Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

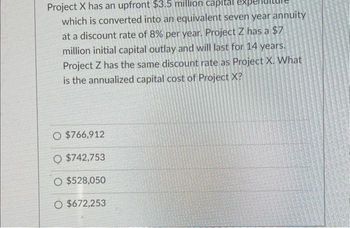

Transcribed Image Text:Project X has an upfront $3.5 million capital expe

which is converted into an equivalent seven year annuity

at a discount rate of 8% per year. Project Z has a $7

million initial capital outlay and will last for 14 years.

Project Z has the same discount rate as Project X. What

is the annualized capital cost of Project X?

O $766,912

O $742,753

O $528,050

O $672,253

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Subject:arrow_forwardA project has estimated annual net cash flows of $11,250 for four years and is estimated to cost $37,500. Assume a minimum acceptable rate of return of 12%. Use Present Value of an Annuity of $1 at Compound Interest table below.arrow_forwardWhat is the net present value of a project that has an initial cost of $40,000 and produces cash inflows of $9,000 a year for 11 years if the discount rate is 15 percent? $3,621.86 $9,074.60 $7,103.41 $2,940.28 $3,869.69arrow_forward

- For the following project, compute an EAA: Project A requires you an upfront payment of $212872 and yearly payments of $51728 for 12 years. Your cost of capital is 4.59%arrow_forwardA project has estimated annual net cash flows of $147,000 for 4 years and is estimated to cost $475,500. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (1) the net present value of the project and (2) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) $fill in the blank 1 Present value index (rounded to two decimal places) fill in the blank 2 Feedback…arrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 8 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: Cash flow: Payback 0 1 -$1,000 $350 years 2 $480 3 $520 4 $300 5 $100arrow_forward

- Please show complete steps all parts or skip itarrow_forward(c) A sum of 10,000 RO is required in 5 yoars from now. An annual sinking fund is to be sot up that will return an interest rate of 6% over this period. What will be the annual sinking fund instalments?arrow_forwardYour required rate of return is 10 percent. If you invest $3,000 today you will receive the following cash flows from year 1 to 4: 2000, 500, 1000, 2000. Calculate the Discounted Payback Period of the project. 3.7 years 3.9 years 3.1 years 3.5 years 3.3 3 yearsarrow_forward

- A company is considering an iron ore extraction project that requires an initial investment of $508,000 and will yield annual cash inflows of $152,000 for four years. The company's discount rate is 9%. What is the NPV of the project? Present value of an ordinary annuity of $1: 8% 9% 10% 1 2 3 4 5 6 7 8 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 OA $101,600 OB. $15,520 OC. $(15,520) OD. $(101,000) 0.917 1.759 2.531 3.24 3.89 4.486 5.033 5.535 0.909 1.736 2.487 3.17 3.791 4.355 4.668 5.335arrow_forwardA company is considering an iron ore extraction project that requires an initial investment of $1,200,000 and will yield annual cash inflows of $534,283 for three years. The company's discount rate is 9%. Calculate IRR. Present value of ordinary annuity of $1: 10% 12% 14% 15% 16% 18% 20% 1 0.909 0.893 0.877 0.870 0.862 0.847 0.833 1.736 1.690 1.647 1.626 1.605 1.566 1.528 3 2.487 2.402 2.322 2.283 2.246 2.174 2.106 4 3.170 3.037 2.914 2.855 2.798 2.690 2.589 OA. 16% OB. 15% D OC. 14% O OD. 18%arrow_forwardKerr Kompany is considering investing in a project that costs $50,000 and is expected to generate cash inflows of $20,450 at the end of each year for three years. The company requires a 11% rate of return on all new investments. Present Value of an Annuity of 1 Periods 9% 10% 11% 12% 3 2.531 2.489 2.444 2.402 4 3.239 3.170 3.102 3.037 The profitability index for this project is: A. 1.00. B. 0.80. C. 1.24. D. 1.27.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education