FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Problem 11-12 (Algo) Effect of transactions on liquidity measures LO 1

Selected

| Cash | $ | 48,000 | |

| Marketable securities | 135,000 | ||

| 165,000 | |||

| Inventory | 187,500 | ||

| Prepaid expenses | 21,000 | ||

| Total current assets | $ | 556,500 | |

| Accounts payable | $ | 108,000 | |

| Other accrued liabilities | 26,400 | ||

| Short-term debt | 48,000 | ||

| Total current liabilities | $ | 182,400 | |

Required:

- Calculate the

working capital ,current ratio , and acid-test ratio for Tibbetts Company as of September 30, 2019. - Summarized here are the transactions/events that took place during the fiscal year ended September 30, 2020. Prepare

journal entries for the below transactions and Indicate the effect of each item on Tibbetts Company's working capital, current ratio, and acid-test ratio. Use + for increase, − for decrease, and (NE) for no effect.- Credit sales for the year amounted to $360,000. The cost of goods sold was $234,000.

- Collected accounts receivable, $378,000.

- Purchased inventory on account, $252,000.

- Issued 750 shares of common stock for $27 per share.

- Wrote off $10,500 of uncollectible accounts using the allowance for

bad debts. - Declared and paid a cash dividend, $30,000.

- Sold marketable securities costing $39,000 for $46,500 in cash.

- Recorded insurance expense for the year, $18,000. The premium for the policy was paid in June 2019.

- Borrowed cash on a short-term bank loan, $15,000.

- Repaid principal of $60,000 and interest of $4,500 on a long-term bank loan.

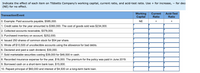

Transcribed Image Text:Indicate the effect of each item on Tibbetts Company's working capital, current ratio, and acid-test ratio. Use + for increase, - for deci

(NE) for no effect.

Working

Capital

Current

Acid-Test

Ratio

Transaction/Event

Ratio

0. Example: Paid accounts payable, $585,000.

1. Credit sales for the year amounted to $360,000. The cost of goods sold was $234,000.

NE

+

2. Collected accounts receivable, $378,000.

3. Purchased inventory on account, $252,000.

4. Issued 250 shares of common stock for $54 per share.

5. Wrote off $10,500 of uncollectible accounts using the allowance for bad debts.

6. Declared and paid a cash dividend, $30,000.

7. Sold marketable securities costing $39,000 for $46,500 in cash.

8. Recorded insurance expense for the year, $18,000. The premium for the policy was paid in June 2019.

9. Borrowed cash on a short-term bank loan, $15,000.

10. Repaid principal of $60,000 and interest of $4,500 on a long-term bank loan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solar Electric Inc. Balance Sheet 32 Marks ACB As at December 31, 2023 Account Title Debit Credit Assets Current Assets Cash 100,649 Accounts Receivable 35,860 Interest Rceivable 9,113 Prepaid Insurance 7,370 Short-Term Investment- Citi Inc 237,000 Short-Term Investment- Bonds 135,000 Inventory 90,640 Valuation Allowance for Fair Value Adjustment 50,700 Total Current Assets 666,332 Non-current Assets Investment in HSBC Inc. Common Shares 503,840 Long-Term Investment- Bond 145,000 Property, Plant & Equipment 280,000 Accumulated Depreciation 86,000 Total Non-Current Assets 842,840 Total Assets 1,509,172 Liabilities Current Liabilities Accounts Payable 212,400 Interest Payable 31,167 Unearned Revenue 21,000 Total Current Liabilities 264,567 Long-Term Liabilities Bonds Payable 340,000 Discount on Bonds Payable 15,741 Bank Loan 225,000 Total-Long Term Liabilities 549,259 Total Liabilities 813,826 Shareholders Equity Common Shares 362,000 Preferred Shares 80,000 Retained Earnings 348,385…arrow_forwardThe following data concern Tech Corporation for the 2022 financial year. Credit sales during the year $2 400 000 Accounts receivable 30 June 2022 410 000 Allowance for bad debts 30 June 2022 55 000 Bad debt expense for the year 70 000 What amount will Tech Corporation show on its year-end balance sheet for the net realisable value of its accounts receivable? a. 410 000 b. $285 000 c. $340 000 d. $ 355 000arrow_forwardBalance Sheet as of December 31, 2021 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2021 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends 552 Addition to retained earnings 2$ 828arrow_forward

- Ratio Analysis Presented below are summary financial data from Pompeo's annual report: Amounts in millions Balance sheet Cash and cash equivalents $6,328 Marketable securities 63,298 Accounts receivable (net) 32,785 Total current assets 136,808 Total assets 430,773 Current liabilities 113,172 Long-term debt 21,837 Shareholders' equity 204,834 Income Statement Interest expense 1,257 Net income before taxes 42,021 Calculate the following ratios: (round to two decimal places) a. Times-interest-earned ratio b. Quick ratioarrow_forwardCalculate average receivable turnoverarrow_forwardRequired information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable. Common stock, $10 par value Retained earnings Total liabilities and equity Current Year $ 30,800 88,100 111,000 10,900 280,000 $ 520,800 $ 128,400 98,000 163,500 130,900 $ 520,800 Current Year 1 Year Ago $ 35,000 61,500 82,400 9,300 250,500 $ 438,700 $ 478,850 243,350 12,100 9,550 $73,750 101,750 163,500 99,700 $438,700 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses $785,000 Interest expense Income tax expense Total costs and expenses Net income Earnings per share For both the Current Year and 1 Year Ago, compute the following ratios: 743,850 $ 41,150 $ 2.52 2…arrow_forward

- Please don't give image formatarrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education