Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Ef 495.

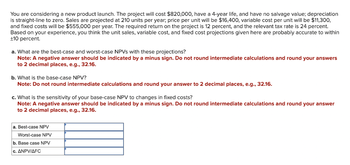

Transcribed Image Text:You are considering a new product launch. The project will cost $820,000, have a 4-year life, and have no salvage value; depreciation

is straight-line to zero. Sales are projected at 210 units per year; price per unit will be $16,400, variable cost per unit will be $11,300,

and fixed costs will be $555,000 per year. The required return on the project is 12 percent, and the relevant tax rate is 24 percent.

Based on your experience, you think the unit sales, variable cost, and fixed cost projections given here are probably accurate to within

+10 percent.

a. What are the best-case and worst-case NPVs with these projections?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers

to 2 decimal places, e.g., 32.16.

b. What is the base-case NPV?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

c. What is the sensitivity of your base-case NPV to changes in fixed costs?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer

to 2 decimal places, e.g., 32.16.

a. Best-case NPV

Worst-case NPV

b. Base case NPV

c. ANPV/AFC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the NPV method to determine whether Root Products should invest in the following projects: • Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B: Costs $380,000 and offers 9 annual net cash inflows of $74,000. Root Products demands an annual return of 10% on investments of this nature. E(Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (i=12%, n=8) Value 1-8 Present value of…arrow_forwardss.arrow_forwardSean and Jenny own a home in Boulder City, Nevada, near Lake Mead. During the year, they rented the house for 40 days for $3,200 and used it for personal use for 18 days. The house remained vacant for the remainder of the year. The expenses for the house included $14,150 in mortgage interest, $3,560 in property taxes, $1,200 in utilities, $1,340 in maintenance, and $11,000 in depreciation. What is the deductible net loss for the rental of their home (without considering the passive loss limitation)? Use the Tax Court method for allocation of expenses.arrow_forward

- bdhdhdjdjdjjdis plz dont answer current ration in the following: Current Asset $20000., Current Liability $20000arrow_forwardA company that was to be liquidated had the following liabilities: Income Taxes Notes Payable secured by land Accounts Payable $ 15,000 120,000 48,000 Salaries Payable ($18,000 for Employee #1 and $5,000 for Employee #2) Administrative expenses for liquidation The company had the following assets: 23,000 Current Assets Land Building Saved 25,000 Book Fair Value Value $130,000 $115,000 60,000 100,000 175,000 220,000 Total liabilities with priority are calculated to be what amount? Multiple Choice О $106,650. $38,000.arrow_forwardA direct quote of €0.1256/Dkr is equivalent to an indirect quote of a . Dkr 7.962/€ b . Dkr 7.8654/€ c . Dkr 0.8654/€ d . Dkr 1.1345/€arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education