EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

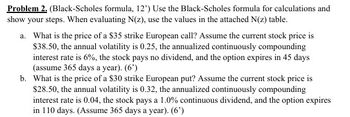

Transcribed Image Text:Problem 2. (Black-Scholes formula, 12') Use the Black-Scholes formula for calculations and

show your steps. When evaluating N(z), use the values in the attached N(z) table.

a. What is the price of a $35 strike European call? Assume the current stock price is

$38.50, the annual volatility is 0.25, the annualized continuously compounding

interest rate is 6%, the stock pays no dividend, and the option expires in 45 days

(assume 365 days a year). (6')

b. What is the price of a $30 strike European put? Assume the current stock price is

$28.50, the annual volatility is 0.32, the annualized continuously compounding

interest rate is 0.04, the stock pays a 1.0% continuous dividend, and the option expires

in 110 days. (Assume 365 days a year). (6')

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve this question financial accountingarrow_forwardYou live in a world where assets are priced by the CAPM. The following information is given to you regarding stock X. The expected payoff from the stock X=£105.00 Expected return of stock X = 18% Risk-free rate =5% Market Risk Premium = 9% Assume there are no other changes, except that the correlation between the returns of Stock X and the market becomes twice what it is currently. How would this change affect the current price of Stock X? Explain why the change of the correlation causes the observed change in the stock price. [hint: Provide a risk-based explanation]arrow_forward(Expected rate of return using CAPM) a. Compute the expected rate of return for Acer common stock, which has a 1.8 beta. The risk-free rate is 5 percent and the market portfolio (composed of New York Stock Exchange stocks) has an expected return of 13 percent. b. Why is the rate you computed the expected rate? ... a. The expected rate of return for Acer common stock is %. (Round to one decimal place.)arrow_forward

- Use the following information to answer the two questions below. State of Prob. of the state of economy. 0.75 the economy Boom Bust 4.1 0.25 Rate of return if state occurs Stock A Stock B 16.1 0.15 0.05 0.02 4 You MUST use 4 digits in every calculation you do in order for your answer to be the same as the one in the system. When entering your answer, round to the nearest 0.01% but do not enter the % sign. For example, if your answer is 3.484% enter 3.48: if your answer is 0.12013 then enter 12.01 What is the expected return of a portfolio with 80% in asset A and 20% in Asset B? 0.02 What is the variance of the portfolio with 80% in asset A and 20% in Asset B?arrow_forwardSuppose TRF = 4%, TM = 9%, and b = 1.1. a. What is n, the required rate of return on Stock i? Round your answer to one decimal place. % b. 1. Now suppose rar increases to 5%. The slope of the SML remains constant. How would this affect ry and n? I. ry will increase by 1 percentage point and n will remain the same. II. Both ry and r, will decrease by 1 percentage point. III. Both rm and r, will remain the same.. IV. Both r and r, will increase by 1 percentage point. V. r will remain the same and r, will increase by 1 percentage point. -Select- v 2. Now suppose rar decreases to 3%. The slope of the SML remains constant. How would this affect ry and n? I. TM will decrease by 1 percentage point and n will remain the same. II. rs will remain the same and n will decrease by 1 percentage point. III. Both ry and r, will increase by 1 percentage point. IV. Both ry and r, will remain the same. V. Both ry and r, will decrease by 1 percentage point. Selectarrow_forwardI need this question general Accountingarrow_forward

- 2. Required Rate of Return Suppose TRF = 4%, FM 9%, and FA = 8%. (a) Calculate Stock A's beta. Round your answer to one decimal place. - (b) If Stock A's beta were 1.3, then what would be A's new required rate of return? Round your answer to one decimal place. % 22222222 122122222322 2014 25226225 250-50 22 352525 2----- 2015arrow_forward35. Let p(S, T, X) denote the value of a European put on a stock selling at S dollars, with time to maturity T, and with exercise price X, and let P(S, T, X) be the value of an American put. a. Evaluate p(0, T, X). b. Evaluate P(0, T, X). c. Evaluate p(S, T, 0). d. Evaluate P(S, T, 0). e. Compare your answers to parts (a) and (b). What do you conclude about the possibility that American puts may be exercised early?arrow_forward3. a. Suppose a stock pays currently pays a $10 dividend each year and that the dividend is expected to grow at 3% each year. Suppose that the risk-adjusted discount rate for that stock is 8%. According to fundamental analysis stock prices are the present value of expected future dividends (discounted at the risk-adjusted discount rate). What should the current price of this stock be? Hint: a=(1+g)/(1+i) where g is the growth rate in dividends and i is the discount rate for stocks. Use the formula in 2. but let ?? → ∞. b. For the stock in part a, what is the expected rate of return for that stock. c. Suppose that market participants think the stock has become riskier and raise the discount rate for the stock to 10%. What is the new stock price value? What is the expected rate of return for this stock?arrow_forward

- Suppose =6%, 11%, and by = 1.3. a. What is n, the required rate of return on Stock I? Round your answer to one decimal place. % b. 1. Now suppose nr increases to 7%. The slope of the SML remains constant. How would this affect г and n? I. г will increase by 1 percentage point and r will remain the same. II. Both г and n will decrease by 1 percentage point. III. Both г and will remain the same. IV. Both г and n will increase by 1 percentage point. -Select- V. r will remain the same and will increase by 1 percentage point. 2. Now suppose FRF decreases to 5%. The slope of the SML remains constant. How would this affect and n? I. г will decrease by 1 percentage point and r, will remain the same. II. г will remain the same and r will decrease by 1 percentage point. III. Both г and n will increase by 1 percentage point. IV. Both г and n will remain the same. V. Both г and will decrease by 1 percentage point. -Select- ✓ c. 1. Now assume that RF remains at 6%, but г increases to 12%. The slope…arrow_forwardAnswer? ? Financial accountingarrow_forwardSuppose TRF = 6%, TM = 11%, and b₁ = 1.2. a. What is n, the required rate of return on Stock i? Round your answer to one decimal place. 12 % b. 1. Now suppose TRF increases to 7%. The slope of the SML remains constant. How would this affect rm and r? I. Both rm and i will increase by 1 percentage point. II. rM will remain the same and r will increase by 1 percentage point. III. rM will increase by 1 percentage point and r₁ will remain the same. IV. Both rm and will decrease by 1 percentage point. V. Both rm and r will remain the same. I 2. Now suppose TRF decreases to 5%. The slope of the SML remains constant. How would this affect rm and n? I. Both rm and n will increase by 1 percentage point. II. Both rm and r will remain the same. III. Both rm and r₁ will decrease by 1 percentage point. IV. rM will decrease by 1 percentage point and r¡ will remain the same. V. rm will remain the same and ri will decrease by 1 percentage point. c. 1. Now assume that rRF remains at 6%, but rM…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT