Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

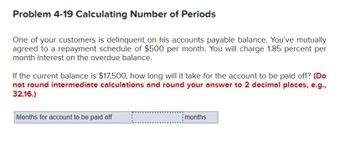

Transcribed Image Text:Problem 4-19 Calculating Number of Periods

One of your customers is delinquent on his accounts payable balance. You've mutually

agreed to a repayment schedule of $500 per month. You will charge 1.85 percent per

month interest on the overdue balance.

If the current balance is $17,500, how long will it take for the account to be paid off? (Do

not round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

Months for account to be paid off

months

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The management of Kunkel Company is considering the purchase of a $29,000 machine that would reduce operating costs by $6,500 per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return is 16%. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the investment in the machine. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount. Use the appropriate table to determine the discount factor(s).) Net present valuearrow_forward-9arrow_forward> Question 7 After making 19 payments on a 60-month, $10,000 car loan with APR of 4%, what is the outstanding balance on the loan? Round your answer to the nearest cent (one-hundredth). Do not include the dollar sign, $.arrow_forward

- solve part B pleasearrow_forwardGiven:account balance:$5,000;account APR=17% please help with 5-8 5. what is the dollar amount paid in interest if the balance is pid off in 24 months,ceteris paribus? 6. how much more will you pay in interest if you make a fixed payment of 4% of the original balnce than if you make the payment required to pay the balance off in 24 months? 7. if the minimum payment is 4% of the oustanding blanace, how many months will it take to pay off the wntire balance if only the minimum oayment is made each month, ceteris paribus? 8. what is the dollar amount paid in interest if the minimum payment ka made each month to pay off the entore balance,ceteris pribus?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education