Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

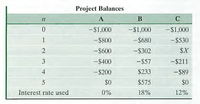

Consider the following project-balance profiles for proposed investment projects, where the project-balance figures are rounded to the nearest dollar:

(a) Compute the net present worth of each investment.

(b) Determine the project balance at the end of period 2 for Project C if

A2 = $500.

(c) Determine the cash flows for each project.

(d) Identify the net future worth of each project.

Transcribed Image Text:Project Balances

A

B

C

-$1,000

-$1,000

-$1,000

1

-S800

-$680

-$530

-$600

-$302

$X

3

-$400

-$57

-$211

4

-$200

$233

- $89

$0

$575

$0

Interest rate used

0%

18%

12%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Explain how to find the value of a capital budgeting project given its cost, its expected annualnet cash flows, its life, and its cost of capital.arrow_forwardA project costing $230,000 has a Net Present Value (NPV) of -$24,400. Which one of the following statements is correct? a. The Present Value of future cash flows equals -$24,400 b. The Present Value of future cash flows equals $254,400. c. The Present Value of future cash flows equals $205,600. d. The Present Value of future cash flows equals -$254,400.arrow_forwardThe management of NUBD Co. is considering three investment projects-W, X, and Y. Project W would require an investment of P21,000, Project X of P66,000, and Project Y of P95,000. The present value of the cash inflows would be P22,470 for Project W, P73,920 for Project X, and P98,800 for Project Y. Rank the projects according to the profitability index, from most profitable to least profitable. *arrow_forward

- In the estimation of incremental cash flows for a new project, several costs and issues are considered. In reference to the lecture materials for cash flow estimation, list the seven important issues to be kept track of in estimating incremental cash flows for expansion, replacement, or new capital projects. [No explanation is required for this part.]arrow_forwardTo calculate net present value of a project with normal cash flows, find the present value of the expected cash flows, and subtract A) retained earnings. B) the cost of the investment. C) the factor loading. D) the payback period.arrow_forward(Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects are found below: a. Calculate the IRR for each of the projects. b. If the discount rate for all three projects is 13 percent, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 13 percent? a. The IRR of Project A is%. (Round to two decimal places.) Data table Year 0 (Initial investment) Year 1 Year 2 Year 3 Year 4 Year 5 Project A $(70,000) $12,000 18,000 19,000 28,000 33,000 Project B $(110,000) $28,000 28,000 28,000 28,000 28,000 Project C $(420,000) $240,000 240,000 240,000arrow_forward

- (c) Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation.) (Round answers to 2 decimal places, e.g. 10.50%.) Annual rate of return Project Bono % Project Edge % Project Clayton %arrow_forwardFor project A, the cash flow effect from the change in net working capital is expected to be $490.00 at time 2 and the level of net working capital is expected to be $750.00 at time 1. What is the level of current assets for project A expected to be at time 2 if the level of current liabilities for project A is expected to be $2,600.00 at time 2? $2,860.00 (plus or minus $10) $3,840.00 (plus or minus $10) $1,360.00 (plus or minus $10) $2,340.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardTo project the appropriate anticipated cash flow for a project, we must put all cash flow knowledge together. This includes of the incremental cash flow. OA) the amount but not the timing B) the timing C) the amount D) both the amount and timing 33arrow_forward

- 2. Match each of the following terms with the appropriate definition. The time expected to recover the cash initially invested in a project. A minimum acceptable rate of return on a potential investment. 1. Discounting A return on investment which results in a zero net present value. 2. Net Present Value A comparison of the cost of 3. Capital Budgeting an investment to its projected cash flows at a single point in time. 4. Accounting Rate of Return 5. Net Cash Flow A capital budgeting method focused on the rate of return on a project's average investment. 6. Internal Rate of Return 7. Payback Period The process of restating future cash flows in terms 8. Hurdle Rate of present time value. Cash inflows minus cash outflows for the period. A process of analyzing alternative long-term investments. >arrow_forwardThe Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initial after-tax cash outflow of $6,500 and has an expected life of 3 years. Annual project after-tax cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,250 0.2 $ 0.6 6,500 0.6 6,500 0.2 6,750 0.2 19,000 BPC has decided to evaluate the riskier project at 11% and the less-risky project at 8%. a. What is each project's expected annual after-tax cash flow? Round your answers to the nearest cent. Project A: $ Project B: Project B's standard deviation (OB) is $6,185 and its coefficient of variation (CVB) is 0.80. What are the values of gg and CVA? Do not round intermediate calculations. Round your answer for standard deviation to the nearest cent and for coefficient of variation to two decimal places. OA: $ CVA:arrow_forwardSunland Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Project Investment 22A $243,500 271,400 23A 24A 283,000 Annual Life of Income Project $17,320 6 years 20,600 9 years 7 years 15,700 Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Sunland Company uses the straight-line method of depreciation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education