Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

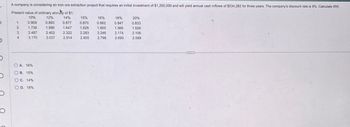

Transcribed Image Text:A company is considering an iron ore extraction project that requires an initial investment of $1,200,000 and will yield annual cash inflows of $534,283 for three years. The company's discount rate is 9%. Calculate IRR.

Present value of ordinary annuity of $1:

10%

12%

14%

15%

16%

18%

20%

1

0.909

0.893

0.877

0.870

0.862

0.847

0.833

1.736

1.690

1.647

1.626

1.605

1.566

1.528

3

2.487

2.402

2.322

2.283

2.246

2.174

2.106

4

3.170

3.037

2.914

2.855

2.798

2.690

2.589

OA. 16%

OB. 15%

D

OC. 14%

O

OD. 18%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A project is estimated to cost $361,465 and provide annual net cash flows of $83,000 for six years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine the internal rate of return for this project, using the Present Value of an Annuity of $1 at Compound Interest table shownarrow_forwardNet Present Value A project has estimated annual net cash flows of $15,000 for three years and is estimated to cost $47,500. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) $fill in the blank 1 Present value index (rounded to two decimal places) fill in the blank 2arrow_forwardA project is estimated to cost $496,798 and provide annual net cash flows of $89,000 for seven years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine the internal rate of return for this project, using the Present Value of an Annuity of $1 at Compound Interest table shown abovearrow_forward

- A business sets up a sinking fund so they will have a $68,000.00 to pay for a replacement piece of equipment in 12 years when the current equipment will be sold for scrap. If they make deposits at the end of each quarter for 12 years in the investment that pays 6.3% compounded quarterly, what size should each payment be? Answer: The quarterly payments are $. (Round to the nearest cent/penny)arrow_forwardUse the following 8% interest factors. Present Value ofOrdinary Annuity Future Value ofOrdinary Annuity 7 periods 5.20637 8.92280 8 periods 5.74664 10.63663 9 periods 6.24689 12.48756 What amount should be recorded as the cost of a machine purchased December 31, 2020, which is to be financed by making 8 annual payments of $21500 each beginning December 31, 2021? The applicable interest rate is 8%. A.)$150500 B.)$228688 C.)$134308 D.)$123553arrow_forwardProject X has an upfront $3.5 million capital expe which is converted into an equivalent seven year annuity at a discount rate of 8% per year. Project Z has a $7 million initial capital outlay and will last for 14 years. Project Z has the same discount rate as Project X. What is the annualized capital cost of Project X? O $766,912 O $742,753 O $528,050 O $672,253arrow_forward

- Please show complete steps all parts or skip itarrow_forwardPlease no written by hand solutionsarrow_forwardA $6,000,000 apartment complex loan is to be paid off in 10 years by making 10 equal annual payments. How much is each payment if the interest rate is 7.5% compounded annually? (a) State the type. ordinary annuity sinking fund amortization present value of an annuity present value (b) Answer the question. (Round your answer to the nearest cent.)arrow_forward

- A project that provides annual cash flows of $11322 for eight years costs $80145 today. At what discount rate would you be indifferent between accepting the project and rejecting it? (Enter your answer as a percentage, omit the "%" sign in your response, and round your answer to 2 decimal places. For example, 0.12345 or 12.345% should be entered as 12.35.)arrow_forwardProject A costs $5,300 and will generate annual after-tax net cash inflows of $1,900 for five years. What is the NPV using 5% as the discount rate? Round your present value factor to three decimal places and final answer to the nearest dollar. (Click here to see present value and future value tables) 2,928 xarrow_forwardKeystone Healthcare Corp. is proposing to spend $101,700 on a 10-year project that has estimated net cash flows of $18,000 for each of the 10 years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Compute the net present value, using a rate of return of 15%. Use the table of present value of an annuity of $1 presented above. If required, round to the nearest dollar. Use the minus sign to indicate a negative net present value. Present value of annual net cash flows $ Less amount to be invested $ Net present value $ b. Based on the analysis prepared in part (a), is the rate of return (1) more than…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education