Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

ff1

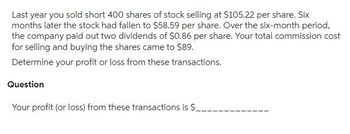

Transcribed Image Text:Last year you sold short 400 shares of stock selling at $105.22 per share. Six

months later the stock had fallen to $58.59 per share. Over the six-month period,

the company paid out two dividends of $0.86 per share. Your total commission cost

for selling and buying the shares came to $89.

Determine your profit or loss from these transactions.

Question

Your profit (or loss) from these transactions is $__

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- E14.7arrow_forwardOn January 1, 2025, Blossom Company has the following defined benefit pension plan balances. Projected benefit obligation $4,454,000 Fair value of plan assets 4,140,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2026, the company amends its pension agreement so that prior service costs of $509,000 are created. Other data related to the pension plan are as follows. 2025 2026 Service cost $149,000 $177,000 Prior service cost amortization -0- 92,000 Contributions (funding) to the plan 237,000 283,000 Benefits paid 196,000 274,000 Actual return on plan assets 248,400 260,000 Expected rate of return on assets 6% 8% (a) Prepare a pension worksheet for the pension plan for 2025 and 2026. (Enter all amounts as positive.) BLOSSOM COMPANY Pension Worksheet-2025 and 2026 General Journal Entries OCI-Prior Service Cost OCI-Gain/ Pel Lossarrow_forwardE10.15arrow_forward

- Hansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardHanderson Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate $ 6.00 per kilo $ 20.00 per hour $ 6.00 per hour Direct materials 8.5 kilos Direct labor 0.4 hours Variable overhead 0.4 hours The company reported the following results concerning this product in August. Actual output 3,200 units Raw materials used in production 29,030 kilos Purchases of raw materials 31,600 kilos Actual direct labor-hours 1,160 hours $ 195,920 $ 22,736 $ 7,540 Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for August is:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education