International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

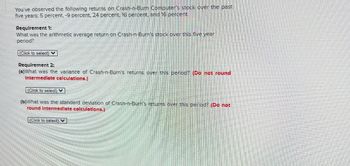

Transcribed Image Text:You've observed the following returns on Crash-n-Burn Computer's stock over the past

five years: 5 percent, -9 percent, 24 percent, 16 percent, and 16 percent.

Requirement 1:

What was the arithmetic average return on Crash-n-Burn's stock over this five year

period?

(Click to select)

Requirement 2:

(a) What was the variance of Crash-n-Burn's returns over this period? (Do not round

Intermediate calculations.)

(Click to select)

(b)What was the standard deviation of Crash-n-Burn's returns over this period? (Do not

round Intermediate calculations.)

(Click to select)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You’ve observed the following returns on Pine Computer’s stock over the past five years: −26.4 percent, 14.6 percent, 32.2 percent, 2.8 percent, and 21.8 percent. What was the arithmetic average return on the stock over this five-year period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What was the variance of the returns over this period? Note: Do not round intermediate calculations and round your answer to 6 decimal places, e.g., .161616. What was the standard deviation of the returns over this period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardYou’ve observed the following returns on SkyNet Data Corporation’s stock over the past five years: 11 percent, –10 percent, 19 percent, 18 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company’s returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardYou've observed the following returns on SkyNet Data Corporation's stock over the past five years: 15 percent, -6 percent, 18 percent, 14 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company's returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average return b-1. Variance b-2. Standard deviation 10.2 % 72.16000 8.49 %arrow_forward

- You’ve observed the following returns on Pine Computer’s stock over the past five years: −29.1 percent, 16.4 percent, 35.8 percent, 3.7 percent, and 22.7 percent. What was the arithmetic average return on the stock over this five-year period? What was the variance of the returns over this period? What was the standard deviation of the returns over this period?arrow_forwardhe last four years of returns for a stock are as shown here: LOADING... . a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Question content area bottom Part 1 a. What is the average annual return? The average return is enter your response here%. (Round to two decimal places.) Part 2 b. What is the variance of the stock's returns? The variance of the returns is enter your response here. (Round to five decimal places.) Part 3 c. What is the standard deviation of the stock's returns? The standard deviation is enter your response here%. (Round to two decimal places.) Time Remaining: 00:26:16 pop-up content starts Data table (Click on the following icon in order…arrow_forwardThe last four years of returns for a stock are as shown here: E a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. ..... Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year 1 2 3 4 Return - 4.3% + 27.9% + 12.3% + 3.6%arrow_forward

- You've observed the following returns on Pine Computer's stock over the past five years: 10 percent, -10 percent, 17 percent, 22 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 16161.) b-2. What was the standard deviation of the company's returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average return b-1. Variance b-2. Standard deviation % %arrow_forwardYou've observed the following returns on Pine Computer's stock over the past five years: 15 percent, -15 percent, 17 percent, 27 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company's returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe last four years of returns for a stock are shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the average annual return? The average return is ☐ %. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year Return 1 -4.12% 2 +27.56% 3 + 12.24% +4.35% Print Done - Xarrow_forward

- The last four years of returns for a stock are shown here: - a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the average annual return? The average return is 10.02 %. (Round to two decimal places.) b. What is the variance of the stock's returns? The variance of the stock's returns is -0.04103. (Round to five decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year Return 1 -3.61% 2 +27.93% 3 +11.83% 4 +3.92% - Xarrow_forwardThe last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 4 Return +3.51% 1 - 4.17% 2 +27.82% 3 + 11.88% Xarrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning