FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

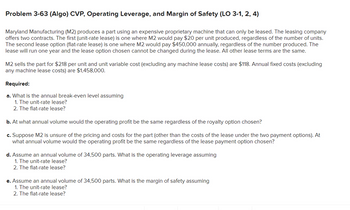

Transcribed Image Text:Problem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4)

Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company

offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units.

The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The

lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same.

M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding

any machine lease costs) are $1,458,000.

Required:

a. What is the annual break-even level assuming

1. The unit-rate lease?

2. The flat-rate lease?

b. At what annual volume would the operating profit be the same regardless of the royalty option chosen?

c. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At

what annual volume would the operating profit be the same regardless of the lease payment option chosen?

d. Assume an annual volume of 34,500 parts. What is the operating leverage assuming

1. The unit-rate lease?

2. The flat-rate lease?

e. Assume an annual volume of 34,500 parts. What is the margin of safety assuming

1. The unit-rate lease?

2. The flat-rate lease?

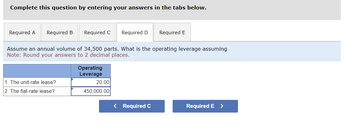

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

Required C

1. The unit-rate lease?

2. The flat-rate lease?

Assume an annual volume of 34,500 parts. What is the operating leverage assuming

Note: Round your answers to 2 decimal places.

Operating

Leverage

Required D Required E

20.00

450,000.00

< Required C

Required E >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6. A lamp socket die-cutting company has two alternatives to purchase a new die-cutting machine, where the initial investment (in US dollars) and the projected net income stream for each alternative is shown in the following tables; the number of periods corresponds to the number of years of service life. If the company's purchasing committee considers a capital cost of 12.50% for internal financing, which machine should be purchased?arrow_forwardD1.arrow_forwardA stereo company supplier car radios to auto manufacturers and is going to open a new plant. The company is undecided between Serendah and Seremban as the site. The fixed costs for Serendah are lower due to cheaper land costs, but the variable costs are higher because shipping distances would increase. Given the following costs: i. ii. iii. Cost Fixed Variable Serendah RM600,000 RM28/radio Seremban RM800,000 RM22/radio Graph the total-cost lines for all the sites. Over what range of volume is each location the preferable one? For a volume of 20,000 units, which site is the best?arrow_forward

- Plymouth corporation sells units for $108 each Variable costs are $39 per unit, and fixed costs are $212,000. If Plymouth leases a bed cast wail increase by $85,000 a year, but production will be more efficient, saving $5 per unit. At what level of production will Plymouth be indifferent between leasing and not leasing the new machine?arrow_forwardPlease dont provide solution in image thnkuarrow_forward4arrow_forward

- Problem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4) Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding any machine lease costs) are $1,458,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is…arrow_forwardProblem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4) Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding any machine lease costs) are $1,458,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is…arrow_forward14. Asset betas (S9.3) Which of these projects is likely to have the higher asset beta, other things equal? Why? a. The sales force for project A is paid a fixed annual salary. Project B's sales force is paid by commissions only. b. Project C is a first-class-only airline. Project D is a well-established line of breakfast cereals.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education