FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:I

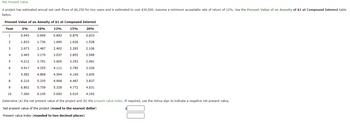

Net Present Value

A project has estimated annual net cash flows of $6,250 for two years and is estimated to cost $30,000. Assume a minimum acceptable rate of return of 12%. Use the Present Value of an Annuity of $1 at Compound Interest table

below.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

12%

15%

20%

1

0.943

2

3

4

5

6

7

8

9

1.833

2.673

3.465

4.212

4.917

5.582

6.210

6.802

10

10%

7.360

0.909

1.736

2.487

3.170

3.791

4.355

4.868

5.335

5.759

6.145

0.893

1.690

2.402

3.037

3.605

4.111

0.870

1.626

2.283

2.855

3.353

3.785

4.160

4.487

4.772

0.833

5.019

1.528

2.106

2.589

4.564

4.968

5.328

5.650

Determine (a) the net present value of the project and (b) the present value index. If required, use the minus sign to indicate a negative net present value.

Net present value of the project (round to the nearest dollar)

Present value index (rounded to two decimal places)

2.991

3.326

3.605

3.837

4.031

4.192

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- please step by step solution.arrow_forwardFind the periodic payments PMT necessary to accumulate the given amount in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $30,000 in a fund paying 5% per year, with monthly payments for 5 years, if the fund contains $10,000 at the start PMT = $arrow_forwardFind the present value PV of the annuity account necessary to fund the withdrawal given. (Assume end-of-period withdrawals and compounding at the same intervals as withdrawals. Round your answer to the nearest cent.) $200 per month for 20 years, if the account earns 2% per yeararrow_forward

- Nonearrow_forwardCalculate the convexity of a 4-year annuity-immediate with payments of $100, $100, $200, and $300. The annual effective yield rate is 6%. A 11.320 B 12.320 с 13.320 Ꭰ 14.320 E 15.320arrow_forwardA project has estimated annual net cash flows of $11,250 for four years and is estimated to cost $37,500. Assume a minimum acceptable rate of return of 12%. Use Present Value of an Annuity of $1 at Compound Interest table below.arrow_forward

- Find the present value of an investment if it is expected to provide annual earnings of $20,000 for 10 years and to have a resale value of $50,000 at the end of that period. Assume a 8% rate and earnings at year end. The present value of 1 at 8% for 10 periods is .46319. The present value of an ordinary annuity at 8% for 10 periods is 6.71008. The future value of 1 at 8% for 10 periods is 2.15892.arrow_forwardA project has estimated annual net cash flows of $147,000 for 4 years and is estimated to cost $475,500. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annuity of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Determine (1) the net present value of the project and (2) the present value index. If required, use the minus sign to indicate a negative net present value. Net present value of the project (round to the nearest dollar) $fill in the blank 1 Present value index (rounded to two decimal places) fill in the blank 2 Feedback…arrow_forwardFind the periodic payments PMT necessary to accumulate the given amount in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $90,000 in a fund paying 3% per year, with monthly payments for 10 years, if the fund contains $30,000 at the startarrow_forward

- Given the following information, calculate the rate of return. price = $501.88time to maturity = 10 yearsannual payment = $100type = ordinary annuityarrow_forwardUse the following 8% interest factors. Present Value ofOrdinary Annuity Future Value ofOrdinary Annuity 7 periods 5.20637 8.92280 8 periods 5.74664 10.63663 9 periods 6.24689 12.48756 What amount should be recorded as the cost of a machine purchased December 31, 2020, which is to be financed by making 8 annual payments of $21500 each beginning December 31, 2021? The applicable interest rate is 8%. A.)$150500 B.)$228688 C.)$134308 D.)$123553arrow_forwardA $6,000,000 apartment complex loan is to be paid off in 10 years by making 10 equal annual payments. How much is each payment if the interest rate is 7.5% compounded annually? (a) State the type. ordinary annuity sinking fund amortization present value of an annuity present value (b) Answer the question. (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education