Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

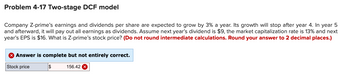

Transcribed Image Text:Problem 4-17 Two-stage DCF model

Company Z-prime's earnings and dividends per share are expected to grow by 3% a year. Its growth will stop after year 4. In year 5

and afterward, it will pay out all earnings as dividends. Assume next year's dividend is $9, the market capitalization rate is 13% and next

year's EPS is $16. What is Z-prime's stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

> Answer is complete but not entirely correct.

Stock price

$

156.42 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- REVIEW AND SELF-TEST PROBLEMS 12.1 Calculating the Cost of Equity Suppose stock in Boone Corporation has a beta of .90. The market risk premium is 7 percent, and the risk-free rate is 8 percent. Boone's last dividend was $1.80 per share, and the dividend is expected to grow at 7 percent indefinitely. The stock currently sells for $25. What is Boone's cost of equity capital? (See Problem 1.)arrow_forwardProblem 10.17 (calmulation of g and EPS) Sidman Buduct's common stock currently sells for $41 a share. The firm is expected to earn $4,10 per share this year and to dividend of $2.60, and it finances only with pay a year-end common equity. a) If investors require a 10%. return, what is the expected growth rate? Round your answer to places. two decimal % b) If Sidman reinvests retained earnings in Projects whose average return is equal to the stock's expected rate of return, what will be next year's EPS? (Hintis = (1-Payout ratio) ROE). Round to the nearest cent. your criswer $ share - perarrow_forwardQuestion content area top Part 1 Assume Gillette Corporation will pay an annual dividend of $ 0.66 one year from now. Analysts expect this dividend to grow at 11.2 % per year thereafter until the fifth year. Thereafter, growth will level off at 1.6 % per year. According to the DDM, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.3 % ? Question content area bottom Part 1 The value of Gillette's stock is $ enter your response here. (Round to the nearest cent.arrow_forward

- Question A Suppose a zero-growth stock is expected to pay a $0.5 dividend every quarter and the required annual return is 5%. What is the price? Group of answer choices: $20 $10 $5 $40 Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forward9arrow_forwardNikularrow_forward

- Question 13 Burke Tires just paid a dividend of Do-$1.3. Analysts expect the company's dividend to grow by 30% this year, by 10% in Year 2, and at a constant rate of 4% in Year 3 and thereafter. The required return on this low-risk stock is 9.00%. What is the best estimate of the stock's current market value?arrow_forwardProblem 7-24 Negative Growth [LO 1] You've collected the following information from your favorite financial website. Dividend PE Yield 2.6 3.8 52-Week Price LO 10.43 Acevedo .36 33.42 69.50 14.12 Manta Energy .97 20.74 Winter Sports .32 Hi 77.40 55.81 130.93 50.41 35.00 Stock (Dividend) Georgette, Incorporated 1.54 YBM 2.00 Answer is complete but not entirely correct. Required return 4,40 2.2 6.2 1.5 Ratio 6 10 10 6 28 Close Price 13.90 40.43 88.97 15.60 77 Net Change -.24 -.01 According to your research, the growth rate in dividends for Manta Energy for the previous 10 years has been negative 10 percent. If investors feel this growth rate will continue, what is the required return for the stock? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 3.07 -.26 .18arrow_forwardQUESTION 7 Manchester plc is expected to pay annual dividends of £1.50, £1.75 and £2.00 per share at the end of each of the next three years (i.e., from t-1 to t=3). After year 3, annual dividends are expected to grow at a rate of 2% forever. Assuming that shareholders of Manchester plc. require a rate of return equal to 5% per year, what is the fair value for the share of Manchester plc.? O £95.52 £64.70 O £48.37 O £63.48arrow_forward

- Problem 18-9 MF Corp. has an ROE of 14% and a plowback ratio of 75%. The market capitalization rate is 13%. a. If the coming year's earnings are expected to be $2.30 per share, at what price will the stock sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price b. What price do you expect MF shares to sell for in three years? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Pricearrow_forwardQuestion 11 ABC company is growing at a constant rate of 8% every year. Last week the company paid a dividend of $2.8. If dividends are expected to grow at the same rate as the fi rm and the required rate of return is 12 percent, what should be the stock’s price four years from now? Show your calculation. Only typing answer Please explain step by step without table and graph thankyouarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education