FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ok

t

M

ences

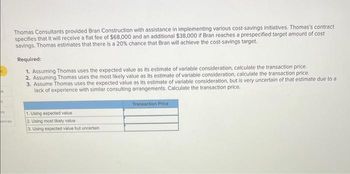

Thomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas's contract

specifies that it will receive a flat fee of $68,000 and an additional $38,000 if Bran reaches a prespecified target amount of cost

savings. Thomas estimates that there is a 20% chance that Bran will achieve the cost-savings target.

Required:

1. Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price.

2. Assuming Thomas uses the most likely value as its estimate of variable consideration, calculate the transaction price.

3. Assume Thomas uses the expected value as its estimate of variable consideration, but is very uncertain of that estimate due to a

lack of experience with similar consulting arrangements. Calculate the transaction price.

1. Using expected value

2. Using most likely value

3. Using expected value but uncertain

Transaction Price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Acadia Logistics anticipates that it will need more distribu-tion center space to accommodate what it believes will bea significant increase in demand for its final-mile services.Acadia could either lease public warehouse space to coverall levels of demand or construct its own distribution centerto meet a specified level of demand, and then use publicwarehousing to cover the rest. The yearly cost of buildingand operating its own facility, including the amortized costof construction, is $12.00 per square foot. The yearly cost ofleasing public warehouse space is $20.00 per square foot. Theexpected demand requirements follow: a. Calculate the expected value of leasing public warehousespace as required by demand.b. Calculate the expected value of building a 200,000-square-foot distribution center and leasing public warehousespace as required if demand exceeds the need for 200,000square feet of space.c. Calculate the expected value of building a 300,000-square-foot distribution center and…arrow_forwardThe constraint at Pickrel Corporation is time on a particular machine. The company makes three products that use this machine. Data concerning those products appear below: Selling price per unit Variable cost per unit Minutes on the constraint Multiple Choice O Assume that sufficient time is available on the constrained machine to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of this constrained resource? (Round your intermediate calculations to 2 decimal places.) O $27.36 per unit $15.60 per minute $13.10 per minute VD $ 344.85 $ 270.18 5.70 $104.52 per unit JT $ 415.40 $310.88 6.70 SM $ 119.32 $ 91.96 1.90arrow_forwardplease give me an accurate answer please for allarrow_forward

- The operations manager at Sebago Manufacturing is considering three proposals for supplying a critical component for its new line of electric watercraft. Proposal one is to purchase the component, proposal two is make the component in-house using rebuilt equipment, and proposal three is to purchase new, highly automated equipment. The costs associated with each proposal are provided in the table below. Proposal Annual cost ofcapital required Variable cost ofeach component One: purchase $0.00 $22.00 Two: make with rebuiltequipment $150,000.00 $14.00 Three: make with newequipment $450,000.00 $12.50 At what quantity range will each option be preferred?arrow_forwardRahularrow_forwardwho has an average wage of $48,890 per year. In addition, the equipment will have operating and energy costs of $12, 190 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest whole percent. % Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $126,000 with a $11,000 residual value and a 5-year life. The equipment will replace one employee who has an average wage of $48,890 per year. In addition, the equipment will have operating and energy costs of $12,190 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest whole percent. %arrow_forward

- Thomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas’s contract specifies that it will receive a flat fee of $70,000 and an additional $40,000 if Bran reaches a prespecified target amount of cost savings. Thomas estimates that there is a 30% chance that Bran will achieve the cost-savings target. Required: Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price. Assuming Thomas uses the most likely value as its estimate of variable consideration, calculate the transaction price. Assume Thomas uses the expected value as its estimate of variable consideration, but is very uncertain of that estimate due to a lack of experience with similar consulting arrangements. Calculate the transaction price.arrow_forwardThomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas's contract specifies that it will receive a flat fee of $56,000 and an additional $26,000 if Bran reaches a prespecified target amount of cost savings. Thomas estimates that there is a 20% chance that Bran will achieve the cost-savings target. Required: 1. Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price. 2. Assuming Thomas uses the most likely value as its estimate of variable consideration, calculate the transaction price. 3. Assume Thomas uses the expected value as its estimate of variable consideration, but is very uncertain of that estimate due to a lack of experience with similar consulting arrangements. Calculate the transaction price. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 2. Assuming Thomas uses the most likely value as its estimate of variable…arrow_forwardanalysis Your program office has just completed of the latest Contract Performance Report on its Cost Plus Fixed Fee contract with Truman Inc. The original estimated cost of the contract is $300 million and the fixed fee is $15 million. The following information is available: "Best Case" EAC = $295 million "Most Likely" EAC = $310 million "Worst Case" EAC = $348 million Which one of the following represents the best estimate of the funding requirements for the Truman Inc. contract?arrow_forward

- 6. Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts: a. What are the profitability indexes of the projects? b. What should Fabulous Fabricators do? **round to two decimal places**arrow_forwardThe Dammon Corp. has the following investment opportunities: Machine A Machine B Machine C ($10,000 cost) ($22,500 cost) ($35,500 cost) Inflows Inflows Inflows year 1 $6,000 year 1 $12,000 year 1 $-0- year 2 year 3 3,000 year 3 3,000 year 2 7,500 1,500 year 3 1,500 year 4 20,000 year 2 30, 000 5,000 year 4 -0- year 4 Under the payback method and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose? Multiple Choice Machine C Machine B Machine Aarrow_forwardSub : FinancePls answer As Early As Possible.Dnt CHATGPT.I ll upvote. Thank Youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education