Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

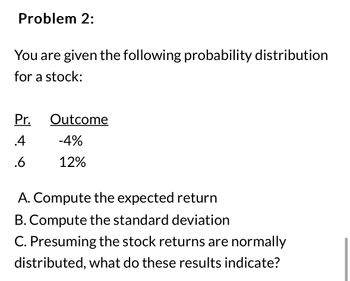

Transcribed Image Text:Problem 2:

You are given the following probability distribution

for a stock:

Pr.

Outcome

4

-4%

.6

12%

A. Compute the expected return

B. Compute the standard deviation

C. Presuming the stock returns are normally

distributed, what do these results indicate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Read the box “The ‘Beta’ of a Stock” in the attachment.a. Suppose that the value of β is greater than 1 for a particular stock.Show that the variance of (R - Rf) for this stock is greater than thevariance of (Rm - Rt).b. Suppose that the value of β is less than 1 for a particular stock. Is itpossible that variance of (R - Rf) for this stock is greater than thevariance of (Rm - Rt)? (Hint: Don’t forget the regression error.) c. In a given year, the rate of return on 3-month Treasury bills is 2.0%and the rate of return on a large diversified portfolio of stocks (theS&P 500) is 5.3%. For each company listed in the table in the box,use the estimated value of β to estimate the stock’s expected rate ofreturn.arrow_forwardConsider the following probability distribution for stocks A and B: Table 4 Probability Distribution for Stocks A and B State Probability Return on Stock A Return on Stock B 1 0.1 10% 8% 2 0.2 13% 7% 3 0.2 12% 6% 4 0.3 14% 9% 5 0.2 15% 8% The variances of Stocks A and B are _____ and _____, respectively. Group of answer choices .015%; .019% .022%; .012% .032%; .02% .015%; .011% .014%; .021%arrow_forwardb) Suppose that you observe the following information in Table 2 for stocks A and B: Table 2 Expected Return (%) 11% Stock Beta A 0.8 В 14% 1.5 The risk-free rate of return is 6% and the expected rate of return on the market index is 12%. Using the Single-Index Model, calculate the alpha of both stocks. Show your calculations. Explain what the alpha of the single-factor model represents and interpret your results.arrow_forward

- You have estimated the following probability distributions of expected future returns for Stocks X and Y: Stock X Stock Y Probability Return Probability Return 0.1 -12 % 0.2 4 % 0.1 11 0.2 7 0.3 14 0.3 11 0.3 30 0.2 17 0.2 40 0.1 30 What is the expected rate of return for Stock X? Stock Y? Round your answers to one decimal place.Stock X: % Stock Y: % What is the standard deviation of expected returns for Stock X? For Stock Y? Round your answers to two decimal places.Stock X: % Stock Y: % Which stock would you consider to be riskier? is riskier because it has a standard deviation of returns.arrow_forwardb. Consider the following information about three stocks: Probability of State of i. ii. iii. iv. State of Economy V. Boom Recession Economy 0.40 0.60 From the information given, you are required to answer the following questions. Compute the Standard Deviation for each stock. Compute the Coefficient Variation for each stock. Based on your computation in part (i) and (ii), which stock is riskier? Explain your answer. Rate of Return if State Occurs Stock Hang Stock Hang Jebat 7% 13% Tuah 28% (5%) Stock Hang Kasturi 15% 3% Assume that you have RM14,000 invested in Stock Hang Jebat whose beta is 1.5, RM19,000 invested in Stock Hang Kasturi whose beta is 2.5 and RM17,000 invested in Stock Hang Tuah whose beta is 1.6. Determine what is the beta of this portfolio. Based on your answer in part (iv), compute the required rate of return for this portfolio, given that the market rate of return is 13% and risk-free rate is 5%.arrow_forwardConsider the following probability distribution for stocks A and B: State Probability Return on Stock A Return on Stock B 1 0.10 10% 8% 2 0.20 13% 7% 3 0.20 12% 6% 4 0.30 14% 9% 5 0.20 15% 8% The coefficient of correlation between A and B is:arrow_forward

- Given the following probability distribution, what are the expected return and the standard deviation of returns for Security J? State Pi ri 1 0.5 11% 2 0.3 8% 3 0.2 5% O 9.40%; 2.04% O 8.90%; 2.34% O 7.40%; 2.94% O 8.40%; 2.64% O 7.90%; 1.74%arrow_forwardGiven the following information on five stocks, construct: a. A simple price-weighted average b. A value-weighted average c. A geometric average d. What is the percentage increase in each average if the stock prices change to those in Column I? e. What is the percentage increase in each average if the stock prices change from those in the Price column to those in Column II? f. Why were the percentage changes different in parts (d) and (e)? g. If you were managing a fund and wanted a source to compare your results to, which of the three averages would you prefer to use, and why? Stock Price # of Shares I II A B C D E F $12.00 150,000 $14.00 125,000 $11.00 200,000 $ 22.00 80,000 $8.00 30,000 $29.00 140,000 $12.00 $12.00 $14.00 $14.00 $20.00 $11.00 $ 22,00 $ 22.00 $8.00 $15.00 $29.00 $29.00arrow_forwardStock A has a correlation with the market of 0.53. Assuming that the standard deviation of returns for Stock A is 24.0% and that the standard deviation of returns for the market is 10.0%, what is beta for stock A? A 1.31 B. 1.27 C. 0.17 D. 0.22arrow_forward

- 7. In a small stock market, there are three assets. The corresponding covariance matrix and the expected rates of return are 1 2 0 1 2 2 1 0 13 Find the optimal portfolio with the expected rate of return ī and in particular with T = 1.arrow_forwardK -61 =1 2 N (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Probability 0.25 0.50 0.25 Common Stock A Probability 0.25 0.25 0.25 0.25 (Click on the icon in order to copy its contents into a spreadsheet.) @ 2 a. Given the information in the table, the expected rate of return for stock A is 16.25 %. (Round to two decimal places.) The standard deviation of stock A is %. (Round to two decimal places.) b. The expected rate of return for stock B is%. (Round to two decimal places.) The standard deviation for stock B is%. (Round to two decimal places.) c. Based on the risk (as measured by the standard deviation) and return of each stock, which investment is better? (Select the best choice below.) 30² F2 W OA. Stock A is better because it has a higher expected rate of return with less risk B. Stock B is…arrow_forwardA stock's returns have the following distribution: Probability Rate of Return 0.1 -2% 0.2 -10% 0.4 10 % 0.2 20 % 0.1 30% Calculate the stock's a) expected return, b) standard deviation, and c) coefficient of variation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education