Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

5:1 Answer B questions

Transcribed Image Text:O

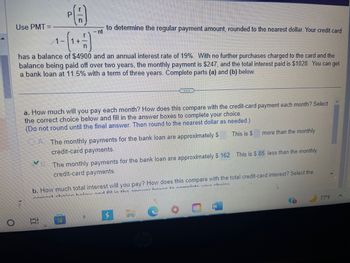

Use PMT=

1-

P

+

Ei

has a balance of $4900 and an annual interest rate of 19%. With no further purchases charged to the card and the

balance being paid off over two years, the monthly payment is $247, and the total interest paid is $1028. You can get

a bank loan at 11.5% with a term of three years. Complete parts (a) and (b) below.

to determine the regular payment amount, rounded to the nearest dollar. Your credit card

- nt

a. How much will you pay each month? How does this compare with the credit-card payment each month? Select

the correct choice below and fill in the answer boxes to complete your choice.

(Do not round until the final answer. Then round to the nearest dollar as needed.)

This is $

...

The monthly payments for the bank loan are approximately $

credit-card payments.

a

The monthly payments for the bank loan are approximately $ 162. This is $ 85 less than the monthly

credit-card payments.

b. How much total interest will you pay? How does this compare with the total credit-card interest? Select the

correct choice below and fill in the answer have to complete your choic

more than the monthly

H

77°F

Transcribed Image Text:O

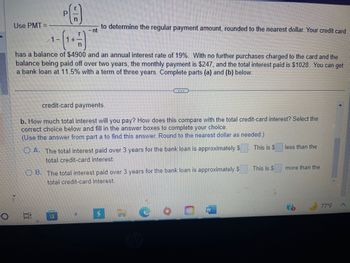

Use PMT=

PA

to determine the regular payment amount, rounded to the nearest dollar. Your credit card

- nt

has a balance of $4900 and an annual interest rate of 19%. With no further purchases charged to the card and the

balance being paid off over two years, the monthly payment is $247, and the total interest paid is $1028. You can get

a bank loan at 11.5% with a term of three years. Complete parts (a) and (b) below.

credit-card payments.

b. How much total interest will you pay? How does this compare with the total credit-card interest? Select the

correct choice below and fill in the answer boxes to complete your choice.

(Use the answer from part a to find this answer. Round

the nearest dollar as needed.)

OA. The total interest paid over 3 years for the bank loan is approximately $

total credit-card interest.

OB. The total interest paid over 3 years for the bank loan is approximately $

total credit-card interest.

a

This is $

This is $

less than the

more than the

77°F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On January 31, Outback Coast Resorts Inc. reacquired 23,900 shares of its common stock at $31 per share. On April 20, Outback Coast Resorts sold 14,000 of the reacquired shares at $40 per share. On October 4, Outback Coast Resorts sold the remaining shares at $29 per share. Required: Journalize the transactions of January 31, April 20, and October 4. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardmation |x A Assignmenta: Corp Fin Reprtn x Question 2 Graded Assignme x HExam1-ep6778a@student.am x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252FIms.mheducation.com%252F... M (no subject) - ellse.patipewe@ x signment #4 (Leases) i Saved Help es At the beginning of 2021, VHF Industries acquired a machine with a fair value of $9,415,785 by signing a four-year lease. The lease is payable in four annual payments of $3.1 million at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What is the effective rate of interest implicit in the agreement? 2-4. Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at December 31, 2021 and the second lease payment at December 31, 2022. 5. Suppose the fair value of the machine and the lessor's implicit rate were unknown at the time of the lease, but that…arrow_forwardQuestion list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forward

- 88 MULTIPLE CHOICE Question 2 Listen Given 0=787°, what is the measure of the coterminal angle? A 67° B 23° C 157° D 113°arrow_forward12:52 S ㅁ expert.chegg.com/qna/au Chegg Hide student question Student question LTE Skip Exit + 32 5G Classify the following balance sheet items under fixed assets, working capital, shareholders' equity, or net debt: overdraft, retained earnings, brands, taxes payable, finished goods inventories, bonds. Time Left: 01:59:57 Submit ||| 8 Trainingarrow_forwardU-s-e- -E-x-h-i-b-i-t- -W-o-r-k-s-h-e-e-t- 6.1. A-n-a-l-y-n- -R-a-m-o-s- -i-s- -e-v-a-l-u-a-t-i-n-g- -h-e-r- -d-e-b-t- -s-a-f-e-t-y- -r-a-t-i-o-.- -H-e-r- -m-o-n-t-h-l-y- -t-a-k-e---h-o-m-e- -p-a-y- -i-s- - ₱166,000.00. E-a-c-h- -m-o-n-t-h-,- -s-h-e- -p-a-y-s- - ₱19,000.00 f-o-r- -a-n- -a-u-t-o- -l-o-a-n-, ₱6,000.00 -o-n- -a- -p-e-r-s-o-n-a-l- -l-i-n-e- -o-f- -c-r-e-d-i--t,-- ₱3,000.00 -o-n -a- -d-e-p-a-r-t-m-e-n-t- -s-t-o-r-e- -c-h-a-r-g-e- -c-a-r-d-,- -a-n-d- ₱4,250.00 -o-n- -h-e-r- --b-a-n-k- -c-r-e--d-i-t- -c-a-r-d-. C-o-m-p-l-e-t-e- -t-h-e- -w-o-r-k-s-h-e-e-t- -b-y- -l-i-s-t-i-n-g- -A-n-a-l-y-n-’-s- -o-u-t-s-t-a-n-d-i-n-g- -d-e-b-t-s-,- -a-n-d- -t-h-e-n- -c-a-l-c-u-l-a-t-e- -h-e-r- -d-e-b-t- -s-a-f-e-t-y- -r-a-t-i-o-.- -G-i-v-e-n- -h-e-r- -c-u-r-r--e-n-t- -t-a-k-e---h-o-m--e -p-a-y-,- -w-h-a-t- -i-s- -t-h-e-- -m-a-x-i-m-u-m- -a-m-o--un-t- -o-f- -m-o-n-t-h-l-y- -d-e-b-t- -p-a-y-m-e-n-t-s- -t-h-a-t- -A-n-a-l-y-n- -c-a-n-- h-a-v-e- -i-f- --s-h-e- -w-a-n-t-s- -h-e-r- -d-e-b-t-…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education