Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

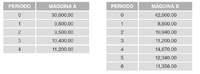

6. A lamp socket die-cutting company has two alternatives to purchase a new die-cutting machine, where the initial investment (in US dollars) and the projected net income stream for each alternative is shown in the following tables; the number of periods corresponds to the number of years of service life.

If the company's purchasing committee considers a capital cost of 12.50% for internal financing, which machine should be purchased?

Transcribed Image Text:PERIODO

MÁQUINA A

PERIODO

MÁQUINA B

30,000.00

42,000.00

9,500.00

1

8,600.00

2

9,500.00

10,940.00

10,400.00

3

11,200.00

4

11,200.00

4

14,670.00

12,340.00

11,356.00

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Please use the images attached to answer the following:Determine the weighted average cost of capital (WACC) for VigourPharmaceuticals.arrow_forwardKeeper Inc. is considering the purchase of new equipment that will automate production and thus reduce labor costs. Keeper made the following estimates related to the new machinery: (Click the icon to view the information.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Requirement 1. Calculate (a) net present value, (b) payback period, (c) discounted payback period, and (d) internal rate of return. a. Net present value. (Round intermediary calculations to the nearest whole dollar. Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is $ 40,275 b. Payback period. (Round your answer to two decimal places.) The payback period in years is 4.79 c. Discounted payback period. (Round interim calculations to the nearest whole…arrow_forwardREQUIRED Use the information provided below to answer the following questions: 3.1. Calculate the Payback period for the HMC. 3.2. Calculate the Net Present Value for both the HMC and VMC. 3.3. Calculate the Internal Rate of Return (IRR) for the HMC and VMC. 3.4. Which configuration of the CNC machining centres should SMT purchase, if any? Motivate your answer by referring to the answers obtained in questions 3.3 and 3.4. INFORMATION Southern Manufacturing Tools Limited (SMT) is considering the purchase of a Computer Numerical Control (CNC) machining centre for its operations. Two configurations of the CNC machining centres are available: horizontal CNC machining centre (HMC) and vertical CNC machining centre (VMC). Both the HMC and VMC will require an initial investment of R10 000 000, will have a useful life of 7 years and a residual value of R1 500 000. SMT uses the straight-line method of depreciation. The expected net cash inflows of the VMC are expected to be R2 100 000…arrow_forward

- Interstate Manufacturing is considering either replacing one of its old machines with a new machine or having the old machine overhauled. Information about the two alternatives follows. Management requires a 12% rate of return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)Alternative 1: Keep the old machine and have it overhauled. If the old machine is overhauled, it will be kept for another five years and then sold for its salvage value. Cost of old machine $ 109,000 Cost of overhaul 154,000 Annual expected revenues generated 92,000 Annual cash operating costs after overhaul 40,000 Salvage value of old machine in 5 years 24,000 Alternative 2: Sell the old machine and buy a new one. The new machine is more efficient and will yield substantial operating cost savings with more product being produced and sold. Cost of new machine $ 300,000 Salvage…arrow_forwardAn electronic circuit board manufacturer is considering six mutually exclusive cost-reduction projects for its PC-board manufacturing plant. All have lives of 10 years and zero salvage value. The required investment, the estimated after-tax reduction in annual disbursements, and the gross rate of return arc given for each alternative in the following table: llte rate of return on incremental investments is given for each project as follows: Which project would you select according to the rate of return on incremental investment if it is stated that the MARR is 15%?arrow_forwardZenith Investment Company is considering the purchase of an office property. It has done an extensive market analysis and has estimated that based on current market supply or demand relationships, rents, and its estimate of operating expenses, annual NOI will be as follows: Year NOI 1 $ 1,030,000 2 1,030,000 3 1,030,000 4 1,210,000 5 1,260,000 6 1,310,000 7 1,349,000 8 1,389,170 A market that is currently oversupplied is expected to result in cash flows remaining flat for the next three years at $1,030,000. During years 4, 5, and 6, market rents are expected to be higher. It is further expected that beginning in year 7 and every year thereafter, NOI will tend to reflect a stable, balanced market and should grow at 3 percent per year indefinitely. Zenith believes that investors should earn a 12 percent return (r) on an investment of this kind.Required: a. Assuming that the investment is expected to produce NOI in years 1 to 8 and is expected to be owned for…arrow_forward

- Assume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice O 0.95. 1.01. 1.05. 1.11.arrow_forwardDo all plarrow_forwardCadet Inc. is considering the purchase of new equipment that will automate production and thus reduce labor costs. Cadet made the following estimates related to the new machinery: (Click the icon to view the information.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. C Requirement 1. Calculate (a) net present value, (b) payback period, (c) discounted payback period, and (d) internal rate of return. a. Net present value. (Round intermediary calculations to the nearest whole dollar. Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is Requirements 1. Calculate (a) net present value, (b) payback period, (c) discounted payback period, and (d) internal rate of return. 2. Compare and contrast the capital budgeting methods in…arrow_forward

- Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $495,000 cost with an expected four-year life and a $10,000 salvage value. Additional annual information for this new product line follows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. $ 1,960,000 1,502,000 121,250 167,000 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 8%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine income and net cash flow for each year of this machine's…arrow_forwardInterstate Manufacturing is considering either overhauling an old machine or replacing it with a new machine. Information about the two alternatives follows. Management requires a 10% rate of return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Alternative 1: Keep the old machine and have it overhauled. This requires an initial investment of $150,000 and results in $60,000 of net cash flows in each of the next five years. After five years, it can be sold for a $20,000 salvage value. Alternative 2: Sell the old machine for $50,000 and buy a new one. The new machine requires an initial investment of $300,000 and can be sold for a $20,000 salvage value in five years. It would yield cost savings and higher sales, resulting in net cash flows of $60,000 in each of the next five years. Required: 1. Determine the net present value of alternative 1. 2. Determine the net present value of alternative 2. 3. Which…arrow_forwardFactor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $491,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new product line follows. (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 7%. $ 1,990,000 1,509,000 117,750 162,000 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute net present value…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education