Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

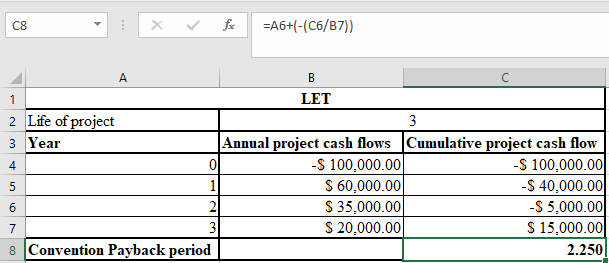

Illustrate the conventional payback period, annual project cash flow over the life of project, and cumulative project cash flow over time?

Expert Solution

arrow_forward

Step 1

The illustration is shown below:

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The payback period is a non - discounted cash flow technique that measures: a. The time required to recover the initial investment b. The profitability of the project c. The net present value of the project d. The internal rate of return of the projectarrow_forwardThe method that measures a projects return based on present values is the: Internal Rate of Return Discounted Payback Period Modified Internal Rate of Return None of the Abovearrow_forwardHow to calculate cash payback period for this investmentarrow_forward

- What is the procedure of developing Project Cash Flow Statements?arrow_forwardDefine each of the following terms:b. Incremental cash flow; sunk cost; opportunity cost; externality; cannibalization; expansion project; replacement projectarrow_forwardor a typical capital investment project, the bulk of the investment-related cash outflow occurs: Multiple Choice During the initiation stage of the project (i.e., at time period 0). During the operation stage of the project (i.e., after time period 0). Either during the initiation stage or the operation stage. During neither the initiation stage nor the operation stage. Evenly during all three stages: initiation, operation, and final disposal.arrow_forward

- How do we develop the project cash flows, after taxes, over the life of the project?arrow_forwardWhich of the following statements is true regarding the payback period? Multiple Choice It measures the length of time that it takes for a project to recover its initial cost from the discounted net cash inflows that it genera It measures the length of time that it takes for a project to recover its initial cost from the net cash inflows that it generates. It measures the length of time that it takes for a project to recover its initial cost from the incremental net operating income that It measures the length of time that it takes for a project to recover its initial cost from the discounted incremental net operating it generates.arrow_forwardQuestion: Which of the following methods of capital budgeting accounts for the time value of money? Options: A) Net Present Value (NPV) B) Payback Period C) Accounting Rate of Return (ARR) D) Profitability Index (PI)arrow_forward

- When evaluating a project with non-normal cash flows (cash flows change sign for at least two times during the project life), the best method to use for capital budgeting analysis is the: internal rate of return payback rule discounted payback Modified internal rate of return (MIRR)arrow_forwardTo project the appropriate anticipated cash flow for a project, we must put all cash flow knowledge together. This includes of the incremental cash flow. OA) the amount but not the timing B) the timing C) the amount D) both the amount and timing 33arrow_forward2. Match each of the following terms with the appropriate definition. The time expected to recover the cash initially invested in a project. A minimum acceptable rate of return on a potential investment. 1. Discounting A return on investment which results in a zero net present value. 2. Net Present Value A comparison of the cost of 3. Capital Budgeting an investment to its projected cash flows at a single point in time. 4. Accounting Rate of Return 5. Net Cash Flow A capital budgeting method focused on the rate of return on a project's average investment. 6. Internal Rate of Return 7. Payback Period The process of restating future cash flows in terms 8. Hurdle Rate of present time value. Cash inflows minus cash outflows for the period. A process of analyzing alternative long-term investments. >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education