Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

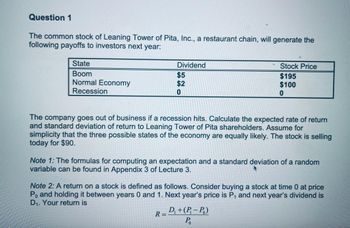

Transcribed Image Text:Question 1

The common stock of Leaning Tower of Pita, Inc., a restaurant chain, will generate the

following payoffs to investors next year:

State

Boom

Normal Economy

Recession

Dividend

$5

$2

0

Stock Price

$195

$100

0

The company goes out of business if a recession hits. Calculate the expected rate of return

and standard deviation of return to Leaning Tower of Pita shareholders. Assume for

simplicity that the three possible states of the economy are equally likely. The stock is selling

today for $90.

Note 1: The formulas for computing an expectation and a standard deviation of a random

variable can be found in Appendix 3 of Lecture 3.

Note 2: A return on a stock is defined as follows. Consider buying a stock at time 0 at price

Po and holding it between years 0 and 1. Next year's price is P, and next year's dividend is

D₁. Your return is

R=D₁ + (P₁-P₁)

P₁

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The common stock of Leaning Tower of Pita Inc., a restaurant chain, will generate payoffs to investors next year, which depend on the state of the economy, as follows: Boom Dividend $8 Stock Price Normal economy Recession 4 0 $240 90 The company goes out of business if a recession hits. Assume for simplicity that the three possible states of the economy are equally likely. The stock is selling today for $80. a-1. Calculate the rate of return to Leaning Tower of Pita shareholders for each economic state. (Negative amounts should be indicated by a minus sign. Enter your answers as a percent rounded to 2 decimal places.) Boom Normal economy Recession Rate of return % % % a-2. Calculate the expected rate of return and standard deviation of return to Leaning Tower of Pita shareholders. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Expected return Standard deviation % %arrow_forwardAssume IBM is expected to pay a total cash dividend of $3.90 next year and dividends are expected to grow indefinitely by 3.0 percent a year. Assume the required rate of return (i.e. equity holder's opportunity cost of capital) is 9.3 percent. Assuming this is the best information available regarding the future of this firm, what would be the most economically rational value of the stock today (i.e. today's "price")? Answer to 2 decimal places.arrow_forwardIf you look at stock prices over any year, you will find a high and low stock price for the year. Instead of a single benchmark PE ratio, we have a high and low PE ratio for each year. We can use these ratios to calculate a high and a low stock price for the next year. Suppose we have the following information on a particular company. Year 1 $ 62.18 40.30 2.35 a. High target price b. Low target price Year 2 $67.29 43.18 2.58 Year 3- $74.18 39.27 2.73 Year 4 $78.27 46.21 High price Low price EPS Earnings are expected to grow at 9 percent over the next year. 6. What is the high target stock price in one year? 32.16. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. b. What is the low target stock price in one year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. 2.890arrow_forward

- Please answer fast i give upvotearrow_forwardHi can you help me with these two problem down below 1. Suppose you observe the following situation: State of Economy Probability of State of Economy Return of Stock A Return of Stock B Bust .15 -.08 -.10 Normal .60 .11 .09 Boom .25 .30 .27 Calculate the expected return on each stock. 2. Indicate whether the following events might cause stocks in general to change price, and whether they might cause Big Widget Corp.’s stock to change price: The government announces that inflation unexpectedly jumped by 2 percent last month. Big Widget’s quarterly earnings report, just issued, generally fell in line with analysts’ expectations. The government reports that economic growth last year was at 3 percent, which generally agreed with most economists’ forecasts. The directors of Big Widget die in a plane crash. Congress approves changes to the tax code that will decreases the top marginal corporate tax rate. The legislation had been debated…arrow_forwardAn analyst has estimated how a particular stock’s return will vary depending on what will happen to the economy. What is the coefficient of variation on the company's stock? OF THEECONOMY PROBABILITY OFSTATE OCCURRING STOCK'S EXPECTEDRATE IF THISSTATE OCCURS Recession Below Average Average Above Average Boom .10 .20 .40 .20 .10 (.60) (.10) .15 .40 .90arrow_forward

- •Suppose we are trying to value the company Inactivision, a video game developer that does not pay dividends and has negative earnings but it growing. If the appropriate industry price to sales ratio for this type of company is 20 and you predict sales to be $3 per share for the coming year, then the forecasted stock price for a year from now, or target price, is the following: Respuesta:arrow_forwardWe are trying to value the technology company B&B's share price. If the appropriate industry PE for this type of company is 5 and you predict net income for B&B to be $3 million for the coming year. Assuming the firm has 1 million shares of common stock. What is the forecasted stock price for a year from now? $3 $10 $8 $15arrow_forward1. Consider the following information State of Economy Probability of State of Economy Rate of Return if State Occurs Stock S Stock T Boom .20 22% 18% Normal .80 15 % 14% i) What is the expected return for stock S? For Stock T? ii) What is the standard deviation for Stock S? For stock T? iii) What is the coefficient of variation for Stock S? For stock T? iv) If you invest 40% of your money in stock S and 60% in stock T, what is the expected return of the portfolio v) Find the return of your portfolio when a) economy is booming and b) economy is normal. vi) What is the standard deviation for your portfolio?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education