Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

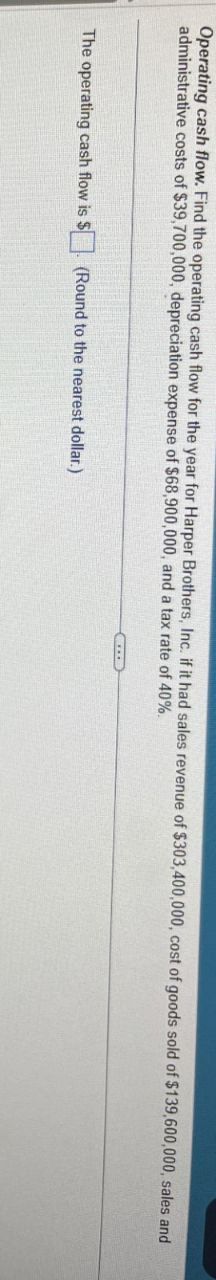

Transcribed Image Text:Operating cash flow. Find the operating cash flow for the year for Harper Brothers, Inc. if it had sales revenue of $303,400,000, cost of goods sold of $139,600,000, sales and

administrative costs of $39,700,000, depreciation expense of $68,900,000, and a tax rate of 40%.

The operating cash flow is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Carter Swimming Pools has $16 million in net operating profit after taxes (NOPAT) in the current year. Carter has $12 million in total net operating assets in the current year and had $10 million in the previous year. What is its free cash flow?arrow_forwardOperating cash flow. Find the operating cash flow for the year for Harper Brothers, Inc. if it had sales revenue of $308,900,000, cost of goods sold of $146,800,000, sales and administrative costs of $39,400,000, depreciation expense of$66,700,000, and a tax rate of 40% . The operating cash flow is $ (Round to the nearest dollar.)arrow_forwardOperating cash flow. Find the operating cash flow for the year for Harper Brothers, Inc. if it had sales revenue of $305,400,000, cost of goods sold of $146,600,000, sales and administrative costs of $39,700,000, depreciation expense of $60,400,000, and a tax rate of 40%. The operating cash flow is $ (Round to the nearest dollar.)arrow_forward

- Operating cash flow. Find the operating cash flow for the year for Robinson and Sons if it had sales revenue of $78,200,000, cost of goods sold of $34,400,000, sales and administrative costs of $6,100,000, depreciation expense of $7,900,000,and a tax rate of 30%. The operating cash flow is $ (Round to the nearest dollar.)arrow_forwardOperating cash flow. Find the operating cash flow for the year for Robinson and Sons if it had sales revenue of $81,500,000, cost of goods sold of $34,500,000, sales and administrative costs of $6,200,000, depreciation expense of $7,100,000, and a tax rate of 30%. The operating cash flow is $ (Round to the nearest dollar.)arrow_forwardFind the operating cash flow for the year for Harper Brothers, Inc. if it had sales revenue of $318,600,000, cost of goods sold of $134,300,000, sales and administrative costs of $39,600,000, depreciation expense of $64,800,000, and a tax rate of 40%. The operating cash flow is $ (Round to the nearest dollar.)arrow_forward

- Please answer with explanations thx.arrow_forwardFind the operating cash flow for the year for Harper Brothers, Inc. if it had sales revenue of $310,000,000, cost of goods sold of $134,000,000, sales and administrative costs of $40,100,000, depreciation expense of $67,000,000, and a tax rate of 40%.arrow_forwardNeed answer the questionarrow_forward

- Find the operating cash flow for the year for Robinson and Sons if it had sales revenue of $81,900,000, cost of goods sold of $34,700,000, sales and administrative costs of $6,300,000, depreciation expense of $7,200,000, and a tax rate of 30%.arrow_forwardFind the operating cash flow for the year for Marathon and Sons if it had sales revenue o\f $80,200,000, cost of goods sold of $35,700,000, sales and administrative costs of $6,800,000, depreciation expense of $4,000,000, and a tax rate of 30%.arrow_forwardNeed help general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning