Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

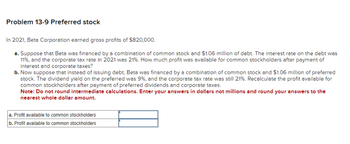

Transcribed Image Text:Problem 13-9 Preferred stock

In 2021, Beta Corporation earned gross profits of $820,000.

a. Suppose that Beta was financed by a combination of common stock and $1.06 million of debt. The interest rate on the debt was

11%, and the corporate tax rate in 2021 was 21%. How much profit was available for common stockholders after payment of

interest and corporate taxes?

b. Now suppose that instead of issuing debt, Beta was financed by a combination of common stock and $1.06 million of preferred

stock. The dividend yield on the preferred was 9%, and the corporate tax rate was still 21%. Recalculate the profit available for

common stockholders after payment of preferred dividends and corporate taxes.

Note: Do not round intermediate calculations. Enter your answers in dollars not millions and round your answers to the

nearest whole dollar amount.

a. Profit available to common stockholders

b. Profit available to common stockholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Problem 14-04 You are considering purchasing the preferred stock of a firm but are concerned about its capacity to pay the dividend. To help allay that fear, you compute the times-preferred-dividend-earned ratio for the past three years from the following data taken from the firm's financial statements: Round your answers to two decimal places. 20X1: Year Operating income Interest Taxes Preferred dividends Common dividends 20X1 20X2 20X3 $18,000,000 $14,000,000 $18,000,000 4,600,000 4,500,000 8,100,000 5,400,000 4,200,000 4,700,000 1,500,000 1,200,000 1,400,000 2,400,000 3,300,000 20X2: 20X3: What does your analysis indicate about the firm's capacity to pay preferred stock dividends? Times preferred dividend earned has -Select- ✓each year, which indicates the firm's capacity to pay the dividend has |-Select-arrow_forwardProblem 18-4 WACC Use the following information: Debt: $69,000,000 book value outstanding. The debt is trading at 95% of book value. The yield to maturity is 10%. Equity: 1,900,000 shares selling at $36 per share. Assume the expected rate of return on Federated's stock is 19%. • Taxes: Federated's marginal tax rate is Tc = 0.21. ● ● Suppose Federated Junkyards decides to move to a more conservative debt policy. A year later, its debt ratio is down to 16.50% (D/V= 0.1650). The pre-tax cost of debt has dropped to 9.6%. The company's business risk, opportunity cost of capital, and tax rate have not changed. Use the three-step procedure to calculate Federated's WACC under these new assumptions. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. > Answer is complete but not entirely correct. Weighted-average cost of capital 14.59 X %arrow_forwardProblem 17-5 How Corporations Pay Dividends (LO1) The stock of Payout Corporation will go ex-dividend tomorrow. The dividend will be $0.40 per share, and there are 15,000 shares of stock outstanding. The market-value balance sheet for Payout is shown below. Ignore taxes. Assets Cash Fixed assets $ 280,000 1,070,000 a. Price b. Price Liabilities and Equity Equity $ 1,350,000 a. What price is Payout stock selling for today? b. What price will it sell for tomorrow? Note - For all requirements, round your answer to 2 decimal places.arrow_forward

- Pls correct and stepwisearrow_forwardChapter 9 #3 Assume that a firm has earned before-tax income. The corporate tax rate is 35 percent. If the security used to finance the investment is $1,000 of 10 percent debt, the firm holding the debt (supplying the debt capital) will earn _______________after tax. If the security used to finance the investment is $1,000 of 10 percent preferred stock, the corporation holding the preferred stock (supplying the capital) will earn _______________ after tax with a 0.70 dividend received reduction. If the security used to finance the investment is $1,000 of common stock and if the entire after-tax amount of income is paid as a dividend, the corporation holding the common stock will earn _______________ after tax. The firm has earned before tax income of $153.85.arrow_forwardQuestion 8 Ch. 13. For questions 7, 8, and 9, use the following information: 7.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX" 5.53 8.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. Using the pretax cost of debt…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education