ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

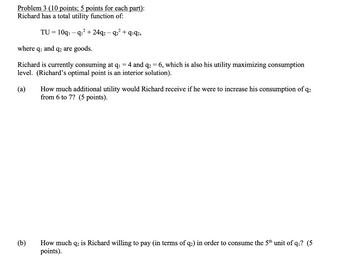

Transcribed Image Text:Problem 3 (10 points; 5 points for each part):

Richard has a total utility function of:

TU = 10q₁q₁²+24q2q2² +9192,

where q₁ and q2 are goods.

Richard is currently consuming at q₁ = 4 and q₂ = 6, which is also his utility maximizing consumption

level. (Richard's optimal point is an interior solution).

(a) How much additional utility would Richard receive if he were to increase his consumption of q2

from 6 to 7? (5 points).

(b)

How much q2 is Richard willing to pay (in terms of q2) in order to consume the 5th unit of q₁? (5

points).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Maya is doing her undergrad at Queen's University. She loves donuts and chocolate chip cookies (CCC). Her utility function is given by u(x, y) = √8x +5 + 2y, where x denotes her consumption of donuts and y denotes her consumption of CCC. Her budget is $10/day. The price of a donut is $1. (a) When the price of CCC is $1, what is Maya's optimal choice of donuts and CCC? (b) When the price of CCC is $8, what is Maya's optimal choice of donuts and CCC? (c) When the price of CCC increases from $1 to $8, calculate Maya's substitution effect and income effect. (d) According to your calculation in part (c), is CCC a normal good or an inferior good? Explain. Is CCC an ordinary good or a Giffen good? Explain.arrow_forward2) A consumer’s utility function is: U(x,y) = sqrt(9xy). The price of each good is: (PX,PY) = (15,20). The monthly budget is: M = 600, answer the following:a. What is the optimal bundle (X, Y) that maximizes the consumer’s utility?b. What is the optimal utility given your answer from part a?c. If the desired level of utility the consumer is U = 400, what would be the optimal bundle (X, Y) to minimize consumer expenses?d. Given U = 400 from part c, what would be the new optimal bundle for both goods if PX increases to 25?e. Given the price increase in good X from part d, what would be the optimal bundle for this consumer wishing to maximize its utility with an income, M = 600?f.: Graph the budget line and utility curve from part a i need help on part carrow_forward2. Consider a consumer whose preference relation over the consumption set X = R can be repre- sented by the utility function: u (x1, x2, 13) = A (x1 – T1)ª (x2 – ã2)° (x3 – ã3)" - where A, a, B and y are all strictly positive. (a) Why can you assume A = 1 and a + B+y= 1 without loss of generality? Do so for the rest of the question. (b) Solve the UMP and derive the consumer's Walrasian demand. (c) Find the indirect utility function, the minimum expenditure function, and the Hicksian demand function.arrow_forward

- Please get correctarrow_forwardPROBLEM (4) You have the Cobb-Douglas utility function u(x, y) = xy over apples (x) and plums (y) and you have $120 budget to spend and can carry at most 480 ounces in weight in your backpack going back to the dorm. Each apple costs $1 and weighs 8 ounces, and each plum costs $3 and weighs 4 ounces. You can only leave the store with a bundle of fruits you can afford and carry. (a) Drawing the relevant lines, intercepts, marking the points and hence identifying the feasible set of bundles, calculate the optimal bundle. (b) Forget about (a). If you were to choose a backpack before going on this shopping trip, for the weight constraint not to be an issue for you, how many ounces of weight capacity would you need for your backpack? HINT: That is, for this weight capacity of the backpack, you'd be able to carry the best bundle you can afford, i.e, the weight constraint is not binding for your decision. (c) Forget about (b). In (a), just before going out for shopping with your backpack to…arrow_forward3. Consider the following utility function: U = 5 x1 + 2 x2 Also consider the following bundles: A=(6, 6) B=(8, 4) C=(4,11) D=(7, 9) E=(9, 3) If x1=20, how much of x2 does the consumer has to consume to obtain a utility level of 150? 50 300 170 25arrow_forward

- For the utility function U = Qx0.28Q (1-0.28) and the budget 137 = 11Qx+6Qy find the CHANGE in optimal consumption of X if the price of X increases by a factor of 1.6. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 = 1.2, 1.14 = 1.1).arrow_forwardFor the utility function U = Qx0.46Qy(1-0.46) and the budget 100 = 11Qx + 11Qy find the CHANGE in optimal consumption of X if the price of X increases by a factor of 1.5. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 = 1.2, 1.14 = 1.1).arrow_forwardFind the expenditure function corresponding to utility function u(x₁,x₂) = ln(x₁ +a)+ln(x₂+b). a.e(p₁u) = 2√P₁P₂)eu/2 b.e(p,u)=e¹(√P₁P₂)+ap₁ + bp₂ Ⓒc. e(p₁u) = 2(√P₁P₂)eu/2-ap₁-bp₂ d.elpu)=e"√√P₁P₂arrow_forward

- QUESTION 1 For the utility function U = Qx0.50Qy(1-0.50) and the budget 122 = 8Qx + 14Qy find the CHANGE in optimal consumption of Y if the price of Xincreases by a factor of 1.7. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 1.2, 1.14 = 1.1).arrow_forwardReese thinks peanut butter and chocolate are great when separate, but when they combine they are even more epic. In other words, Reese likes to eat either peanut butter or chocolate, but when he eats them together, he gets additional satisfaction from the combination. His preference over peanut butter (x) and chocolate (y) isrepresented by the utility functionz; u(x, y) = xy + x + y Suppose now that Reese’s income is high relative to the prices of peanut butter andchocolate (more concretely, imagine I > px and I > py). What is Reese’s Marshalliandemand for peanut butter, x^∗(Px, Py, I)?arrow_forwardQUESTION 1 For the utility function U = (Qx0.5+Qy0.5)² and the budget 133 = 8Qx + 10Qy find the CHANGE in optimal consumption of Y if the price of X increases by a factor of 1.1. Please enter your response as a positive number with 1 decimal and 5/4 rounding (e.g. 1.15 1.2, 1.14 = 1.1).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education