balance. If the current balance is $14,810, how long will it take for the account to be paid off? Number of months:arrow_forwardyou take out an installment loan to purchase a time share costing $17,000. You make a down payment of $2,500 and finance the balance by making monthly payments of $718.66 for 24 months. Find the APRarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education